Threads Archive: 2024

Ongoing compilation of various threads from 2024

This page will be regularly updated throughout the year.

Previous Archives: 2023 and Prior

Active/Ongoing Threads

December 2024: Hidden taxes in U.S. society that add friction costs with dubious value-add.

May 2024: Me versus the AI bots from Dubai.

May 2024: Ongoing thread of outbound foreign direct investment (FDI) by Chinese companies in EVs, battery, clean energy and other advanced industries

May 2023: What the heck are Japanese automakers thinking on the ICE-to-EV transition?

January 2023: Significant differences in the cost of construction/capex is a persistent issue that saps the global competitiveness of the U.S. economy.

December 2024

December 28: Abundance mindset to human capital development vs. zero-sum “brain drain” approach.

December 27: Heavy investment in housing and infrastructure investment suppressed growth rates in the 2010s but lower growth rates should not necessarily be equated with bad policy. The trade-off for higher capital intensity was achieving modern living standards earlier and enabling more natural transition to a modern white-collar workforce with the next generation.

December 26: The economics and financial viability of the next massive Chinese hydroelectric project on the Yarlung Tsangpo River in Tibet.

December 26: Huawei is leading China’s advanced chip efforts in the background. If China is able to catchup in advanced chip fabrication, historians will look back at the December 2018 arrest of Meng Wanzhou as a tactical and strategic blunder in the tech war.

December 26: Immigration is good. Immigration fraud is bad. How to fix the H1B program: focus on the IT consultancies.

December 25: It took time to develop the human capital and technology to enable the rise of a new type of Chinese factory.

December 24: “Consumption” (a.k.a. “household expenditures”) defined for GDP purposes is not consumption that regular people are familiar with and we should not conflate the two.

December 23: Designing renewables-centric energy infrastructure and embracing a green future where renewables drive primary energy capture and creation and everything else is some form of storage.

December 22: The unit economics of Costco soup dumplings.

December 21: It makes little sense to compare fossil fuels to renewables on the basis of primary energy consumption measured in exajoules.

December 20: On the reliability of Chinese data sources.

December 19: Triple whammy of seasonally weak hydro, solar and wind fluctuations puts “China coal-fired generation peaked in July 2023” at risk and a broader discussion of how renewables are changing the dynamics of power grid design with renewables as the primary energy source and all other sources conceptually viewed as some form of a “battery”.

December 18: It’s not an either-or choice between HSR and air travel. It is a choice between HSR + air travel and conventional rail + air travel.

December 18: Reversing the “China as Japan in the 1990s” to think about it what Japan at 1990s level of development might have looked like at China scale, particularly in the context of the current U.S.-China trade war and debates around a Plaza-like agreement around capital controls.

December 18: Hyperbolic journalism.

December 17: Are trade surplus countries really more vulnerable in a trade war? Are we measuring “trade surplus” using the right metrics?

December 16: Ideas vs. execution.

December 14: “Temporal wage arbitrage” of long-lived infrastructure assets like high-speed rail.

December 14 (bluesky): ~22 billion passengers have taken China’s high-speed rail network since 2009 with follow-up reaction thread on “temporal wage arbitrage”.

December 14: The relationship between debt and GDP. This is a follow-up to this piece from 2020.

December 13: Comparative vs. competitive advantage.

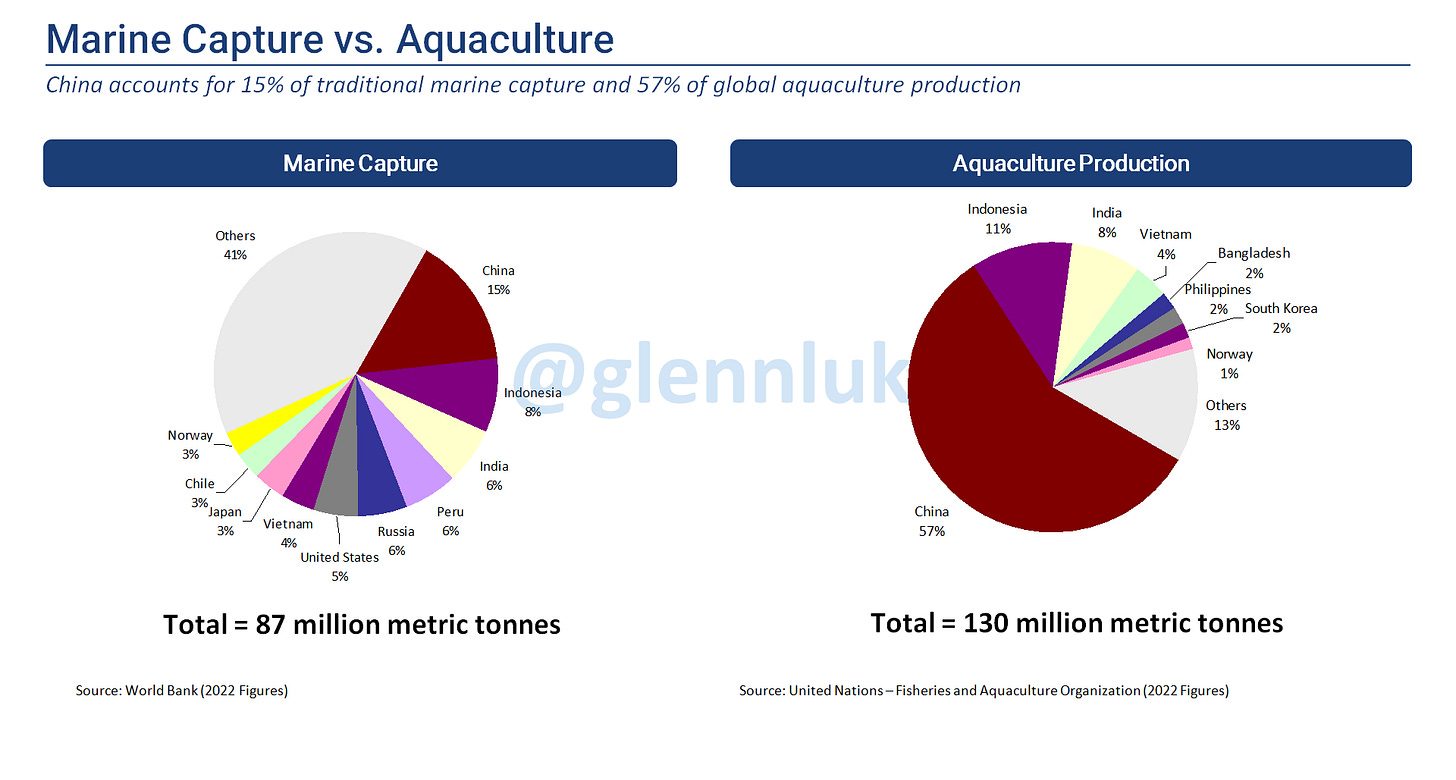

December 12: (Part 1 | Part 2): China’s seafood industry has been driven by aquaculture, not marine capture.

December 12: Unless autonomous driving changes individual driving preferences in the next decade, Nio CEO William Li is significantly under-forecasting the size of China’s auto market.

December 12: We do not need to settle the China balance of payments debate today. But if more time passes and evidence of massive, accumulating hidden capital outflows does not surface, the debate will settle itself.

December 12: What the sudden wind-down and liquidation of Jiyue says about automotive “venture capital with Chinese characteristics”.

December 11 (bluesky): At the core of the trade/tech war is the reality that the United States and China are becoming less economically compatible. There is nothing wrong with that; we just need to manage the breakup peacefully.

December 11: Cross-border fund flows are what determine FX movements. Trade flows are just a subset of cross-border fund flows.

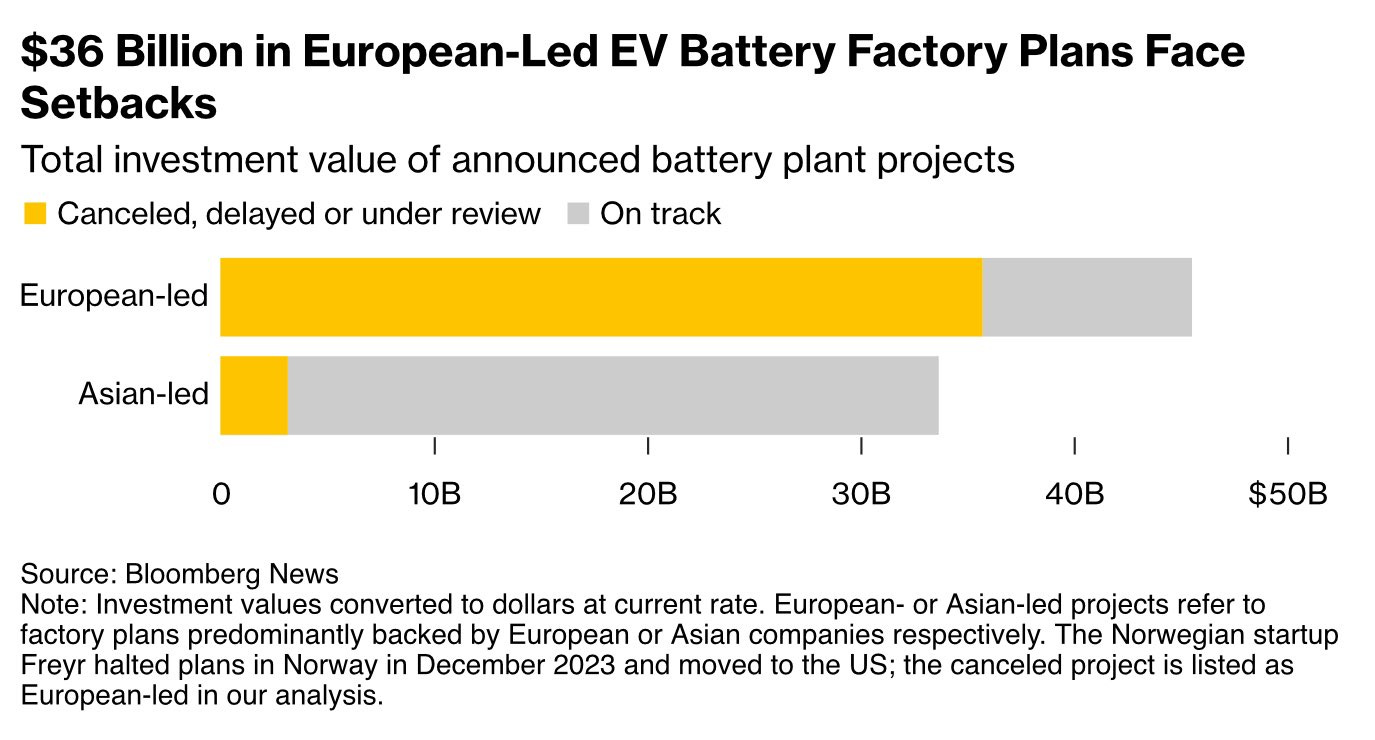

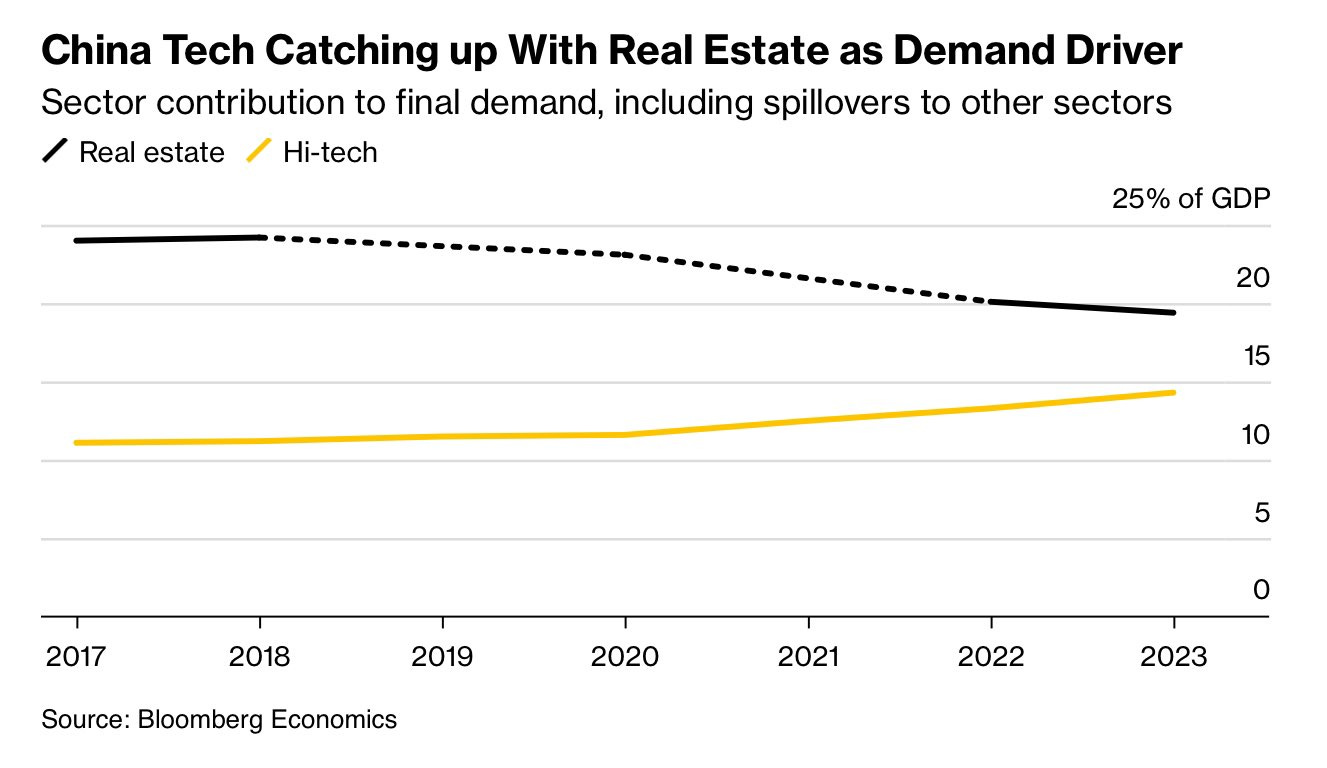

December 10 (Part 1 | Part 2): The success of Chinese batterymakers was not just about “unfair” local factors. The Northvolt bankruptcy illustrates how they have also been able to accumulate significant technology and human capital. For Europe’s car brands to hold onto global market share, they will also need to accumulate more local technology and human capital and build out local supply chains, including battery cell production.

December 10: Frontloading capital-intensive economic model made sense in China if you consider the demographics of its workforce: building as much physical long-term capital stock as possible before the blue-collar workforce started to decline precipitously in the 2020s.

December 10: The issue with Michael Pettis’ predictions a decade-plus ago is not whether China eventually had to transition to a less capital-intensive economic model, but being upwards of three decades off on timing. The core framing issue was believing that accounting identities (e.g. “investment as a % of GDP”) are the driver of economic development policy / strategy. Accounting identities are the output and sit downstream of fundamental drivers like demographics.

December 9: Intel is a cautionary tale for the Western technology sector vis-a-vis rising Chinese competitors.

December 9 (twitter/x): GM just took a $5 billion writedown on its China operations. But over the years it has generated tens of billions of profits on less than $1 billion of initial registered capital investment in the 1990s. The lesson here is not that GM should not have entered China, but in what it decided to do with those windfall profits.

December 9: Economies are dynamic, not static: addressing logical inconsistencies from Michael Pettis in framing the trade-in voucher program for home appliances and automobiles and stimulative effects on the economy that can be better visualized using the circulation model.

December 8: Autos are another example of where cross-border trade data tracked by customs tells an incomplete story. If we look at auto companies by brand nationality, China is still a net importer of foreign brands.

December 8: We need to conceptualize foreign direct investment (FDI) not in abstract dollar terms but for the necessary human capital, technology and real capital that sits behind it as a critical component of risk mitigation. We can see this in the outsize role that ethnic Chinese diaspora business communities played in investment into mainland China in the early decades of reform and opening up.

December 6 (bluesky): ASEAN is at the frontlines of a major shift in global manufacturing in the coming decades. China will likely play an outsize role

December 6: U.S. industrial policy is mainly about reacting to China (external focus) rather than domestic prosperity whereas China's industrial policy is mainly about domestic prosperity (internal focus) than the U.S.

December 6: Apple drives more value to U.S. stakeholders than Chinese ones. Messing with this relationship will hurt the U.S. more than China.

December 5 (bluesky): Billy moneyballs Gallium.

December 4: 90% of gallium is produced as a byproduct of aluminum production. The economics of greenfield gallium mines are just not going to work.

December 4: Some correlation between engineers in the workforce and manufacturing as a share of GDP.

December 3: Critique of Gao Shanwei’s recent note (archive) about the missing “47 million” unemployed.

December 3: Building off David Fishman’s excellent thread on the detailed construction timetable for Hualong One nuclear reactor in Fujian to discuss why China’s scale and focus/specialization combine to make it such a formidable competitor across industry, manufacturing and tech.

December 2: The difference between “flow” (GDP / production) and “stock” (national balance sheet / wealth) is why even if countries like China catch up in productivity, it will still need decades to fully catchup on wealth.

December 2: U.S. manufacturing relative decline predated NAFTA and China by decades.

December 1: Illustrative example of misapplication of trade statistics. The “trade surplus” is not equivalent to fund flows.

November 2024

November 30: Who ultimately wins in the next round of the trade and tech war between China and the U.S.?

November 30 (bluesky): The recent “Chinese honeypot AI” meme reveals deeper is a “Masters of the Universe” level delusions of grandeur in the Silicon Valley AI community.

November 29 (bluesky): People under-appreciate just how much of a “9/11” or “Pearl Harbor” moment the arrest of Huawei CFO (and daughter of the founder) Meng Wanzhou in December 2018 was for Huawei, the Chinese tech sector, Beijing and Chinese people.

November 29: The RMB is persistently weak because of Beijing’s capital controls on inbound financial flows. This thread also discusses some views on long-term development of key Balance of Payments line items.

November 28: Michael Pettis has been writing a version of the same article for well over a decade on the relationship between GDP, income, consumption, investment and trade surplus. It is useful to examine what went awry last time as an indicator of how it might be wrong in the future — it comes down to the base assumptions behind the model.

November 26: (Part 1 | Part 2): Clearing up inaccuracies in the Chinese EV sector. Part 1 on the aggregate financial health of Chinese carmakers and Part 2 on properly calculating capacity utilization.

November 26 (bluesky): We have lost the plot when the solution to “re-industrializing the economy for national security purposes” is reframed around the goal of trying to “rebalance China”. Reaction to presumptive incoming Secretary of Treasury Bessent’s remarks on tariffs and US dollar appreciation.

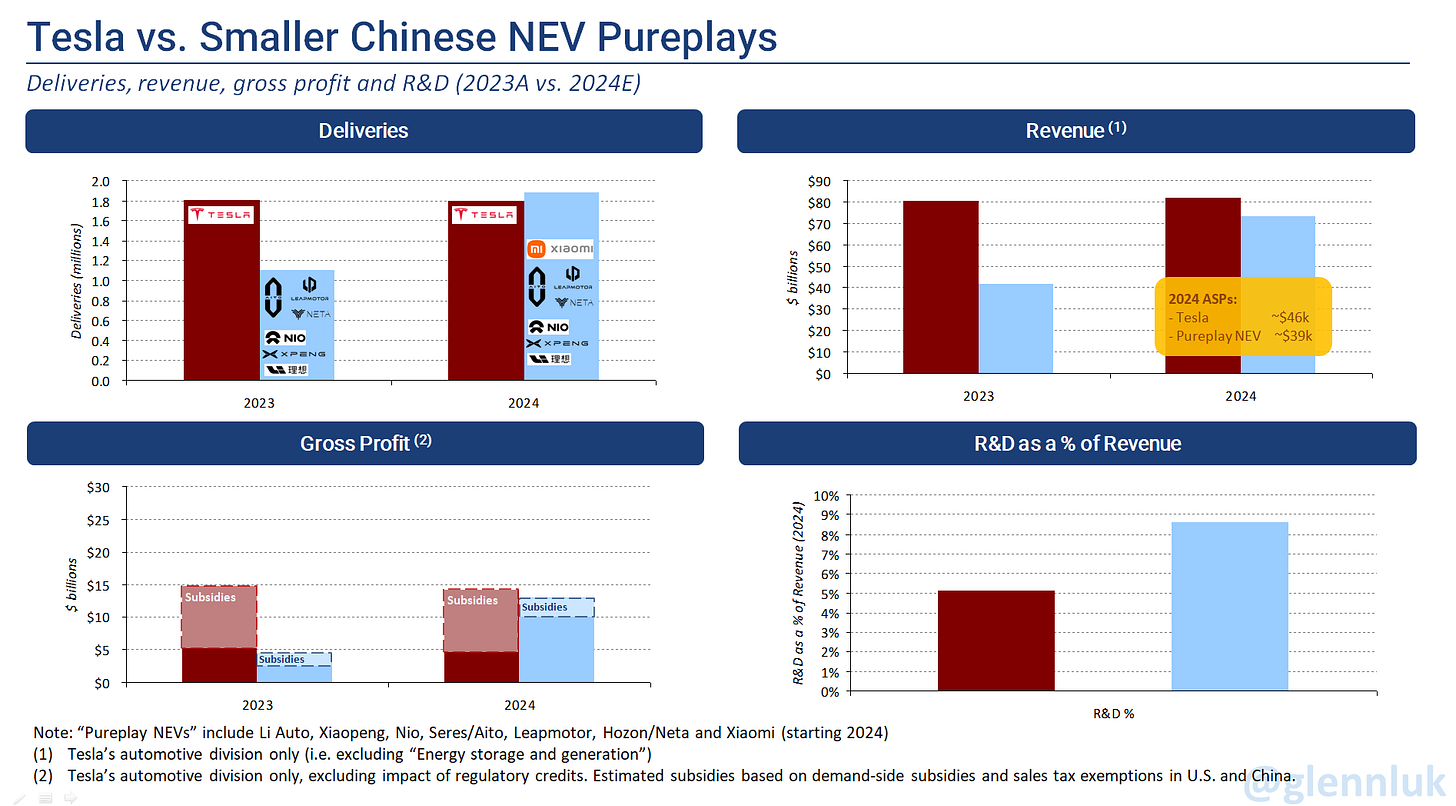

November 24: Compilation of key points from analysis on China’s NEV sector economics.

November 23: Twitter Spaces on “Which car companies will emerge as winners and losers out of the coming consolidation?” and a summary of some key points that came out of the discussion.

November 23 (bluesky): Chart crime when it comes to measuring the “middle class”. Reaction to Economist article “The surprising stagnation of the Asian middle class” (archive).

November 22: When it comes to property rights, perhaps China is not the outlier here. It might just be the United States that is the outlier and the one that needs fixing.

November 21 (bluesky): Thoughts on China’s recent $2 billion sovereign bond issuance in Saudi Arabia by the Ministry of Finance. There was significant excitement from “de-dollarization” advocates about how transformative the transaction was given listing locale and pricing. However, the reasons are likely more mundane: this is just one step in a series of steps to integrate China’s trade and investment links to the world. In this case, the sovereign bond issuance opens up more fundraising avenues for Chinese corporates that are seeking to invest overseas in the coming decades.

November 21 (twitter/x): Good opportunity to update my HSR charts in reaction to this recent article from WSJ: “China Is Building 30,000 Miles of High-Speed Rail—That It Might Not Need”. Also here.

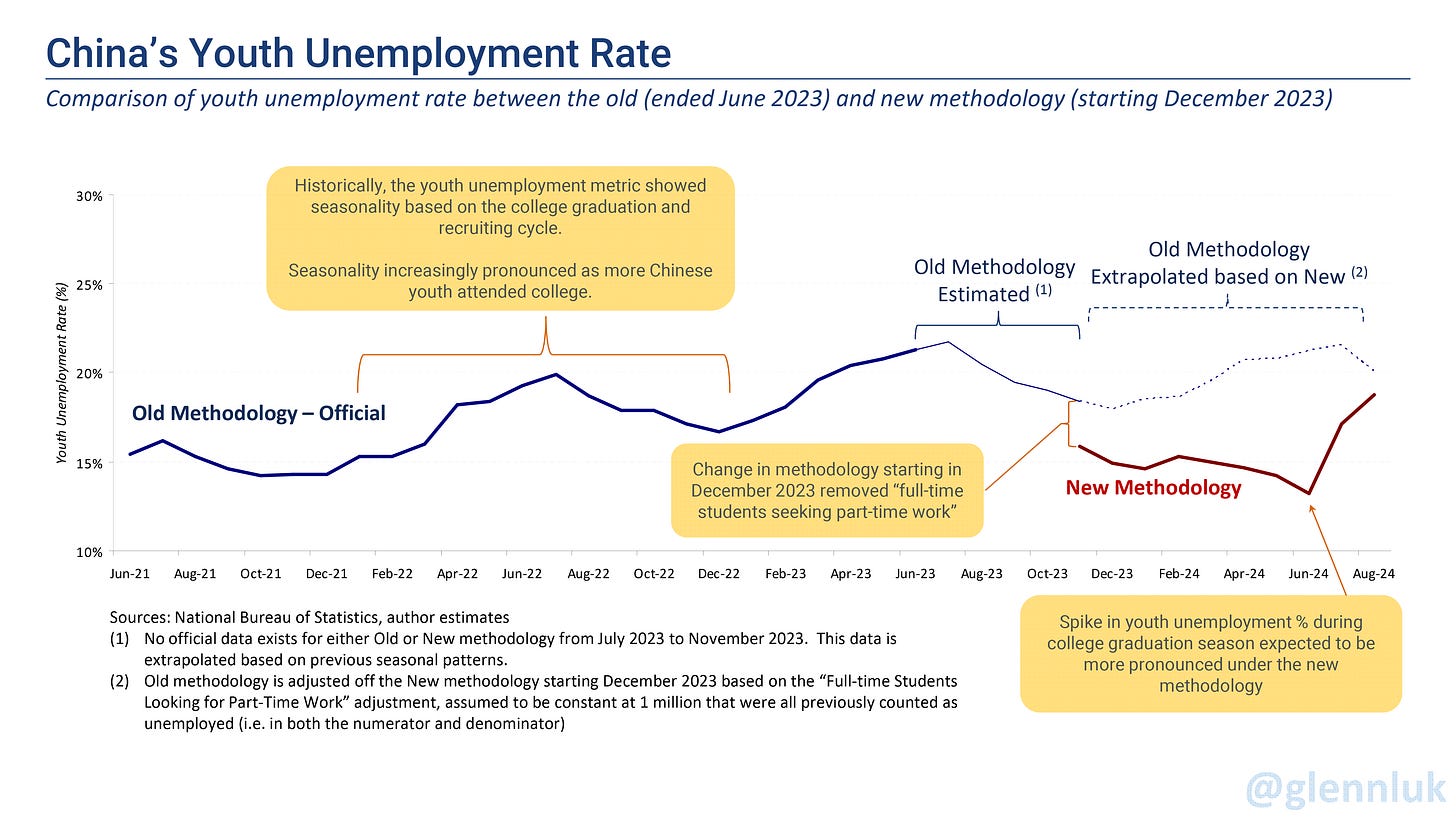

November 20 (twitter/x): October youth unemployment data update.

November 20: How “factoryless manufacturing” led to overstated current account surpluses for decades and some implications on China’s trade relationship with the world.

November 20 (Part 1 | Part 2): China is transitioning from a blue- to white-collar workforce in the coming decades. First “exclusive” quasi-thread on Bluesky (albeit covering a very familiar topic).

November 19 (bluesky): Technology transfer was always about technology for profits.

November 19: While high-speed rail in the United States is too expensive right now, instead of giving up a more constructive approach is to diagnose root causes on why and work on fixes. That’s how societies move forward.

November 18: How kernels of objective truth like trade surplus and consumption as a % of GDP data are conflated to present a distorted reality.

November 17: China’s urban infrastructure is better than Taiwan’s at the same stage of development in part because China has simply invested significantly more into housing and public urban infrastructure.

November 15: October 2024 “flash” numbers and analysis, including an update of the “New LKQ Index”.

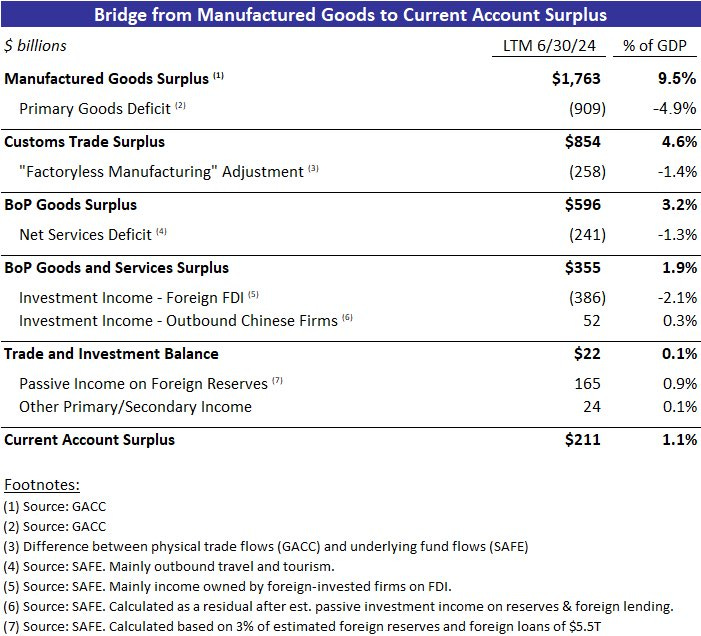

November 14: Conflating China’s very large manufactured goods surplus with holistic trade. The bridge from manufactured goods to the current account balance:

November 13: Response to Zoho founder Sridhar Vembu’s excellent post on how technology progress concentrates wealth and the importance of how society’s think about this phenomenon. Proud Twitter/X moment: earned a follow from Sridhar, who is one of my favorite thinkers on the platform.

November 12: The practical and operational implications of “moving manufacturing”.

November 11: The positive externalities of bike-sharing and the youths who are biking from Zhengzhou to Kaifeng for soup dumplings.

November 10 (bluesky): Billy moneyballs Chinese structural reform

November 10: Manufacturing is being automated even at the micro level: A CNC lathe with milling functionality and aluminum bar feeder/magazine can run unassisted and churn out custom parts at extremely low unit prices.

November 9: The rise of Spain after two decades of painful structural adjustment. “Spain: open economy, unstoppable run?” h/t Benjamin Wolf.

November 9: Who wins and loses with another round of increased tariffs on China by the U.S.? Focusing on the Apple iPhone trade.

November 7: Reactions to an interview with Robert Lighthizer, who will likely play a significant role in the incoming Trump adminsitration: “Bob Lighthizer on Changing the Balance in U.S.-China Trade” from The Wire China.

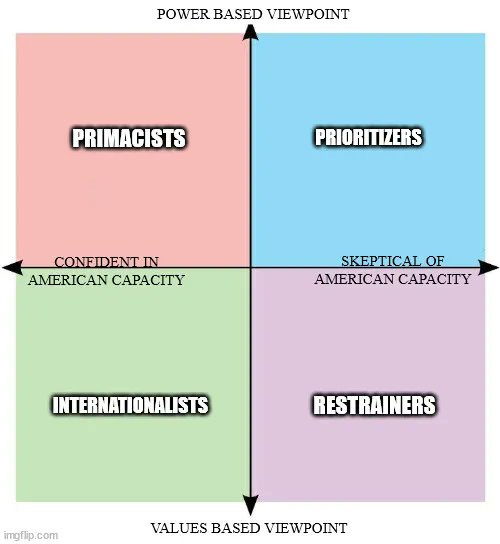

November 6: Helpful framework for describing different viewpoints within the incoming Trump administration with respect to overall policy to China from Tanner Greer: “The Battle to Shape Trump’s China Policy”

November 5: A deeper examination of Chinese subsidies (credit, tax and R&D) in reaction to Bloomberg article “China Can’t Cut EV Subsidies It Isn’t Paying” (archive)

November 4: China’s trade and current account surplus were historically overstated due to the “factoryless manufacturing adjustment. Adjusting historical figures significantly changes the narrative of just how much China’s economy relied on trade surpluses to drive growth since peak “mercantilism” during the Global Financial Crisis.

November 3: “Industry 4.0” and the rise of Chinese advanced manufacturing.

November 1: There is increasing access to high-frequency data in China. Also, thoughts on how “having to pick a side” in data-oriented analysis can pollute the analysis.

October 2024

October 31: Direct rebuttal to the hypothesis that China’s current account surplus has been massively understated since 2022. Applied retroactively, the “factoryless manufacturing” adjustments meaningfully change the perception of China’s trade balances with the rest of the world.

October 30: “Factoryless manufacturing” has resulted in an overstated trade surplus equivalent to approximately 1% of GDP since at least 2012. The 2021-22 changes in methodology that switched from using China Customs data that tracks physical flows to data tracking direct fund flows addresses these distortions in the Balance of Payments data tracked by SAFE.

October 28: More likely that the Chinese trade surplus is overstated than understated. This thread pulls together significant work to understand the distortions caused by the measurement of imports and exports using physical flows vs. fund flows.

October 25: Updated view on household wealth in China and splitting the household balance sheet into “in-use” and financial assets. In doing so, it is clear that there is a tremendous amount of household liquidity sitting on the sidelines in the form of banking deposits.

October 24: Comparing Japan’s failed effort to develop a commercial airliner vs. China: it wasn’t technical capabilities but scale and market size that was the biggest constraint.

October 23: National banks have re-taken the lead from local and regional banks, which dominated growth in incremental lending after the Global Financial Crisis, driven by the local nature of property and traditional infrastructure development.

October 23: Applying the circulation model to recent package of reforms designed to release local government payment arrears back into the local economy.

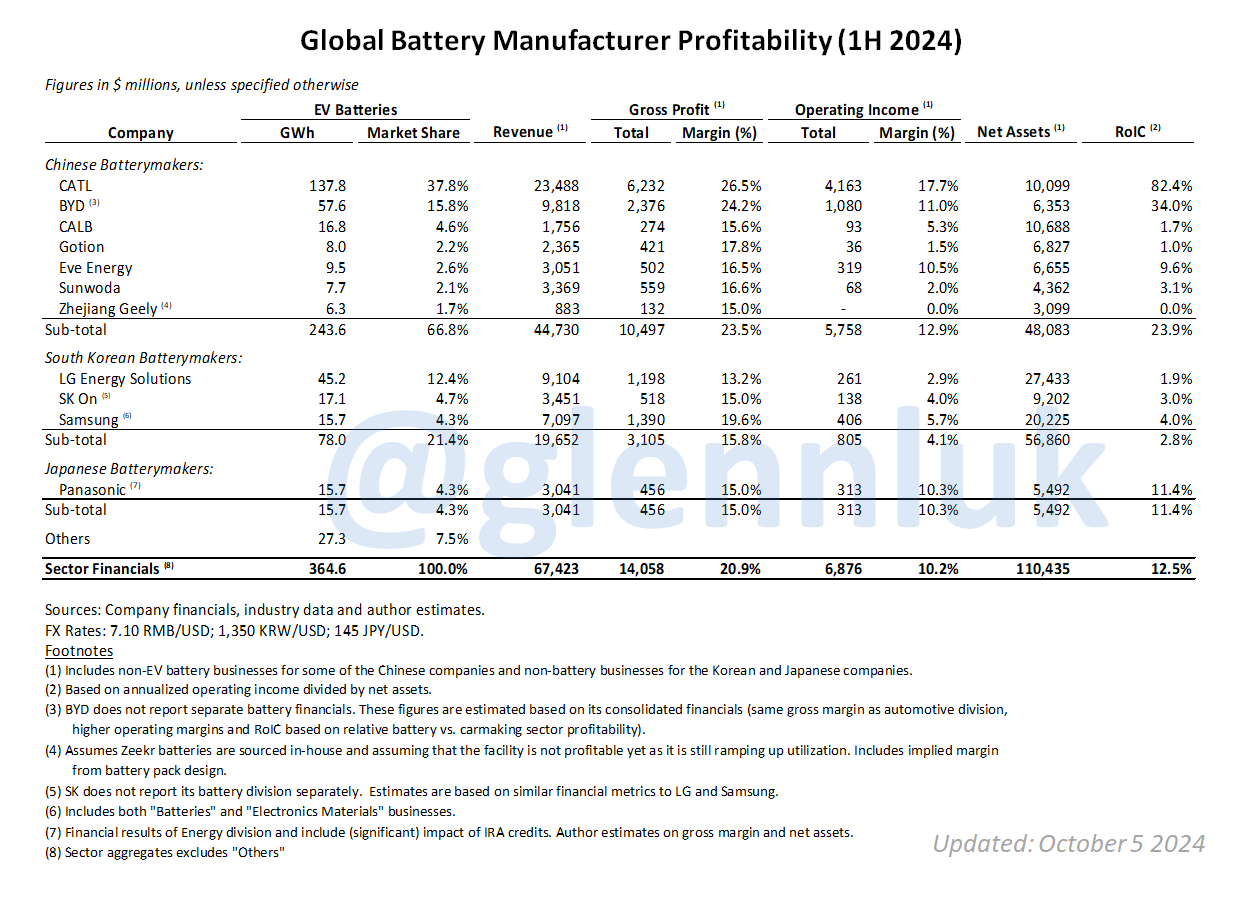

October 21: Addressing the fiction that the NEV and battery sectors are losing money in China; a response to the “White House warns China using overproduction for global dominance”.

October 20: Delving further into the concept of “circulation” and pairing it with concepts of “Pareto efficiency” to visualize how policy intervention can be used to drive sectoral transition: in this case from the property sector to advanced manufacturing.

October 19: On long-term human capital development.

October 18: This compendium is supposed to be a list of my threads but this thread is mostly about pseudoerasmas’ take on the “potted history of institutions in macro-development thinking, at the time of the AJR intervention”.

October 18: Using the recent NEV trade-in subsidies program to explain “circulation” and analyze the policy impacts.

October 18: “Live tweet” of reactions and observations from an interesting podcast from Odd Lots featuring Zichen Wang and Richard Koo on China’s recent stimulus.

October 17: Distinctions between “demand-side” and “supply-side” stimulus is unnecessarily ideological and confusing. What matters is how policy intervention impacts productivity. Economies should be viewed holistically as dynamically interconnected circulatory systems:

October 13: Line-of-sight now into the full-year 2024 domestic Chinese NEV delivery numbers. It is running ahead of forecasts.

October 13: Thoughts on re-capitalization of the “mega banks” in China which have been sharpened via back-and-forth with Alexander Campbell and his recent post “A Depression with Chinese Characteristics”.

October 13: Michael Pettis and the spectacular collision of finance, economics and China.

October 12: “Supply-side” and “demand-side” policy is a false dichotomy as supply and demand are ultimately: Producers are also consumers.

October 11: Implicit assumption of homogeneity in capital stock in traditional calculations of TFP is a significant issue that was quite specific to China in the post-GFC period.

October 9 (Part 1 | Part 2 | Part 3 | Part 4 | Part 5): Referring to a series of detailed analysis by Brad Setser on why he thinks China’s current account might be significantly overstated. In the first part, I discuss the implications of a significantly understated current account surplus, namely the offsetting effect of “hidden” capital flight. In the second part, I use Apple to illustrate why the divergence in trade flow calculations under the traditional customs vs. BoP method and explain why I think the BoP method is actually more accurate for China. In the third part, I examine Apple Japan to confirm certain model assumptions and put a range on the estimated discrepancy of between $23 and $65 billion. In the fourth part, I reference a recent report from CF40 to expand on the technical differences between the physical trade flows captured by Customs data and the funds flows captured by SAFE and explain why for “factoryless” manufacturing, funds flows are more accurate. In Part 5, corroborating data from Alex Etra on China’s customs valuations allows us to get a much more precise measurement of the amount of overstatement.

October 8: The rise of the next cohort of pureplay Chinese NEV makers.

October 4: Contrary to popular belief, Chinese battery manufacturers are quite profitable.

October 3: First Twitter Spaces (along with David Fishman) on “Socioeconomic inequality and ‘Common Prosperity’”

October 2: Run (don’t walk) from reasoning based on GDP accounting identities.

October 1: Acknowledging the risk of ridicule, disagreeing with Elon Musk here about the role that combustion will continue to play in vehicles in the coming decades.

September 2024

September 30: Achieving scale and industry verticalization are the key factors that enable Chinese advanced industrial companies to be so competitive. Reactions to David Fickling’s deep dive into polysilicon (archive), the key base material used in solar photovoltaics.

September 30: Framing the “epic rally” in Chinese capital markets in the context of the “wealth effect” on the real economy.

September 29: Conventional wisdom is that Beijing sets “unrealistically high targets” and then uses (credit-driven) “non-productive” investment to meet them.

A common corollary is that China’s headline GDP is generally inflated or “lower quality” than comparable economies. But have we considered that the opposite may be true?

September 29: Long-term electricity production and consumption drivers and trends in China.

September 27: Structural reforms in China are underpinned by demographic change from a workforce and population dominated by blue-collar workers to one dominated by college-educated white-collar ones.

September 27: More detailed thoughts on how to read the recent announcement of Chinese stimulus, including both fiscal and monetary components.

September 26: August youth unemployment data increased to 18.8%. Some more context and analysis around these numbers. Update: September figure declined to 17.6% (and nobody seemed to care anymore).

September 25: Quantifying how the “wealth effect” has driven relatively weak demand during China's sectoral transition away from real estate and what the Chinese household and economy may look like coming out of the property transition through 2030.

September 25: When analyzing the impact of policy, it is important to go beyond top-level analysis and consider specific impacted groups. Here, I analyze a couple of recently announced stimulus items from the perspective of upper and bottom quintile groups that they target.

September 23 (Part 1 | Part 2 | Part 3): Illustrative archetypes of different socioeconomic levels in China, split by quintile. Part 2 breaks the upper quintile into more discrete segments. Part 3 introduces the “Common Prosperity Ratio”.

September 22: Understanding socioeconomic inequality in China is key to understanding the political economy of the "Common Prosperity" era. I analyze socioeconomic and Gini coefficients using a more comprehensive measure of income that incorporates wages, capital income and redistribution. The results help contextualize both short- and long-term economic prospects for China.

September 20: Breakdown of China’s income and wealth by socioeconomic level over time and the impacts of high socioeconomic inequality on demand.

September 18: HSR ridership in China over the first eight months of 2024 has increased by more than the entire Shinkansen network during its peak year.

September 17: The modern “middle” class in China is actually the upper quintile of society. The median Chinese household is a family that moved from the village to the city around a dozen years ago. Understanding this socioeconomic strata is key to understanding much of its policy direction today.

September 16: Asia Society “China's Post-Plenum Tech Gambit: Chips, Shifts, and the Race to the Next Frontier”

September 16: Technology and software are important, but not everything in the world of EVs today — reactions to Gartner’s latest 2024 “Digital Automaker Index” (archive) rankings.

September 16: China is raising its retirement age. Productivity, not demographics, will be the key driver of China’s economy and its chances at reaching full modernization over the next two to three decades.

September 15: A recent study on systemic corruption in China: “How Corruption Fuels Inequality in China” by Branko Milanovic.

September 15: We can watch Chinese industrial policy in real-time through the effort to develop solid-state batteries and the role of a newly formed cross-industry organization, the China All-Solid-State Battery Collaborative Innovation Platform (CASIP).

September 14 (Part 1 | Part 2): Review and commentary on August 2024 monthly GDP release and some more “macro” thoughts on China.

September 13: The VC and PE investing environment in China is bad. The data and analytical skills embedded in this chart from this FT article are even worse. Follow-up note (March 2025): DeepSeek was founded in 2023.

September 10: Higher-end vehicles like the Aito M9 are a key 2024 China NEV sector theme, along with NEV makers like Geely directly entering battery manufacturing.

September 8: Tesla’s current slowdown in China has nothing to do with the “China Cycle” narrative espoused by Noahpinion.

September 6: New World Bank paper (“How Redistributive Is Fiscal Policy in China? New Evidence on the Distributional Impacts of Taxes and Spending”) that illustrates how China uses “supply-side” policies to execute against its socioeconomic rebalancing policy goals.

September 4: The battery sector is also profitable, but profitability is disproportionately concentrated with the largest players.

September 4: BYD’s auto business will surpass Tesla’s by revenue and on a gross profit basis is already ~75% larger. BYD is able to achieve higher margins through its proprietary battery business.

September 1 (Part 1 | Part 2 | Part 3): Contrary to popular belief, China’s NEV sector is profitable even as subsidies reduce over time. Compared to every other EV sector, it is the only one that is even close to making money.

August 2024

August 31: Plaza Accord hurt Japan’s economy, but not in the way most people think.

August 29: In the debate about LGFVs, there is too much focus on transferring value from the state to the private sector and not enough focus on how changing management and/or transferring ownership can unlock productivity.

August 28: The youth unemployment rate jumps from 13.2% to 17.1% in July. Is it time to get hysterical?

August 27: A collection of thoughts on the renminbi, “hot money” flows, capital flight and its future policy direction.

August 26: Re-visiting the Chinese ICE “overcapacity” debate and discussing the concept of gross vs. effective capacity by incorporating natural depreciation and obsolescence rates of factory equipment.

August 25: NEV growth is driven by supply-side factors in China while ICE decline is driven by demand destruction.

August 25: Domestic consumers are the main absorber of increased manufacturing output in China. This is “funded” by the productivity gains that drive increased manufacturing output.

August 24: Thought exercise to illustrate why market cap isn’t everything: A five-step plan to turn China Railway into a trillion-dollar market cap company and for me to collect my $30 billion banker fee.

August 24: The Chinese banking system was in much worse shape in the 1990s and early 2000s due to the fundamental inefficiency of SOEs before large structural reforms.

August 24: It’s time to revive the Li Keqiang Index. We can keep electricity and credit but railway cargo volumes should be replaced by retail sales of goods and services.

August 24: Framework of different ownership and labor models and applications to specific companies and industries in China.

August 23: China and the United States are both self-sufficient economies.

August 20: China Railway’s July 2024 performance — the first month of the summer travel season.

August 19: Indigenization is the only reliable way for a continent-scale economy like China to become a high-income country: the case study of tunnel-boring machines from Li Zexin.

August 18: There isn’t just one approach to raising household incomes. Beijing’s core approach is targeting full, gainful employment which necessitates the use of supply-side measures. Supporting wages supports downstream demand (consumption and savings). Fiscal income transfers commonly used in OECD countries are not viewed by Beijing as a policy tool to stimulate ddemand, but as an income redistribution tool.

August 18: Unit economics of high-capex, commodity businesses like solar and why I believe the United States should strategically build onshore solar PV manufacturing capacity.

August 17: China is not in a “classic deleveraging trap”. Understanding credit in China requires delving into the underlying assets that collateralize the debt.

August 16: PBOC governor Pan Gongsheng explains why he thinks systemic risk in the financial risk has decreased. This is an update and follow-up to remarks from last November.

August 16: Conflating financial efficiency with productivity.

August 14: Total social financing (TSF) is slowing in China: implications on capital formation and GDP growth.

August 13: Beijing uses a variety of policies to stimulate demand (vouchers, trade-in programs, etc.). But direct fiscal transfers to households are more aimed at income redistribution vs. non-market demand stimulation. The most important policy to stimulate demand is targeting full gainful employment.

August 10: I have thought a lot over the years about why the U.S. has had such difficulties building a modern high-speed rail network.

August 9: On the problems of calculating overcapacity in rapidly growing industries when using forecast “planned capacity”. Capacity expansion is required to meeting rowing demand, and planned capacity is more indicative of industry growth expectations and lead times to build out new capacity.

August 9: On Japan’s industrial and technological stagnation since the 1990s

August 9: Various thoughts in reaction to this Economist article “China’s manufacturers are going broke” including Schumpeter’s creative destruction and contextualizing this chart from Adam Wolfe:

August 8 (Part 1 | Part 2): Thoughts on the recent Foreign Policy article “China’s Real Economic Crisis: Why Beijing Won’t Give Up on a Failing Model” and accompanying thread by Brad Setser. I generally agree that RoW needs to make adjustments to China’s industrial policy but I disagree with the premise that China’s economic model is “failing”, which suggests that it is unsustainable. It is precisely because within China the model is seen as working that the United States and other countries should expect these policies to continue.

August 3: Policy guidelines to boost consumption focus on supply-side measures.

July 2024

July 31: The ongoing shift from labor-intensive to capital-intensive manufacturing and the move up the economic value chain in China, spurred by this FT article “Chinese low-tech manufacturers hanging on by ‘their fingernails’”.

July 30 (Part 1 | Part 2 | Part 3 | Part 4): Net Domestic Product (NDP) is a more precise measure (vs. GDP) of actual production of goods and services in any given period. I present a framework for how various production factors contribute to production as measured by GDP/NDP.

July 26: The Chinese economy may finally be at an inflection point on the balance between consumption and investment. This is driven by the demographic transition of its labor force.

July 25: Consumption is undercounted in China and as an economy that is still in the middle stages of development, it should not be compared to fully developed OECD countries anyway.

July 23: Framing different types of equity categories along disruption/risk vs. capital requirement vectors and how “State-led VC” has developed to address the difficult task of disruptive innovation-driven industries like clean energy that also have high capital requirements.

July 23: Reasons why even though unit labor costs are much cheaper in Southeast Asia, finished solar panels end up being significantly more expensive. How industry verticalization and scale drive down friction costs in solar PV manufacturing in China.

July 21: Pekingnology released a translated full text of the long-form resolution from the Third Plenum. This thread is an ongoing “live stream” of commentary as I go through the document from top to bottom.

July 20: “Retail Sales” is not a good proxy for consumption because it ignores services. Critique of Rhodium’s report “No Quick Fixes: China’s Long-Term Consumption Growth” and long-term consumption forecast.

July 19: Response to Noah Smith’s interesting post about whether China has developed better industrial policy for an advanced economy. I actually don’t agree with the fundamental framing because I do not think it is possible to lift a system that one country uses divorced from its underlying conditions and apply to a different country with a whole different set of conditions. I discuss two examples of major differences (China’s phase of development and its lack of land). What I do think is important is understanding Chinese industrial policy in the context of its unique conditions.

July 19: From Bloomberg: “Trump Welcomes China to Build Cars in US in Departure From Biden”. But Chinese automakers would not invest substantial sums of money in the U.S. market without a reset in U.S.-China relations and a landmark reciprocal access agreement.

July 18: Short-term thinking putting profits over long-term strategy: While most of the rest of the world is shifting to EVs, incumbent U.S. carmakers are doubling down on ICE.

July 17: Discussion on the impact elevated investment in low-RoI (but ultra long lived) housing and infrastructure had on GDP (and TFP) over the last two decades and how the shift to high-RoI (but shorter useful life) manufacturing assets and services might impact both GDP and TFP.

July 17: We should stop thinking about FDI in abstract financial and money terms and in real-world production terms. I explain why the U.S. is not well-positioned to grow manufacturing FDI in India. Instead, India needs to rely on countries with recent and relevant experience in targeted sectors. That so many roads lead to China makes it tricky given the current geopolitics.

July 17: Comparing manufacturing value-add to consumption is not all that useful in assessing trade balances.

July 15: Domestic sales of ICE vs. NEVs in China are driven by both demand- and supply-side factors. Understanding contrasting dynamics better informs long-term forecasting of aggregate domestic auto sales.

July 14: Quick update on China Railway’s passenger rail and freight results through May/June.

July 14: The ICE-to-EV transition is re-organizing the value chain and creating new points of competitive differentation. Chinese auto manufacturers like Chang’an are the closest to turnkey contract manufacturing in the car industry. And technology companies like Huawei are vying to become the Google Android for aspiring EV makers. This is lowering industry barriers to entry and leading to a proliferation in brands.

July 13: The retail value of domestic car sales has recovered to 2017 levels. Rising net exports boosts economic value-add contribution beyond this. Improvements in underlying car quality and lower future fuel costs also means higher quality of GDP. The increase in domestic brand share also means more value-add from activities like R&D and marketing is captured onshore. The combination of all of these factors means that China’s car industry has played a key role in in helping the economy transition away from real estate.

July 12: Chinese “gigafactories” (a.k.a. “advanced manufacturing”) have very low direct labor input and are more capital efficient (both working capital and fixed assets).

July 9: There are even bigger projects in the pipeline. Three Gorges Energy, the same company that manages the Three Gorges Dam, confirmed plans for a ~16 GW integrated solar/wind/coal/battery project outside Ordos, Inner Mongolia. This project is part of a larger 455 GW plan that is targeted to be completed by 2030.

July 6: Last week a 3.5 GW solar project in Xinjiang switched on. In this thread, I go through the energy economics of a solar PV farm vs. farmland to grow corn and what this might mean for the evolution of geopolitics and balance of power.

July 6: Deeper analysis of the unit economics of the EV business in the context of the EU adding incremental tariffs (+17.4%) on BYD imports.

July 4: Indonesia is adding tariffs on “footwear to clothing and ceramics to protect its domestic industries”. How this fits into the tectonic shifts in trade relationships between China and developing vs. developed nations.

July 3: Migrant workers are the “beating heart” of the Chinese economy. How the generational relationship between migrant workers and their increasingly college-educated children sits at the core of China’s social compact. How structural change in China is underpinned by this demographic transition.

July 2: China can substitute its entire kerosene demand with $165B of investment in large plants that can convert wind power into aviation fuel.

June 2024

June 30: The polytunnel and other productivity-enhancing investments in China’s oft-overlooked agricultural sector.

June 26: Analyzing the steel and concrete requirements for onshore wind turbines.

June 25: China and the Costco metaphor.

June 24: Response to thread by Michael Pettis on local vs. central tax reform where I dispute that there have been implicit transfer from households to businesses and governments since the GFC. Instead, I argue the opposite. Since the GFC, government policy has favored households, particularly lower-income ones, over businesses. I discuss how getting the “system framework” right is critical in answering the question about local vs. central tax reform.

June 24: The international money connection between (i) Mexican drug traffickers (ii) U.S. drug users and (iii) Chinese HNW seeking to move assets overseas and the role that Chinese money-laundering organizations (MLOs) play.

June 22: More accurately calculating Chinese EV sector subsidies.

June 17: China “Retail Sales” is only a subset of broad-based consumption. It does not capture consumption-oriented services. If we examine broader-based measures, consumption is much closer to pre-crisis trend than suggested by “Retail Sales”.

June 13 (Part 1 | Part 2 | Part 3): Analyzing the EV transition, specifically BloombergNEF’s EV transition compared to my more aggressive forecasts (Part 1) and then downstream impact on Chinese petroleum consumption (Part 2). Part 3 examines how the pace of the EV transition impacts assessments of excess capacity in upstream industries like batteries.

June 12 (Part 1 | Part 2): The European Commission releases its long-awaited tariffs. It will apply additional individualized tariffs to BEV exporters (ranging from 17% to 38%) from China. Some analysis on how it might affect the prospects of a car like the BYD Atto3 (Yuan Plus in China) in Europe. We should expect a short negotiating window which, if successful would yield some sort of memorandum of understanding, followed by a longer negotiation over definitive terms.

June 11: India will need to work with China if it pursues an labor-intensive export-oriented manufacturing strategy. India will need to pursue such a strategy to drive sustainatable, balanced economic growth. Reactions to two op-eds from Mihir Sharma (Bloomberg) and Raghuran Rajan (FT) on the importance of manufacturing to India’s economic development.

June 11: EV and solar companies are all “feeling the 卷” these days but in distinct ways.

June 10: “Overcapacity” or “involution” (卷)? What did Geely boss Li Shufu really mean in recent comments about EV industry competition? The analogy between the Chinese EV industry today and VC-backed rideshare industry in the 2010s. “Overcapacity” is quite different from “involution”.

June 7: Land subsidies mitigate natural disadvantages; they do not provide a significant competitive advantage for Chinese automakers trying to compete globally.

June 6: Sources of competitive differentiation have changed in the auto industry with the transition to “new energy vehicles”. How this ties into comparative advantages and why China was able to build decisive advantages in this space.

June 4: Upfront subsidies used to get a nascent industry to scale should be amortized over future demand generated on a non-subsidized basis. If applied to the EV industry, the upfront subsidies ($173 billion high-end estimate) from 2009 to 2022 amortized across hundreds of millions in future NEV sales will be relatively de minimis on a per-vehicle basis.

June 3: Fordism in the 21st Century — the number of years it takes the average Chinese manufacturing worker to afford a basic entry-level plug-in hybrid has fallen from 120 to less than 10 since 2008.

June 1: Clean energy deployments are not only growing faster in China (everybody knows this by now) than the G7, but in the rest of the world as well.

June 1: Chinese SOEs come in a variety of forms. Some of them look like Korean chaebols.

May 2024

May 30: Cars still look the same on the outside, but their insides are changing rapidly. How “hybrids” are really just incrementally improved ICE designs while PHEVs and BEVs represent new “species” of vehicles.

May 29: Step 1 of the property correction, involving the transition of economic resources away from property to other sectors, is largely complete. Step 2, involving the restructuring of accumulated malinvestment on the national balance sheet, is beginning in earnest. There are now numbers coming out that help quantify the total scope and scale of this restructuring effort.

May 28: Comparative advantage at the country-level vs. sector-level. Clearing up some confusing aspects of Michael Pettis’ op-ed in FT (archive) “No, trade surpluses aren’t caused by comparative advantage”. Related follow-up thread with Brad Setser.

May 26: Comparative advantage “stock” and “flow” and STEM labor markets.

May 24: China’s solar numbers are about to get crazier.

May 23: Solar and its similarities to commodity chips, “overcapacity” in growing vs. mature sectors, and what Chinese solar industry insiders are really asking for from Beijing.

May 22: Morocco’s Al-Boraq HSR line — the first high-speed segment on the African continent.

May 22: You need to pay more attention to Donghua Jinlong. No, seriously, you need to pay more attention to Donghua Jinlong.

May 21: Technology transfer has now reversed with EV platform development technical knowledge and know-how developed in China and flowing back to German automakers like Audi.

May 20: Summary of Sun Ninghui’s lecture to the Politboro Standing Committee (archive) on the history of computing and how recent AI developments fit into the long arc of computing history.

May 20: The fossil fuel to renewables transition and how path dependencies have made the U.S. — at its core an oil and gas superpower — waver on its climate commitments.

May 18: The irony of Trade Wars are Class Wars is that Beijing’s proactive policy support of the lower class in the post-GFC era is what is causing global spillovers in financial markets and trade.

May 17: China announces a ¥300 billion fund to support local governments to convert existing excess buildings into affordable housing.

May 16: Land subsidies, capital investment and winning the “hearts and minds” of non-aligned, developing nations.

May 15: Throwing some chum out into the water. Why doesn’t Apple just acquire or partner with a Chinese automaker? Follows up this 2018 post on Apple and Tesla.

May 14: Response to NY Times article “China Is Raising Bullet Train Fares as Debts and Costs Balloon” that makes quite a leap interpreting a pilot program for flexible pricing strategy as a signal for deeper economic troubles with local government finances and China Railway, rail network operator.

May 13: Clarifying the excess capacity debate for Chinese ICE exports. Responding to Brad Setser’s thread.

May 11: Auto industry evolution in the ICE-to-EV transition and how it impacts everything from accounting to changes in the critical success factors for competitive car companies. Analysis of three key components: manufacturing, developmand and marketing/distribution.

May 10: A response to Tanner Greer’s excellent essay on 新一轮科技革命和产业变革 “New Round of Techno-Scientific Revolution and Industrial Transformation” with some critiques on framing but more importantly augmenting it with a specific focus on the clean energy revolution.

May 9: China’s transition away from the property sector has been smoother than many expected. What does this say about the “Japanification” comparison? Observations from Richard Koo’s recent interview in Yicai and a follow-up to a thread from last summer on a talk he gave on this topic.

May 9: German automakers are “holding service” on the ICE-to-EV transition.

May 8: The implications of a global economy that is transitioning from “finite” to “non-finite” goods and services. Re-post of a piece I wrote in 2018 “What will happen to the United States if China's technology continues to advance?” on Quora.

May 7: China’s complicated relationship with Myanmar.

May 6: Xiong’an is the culmination of four decades of urbanization in China.

May 3: Thread on declining FDI into China that accompanies a recent post (“Controlled capital investment”) that tries to breaks down the mechanics of the misunderstood “reinvested earnings” component. Follow-up thread looking at Apple’s segment data and explaining how it flows through FDI and balance-of-payment line items.

May 2: How road names reflect Taiwan’s core ambition as a “developmental state”. Also the latest episode of Californians: Taipei.

May 1: Migrant workers are the “beating heart” of the Chinese economy. The latest numbers from the annual migrant worker survey and how I interpret them.

April 2024

April 30: Reminiscing about fantasy baseball and how it impacted everything from math to microeconomics to Excel modeling.

April 30: The Third Plenum is officially on for July. It came about a year later than usual so much speculation about the content and agenda for the meeting. I expect substantive forward-looking reforms tied to the the impact of rapid technological changes, particularly in clearn energy, and Chinese “full acceptance” of a bifurcated globe and policies designed to adapt to it.

April 29: The direct-to-consumer (DTC) distribution model for EVs decreases the cash conversion cycle and lowers working capital requirements. This is one of the many disruptive changes to the traditional car business model that are making it hard for incumbent ICE manufacturers to adapt.

April 27: How asset rotation is decoupling credit formation from GDP growth in China. This is a a response to an excellent set of long-term credit and other charts from Shanghai Macro Strategist and a follow-up to a very important chart shared in October 2023 showing how credit was flowing from property to industrials.

April 26: China and ASEAN are getting closer, driven by powerful and natural economic forces.

April 25: BYD is now using electromagnetic linear motors in its high-end Yangwang cars replacing traditional hydraulic-based suspensions. This is an example of technology spillover, leveraging skills and IP that was developed in adjacent industries.

April 24: The origins of TSMC from a radical new concept in Morris Chang’s head to one of the most geopolitically significant companies on this planet in less than four decades.

April 23: TSMC’s Arizona fab and observations on TSMC’s “intensive, military-style work environment”.

April 23: Global and China EV forecasts from IEA. I am forecasting significantly higher NEV sales and production than the IEA forecasts.

April 22: All about Asian conglomerates from Japanese keiretsu to Korean chaebols to the rise of Indian conglomerates on the world stage like Tata Group today.

April 22: Are Taiwanese contract manufacturers the big losers in evolving Apple and broader consumer electronics manufacturing supply chain?

April 22: Texas controls its own power grid and it is not a coincidence that is leading the country in clean energy deployment.

April 21: Applying Ferguson’s Law to China.

April 20: The emissions payback period on the production of solar PV.

April 19: China’s “mature node” chipmaking strategy. This was a continuation of an earlier thread from from last year where Lu Feng described this strategy.

April 18: I did my first podcast with Steve Hsu at Manifold. Discussed my background and how it has shaped my perspectives on the topic of the Chinese economy. We talked about many of the topics I have been covering:

China’s evolving relationship with the West as it has moved up the economic ladder

Its policy emphasis on human capital development

The importance of advanced manufacturing

My “deep dive” into high-speed rail

Thoughts on the future evolution of the economy

April 17 (Part 1): China’s Q1 GDP numbers came out yesterday. I wrote about the numbers, but more in a broader context of how they fit into several important themes I have been talking about for the past year. Here I focus in on the structural transition away from property to advanced manufacturing and other higher-RoI activities.

April 15: In response to a question posed by Joe Weisenthal about China’s propensity to favor volume over profits in manufacturing, I wrote a long-form blog post and thread discussing this seeming paradox.

April 13: Toyota’s bet on solid-state battery technology as a lynchpin to its EV strategy is a sign that it is not taking the transition to EVs seriously.

April 10: Vietnam announces that it will prioritize the high-speed rail route to China for its North-South express railway project. This would be the second leg of an envisioned regional rail network in Southeast Asia that would enable high-speed passenger rail travel from Beijing to Singapore. This elevates Nanning (南宁), capital of Guangxi Province, in importance as a regional gateway city into Vietnam, the 3rd-largest member of ASEAN.

April 9: Two reactions to Xu Gao’s recent speech about low consumption in China, translated here by East is Read. My two main reactions:

Household demand (expenditures plus gross capital formation) matters more than consumption

Corporate profits (via dividends) are not the only way to distribute economic gains to households. Chinese SOE’s play a major role with “public goods” and are distinct in the industries they operate in (highly regulated/strategic, capital-intensive and domestic industries prone to rent-seeking).

April 9: Second-order effects of the shift from ICE to EVs on where and how they are produced.

April 8: A follow-up on “Gigapresses” from the previous week and recent Noah Smith tweet — diecasting is a mature technology where most of the world’s foremost expertise is now in China. It’s used to produce an EV chassis, which is not close to being the most critical component in the product (batteries or the drive train), so insinuating that China is “stealing this IP” distracts from the much more critical point that so much of the industrial machinery sector has moved to China and how behind America is falling in complex mass manufacturing.

April 7: As with cars, “excess capacity” or “overcapacity” in solar and battery manufacturing must be contextualized.

April 6: Chinese advanced manufacturing are “digital-native” and leading the new “intelligent manufacturing” paradigm, also known as “Industry 4.0”.

April 4: We know that the United States needs to consume less and invest more. What’s not clear is how we can make this happen. The path forward for China is much more clear at this point — deeper economic integration with the developing world.

April 1: Indonesia should develop its own national auto brand. It can leverage changes to the auto supply chain (fragmentation and specialization) and the transition to electric vehicles.

April 1 (Twitter | Substack): Exorbitant privilege of the U.S. dollar as the world’s reserve currency and its impacts on American manufacturing competitiveness.

April 1: The recency of China’s development gives it an advantage over the G-7 to trade and invest in developing countries, especially in ASEAN.

March 2024

March 30-31 (Part 1 | Part 2): Review of 置身事内 (“Chinese Government and Economic Development” h/t Rui Ma) wrapped around a critique of misapplied models (e.g. Janos Kornai’s “hard-budget constraints” vs. “soft-budget" constraints) on the Chinese bureaucracy. Using a more realistic model of the Chinese bureacracy and understanding of its weaknesses shows how the property problem is one of distribution instead of aggregate malinvestment.

March 29 (Part 1 | Part 2): Huawei financials and compensation at Huawei and BYD. Huawei and BYD as the next evolution of East Asian tech/industrial conglomerates.

March 28: To reach high-income levels of development, China will have to rely primarily on its domestic market to drive advanced industries. Its foreign expansion strategy for advanced industries will also rely more on developing economies than the G-7. In this way, the “Second China Shock” is the opposite of the first one.

March 28: Tesla and some of its impacts on the Chinese EV industry: “Gigapresses”. Despite the hoopla over these largest diecasting machines, Tesla’s contribution was more on product design, technology and distribution.

March 27: First podcast with Steve Hsu at Manifold

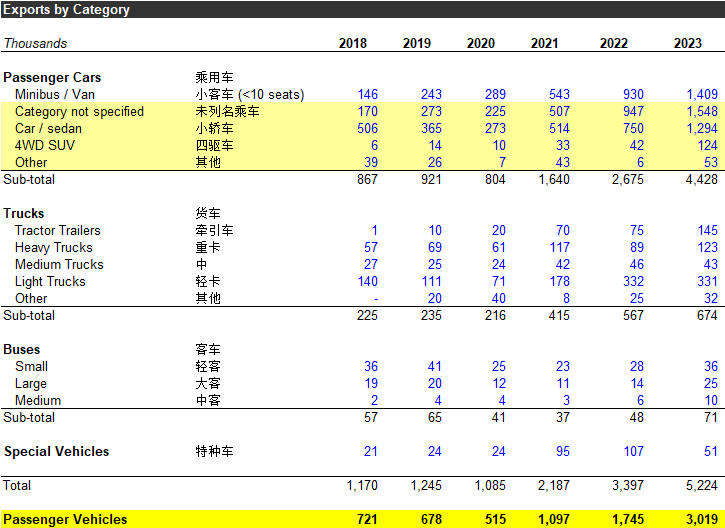

March 26: Focusing in on Chinese NEV and ICE passenger vehicle exports. Breaking down the vehicle export numbers to separate out these exports from trucks, buses and smaller ICE vehicles that do not really touch developed markets.

Source: @glennluk March 25: Response to Michael Pettis’ thread with counterpoints on why the property to advanced manufacturing transition represents a leveling up of the economy.

March 23: Analyzing China’s Belt & Road Initiative (BRI) from the perspective of labor and human capital flows.

March 21 (Part 1 | Part 2): Some interesting recent data from January-February on the Chinese EV industry. EV exports to the EU declined 20% in the first two months of 2024 increasing 36% to RCEP countries. What this says about the evolution of trade flows. From SCMP article “China EV exports, slammed by West’s trade barriers, find greener pastures with free-trade partners” (archive). Chinese EV penetration about to cross 50%, much earlier than most expected.

March 18 (Part 1 | Part 2 | Part 3): High-quality electric vehicles that — due to rapidly declining input and production costs — are cheaper than equivalent (often less fully-featured) ICE vehicles on an upfront basis, and much cheaper on an TCO (total cost of ownership) basis, represent huge productivity gains that result in both higher quantity and quality of GDP. Response to this article (archive) by Thomas Klitgaard entitled “Can Electric Cars Power China’s Growth?”.

March 18: More evidence from the first two months of the year of the property to industrial/manufacturing shift and how it may potentially create a tailwind for GDP growth. Retail also ticked up but is still well under pre-pandemic trends. Reactions to nice data-heavy thread from Patrick Zweifel.

March 18: Capital-intensive vertical farming and clean energy sit at the foundation of an epochal shift.

March 16: The economics of government-funded industrial subsidies to jumpstart a nascent industry by solving economic problems that private capital cannot.

March 16: Widening gulf between politicized economic statistics in India and on-the-ground realities. Ashoka Mody responds (archive) to the announcement of the “elimination of extreme poverty”.

March 14: Analysis of new central government funded “trade-in” stimulus program for businesses and households as reported in this SCMP article (archive) and original release from the State Council.

March 14: Introducing a new mental model that compares sectors by their underlying “productivity” and “labor intensity” characteristics:

Source: @glennluk March 12-13 (Part 1 | Part 2): Trying to figure out the true program development cost of the C919 at COMAC. Previous estimates had been in the $72 billion range. More likely in the $4-7B range (as a high-end estimate).

March 12: Reactions to FT Article “Will China be forced to stimulate?” (archive) on 2024 GDP, focusing on the knowns (policy tools) and unknowns (macro and exogenous factors).

March 12: Technical discussion on the GDP mechanics of sectoral transition from property to industrial investment. How “GDP Return” is different from vs. financial return measurements like RoE and RoIC.

March 12: Correction of a misleading chart that shows the decline in the number of available Chinese data series by the National Bureau of Statistics. It turns out that a third-party data provider (CEIC) was removing access to data series for other reasons. Some data series have been indeed taken down but much milder than what a widely circulated FT chart (archive) indicated.

March 11: India is the best bet to replace China as the labor-intensive manufacturing partner for the United States but there are some challenges. It’s main competition is ASEAN and while the United States can provide demand, FDI will likely have to come from allies like Taiwan, Japan and Korea.

March 11: Ongoing debate between Robin Brooks, Mike Bird and Noah Smith about whether the U.S. has “meaningfully decoupled” itself from the China manufacturing supply chain. Recent data shows that it has not. I also raise concerns that U.S. “decoupling” efforts may accelerate China strengthening its relationship with the developing economies, potentially pushing the U.S. out farther to the periphery.

March 10-11 (Part 1 | Part 2): Introducing the “Pareto efficiency” framework for analyzing Chinese economic development. Why the “China is over-investing” narrative is overly simplified. Applying the model to Chinese historical and ongoing economic development during the rapid urbanization era with export-oriented manufacturing, domestic-oriented housing and infrastructure investment and today’s clean energy transition.

March 9: Why electric vehicles and batteries go hand in hand. Clean energy generation needs to be evaluated as a system, which can include a “dizzying array” of combinations of solar panels, wind turbines, green hydrogen production, transformers, inverters, UHV lines, batteries, pumped storage and many more.

March 9: How many hours does it take for the average wage-earning worker to buy a car? 1909 + 1925 Model T vs. 2007 Ford Mondeo (in China) vs. 2024 BYD Seagull.

March 8: Silicon Valley “deep tech” vs. massive integrated clean energy projects in China.

March 8: How China and the United States approach de facto bans of companies.

March 8: AFRE (Aggregate Financing of the Real Economy”. Review of detailed primer and historical review of China’s financial system.

March 7: Chinese homes are back to 2014-17 levels of affordability. This suggests that China is closer to the end of the property sector adjustment process.

March 7 (Part 1 | Part 2): The GDP mechanics of long-lived housing and infrastructure investment and how it contributed to slowing GDP growth, only to be offset by accelerating real asset gowth on the “national balance sheet”. What does GDP measure and not measure?

March 6: Bytedance will not force-sell TikTok. It may sell the US operations (or maybe just let it get banned).

March 5: On the importance of updating priors.

March 5: When Chinese policymakers talk about “domestic demand” (archive) they are talking about both consumption and investment, which are accounting-driven definitions. Policymakers do not focus on them. Instead, they view things from a sectoral perspective. “Supply-side reform” is a common phrase that refers to the coordination in the shift of economic resources. Thinking about it this way helps us better the new slogan “New Productive Forces”.

March 4: Medium- to long-term dynamics in the global auto industry. Some predictions on how national automakers will shake out.

March 4: Why property prices are structurally higher in China than the United States.

Land scarcity vs. land abundance

Construction & materials costs

Land use rights vs. ongoing property taxes

March 3: Large countries (like China, India and the United States) operate on a different set of economic laws than small ones. The rational basis for greater autarky in larger economies that is driven by the principle of specialization.

March 2: History of Chinese-American immigrants, including some family history.

March 1: Applying Bayesian thinking to applied sciences and technology development. “But I cannot help but wonder whether the long-term ramifications of export controls are to give China, leveraging its enormous STEM pool and human capital, the space to leapfrog in yet another advanced high-tech industry built on applied sciences.”

February 2024

February 29: Response to the Biden Administrations press release (archive) on “National Security Risks to the U.S. Auto Industry”, including the sidelining of Tesla, not even mentioning the word “electric”, de facto U.S. ban on Chinese EVs, and potential long-term risks related to this strategy.

February 29: The different productivity characteristics of various industries. Some drive (manufacturing and technology) productivity growth in the broad economy. Others (labor-intensive services) are consumers of technology and are better at creating jobs.

February 28: Survey of the global auto market as a baseline to evaluate how different regions and countries will evolve in the EV transition. Background for why Chinese EVs are focused so heavily on developing markets.

February 27: How inbound FDI (into China) and outbound FDI (from China) are related. Outbound: Chinese industrial FDI is replacing infrastructure FDI (Belt & Road. Increasing FDI to support offshoring of labor-intensive Chinese manufacturing. Inbound: Rising competition from domestic manufacturers is replacing foreign FDI, particularly in the auto industry from the EV transition.

February 26: Time considerations in travel mode comparison between high-speed rail vs. airplane. “Breakeven (km) = HSR Time Premium (hrs) / Air Velocity Advantage (km/hr)”

February 26: Discussion about how comparative advantages can change over time. Comparison of comparative advantages between the United States and China.

February 26: China is building a “backup” network of Free Trade Agreements (FTAs).

February 23: The benefit of technological progress and productivity gains does not always show up in direct employment numbers. It can also show up in production efficiences that lower the real costs of goods and services in the broad economy.

February 23: GDP is a flow concept and the national balance sheet is a stock concept. We need to pay attention to both when evaluating major resource shifts between “consumption-oriented” and “investment-oriented” production.

February 22: The biggest obstacle to U.S. manufacturing revival is a lack of quantity and depth of manufacturing skill and know-how. Cites Tim Cook’s 60 Minutes interview and talks about how this came to be.

February 21: One of the biggest geopolitical shifts over the next two decades is China transforming from the world’s largest energy importer to an energy exporter, driven by the clean energy transition.

February 20: While China has made strides in aviation, I agree with Airbus' CEO that it won't significantly disrupt global aviation for decades. Discussing the impact of long product cycles, China’s relatively smaller scale advantage and the national security factor.

Note: subsequent information on how much COMAC has actually invested in C919 development changed my views here

February 16: Deflation tells you something different about China than from what it told you about Japan in the 90s.

February 14: The domestic market accounts for the vast majority of Chinese EV growth.

February 13: HSR is not a “terrible idea”. Critique of issues I had with Casey’s blog post on why HSR is obsolete.

February 9: Labor-intensive and low-capex manufacturing vs. high-tech and high-capex manufacturing.

February 5: Different ways to re-capitalize Chinese banks — capital injections, net interest margin, inflate away and move impaired assets off the books.

February 5: What are the embedded losses in the Chinese banking system? Key factors: aggregate level of malinvestment, equity cushion / NPL recovery, and banking system liquidity / time horizon.

February 4: China has been operating a two-speed labor economy.

February 2: Comments on IMF’s medium-term outlook for the Chinese economy and why I have a more optimistic view of 4-6% growth through 2030.

February 1: Taiwan during its labor-intensive manufacturing era with case study of Mattel / Barbie in the 60s to the 80s.

January 2024

January 31: Compilation of ideas on why developing countries are different from deveoped ones.

January 31: Scale in infrastructure can drive innovation and lower costs by changing the unit economics of fixed cost R&D. How “Going Big” played out with HSR in China.

January 30 (Part 1 | Part 2): Issues with the TFP calculation for China.

Calculating capital increase using fixed vs. variable depreciation (rising asset duration)

Problematic GDP data from Penn World Tables (PWT)

“All roads lead to Harry X. Wu”

Housing is not related to “productive capacity”

TFP trendlines based on Taiwan/Korea experience

January 28: My personal experience with Cantonese

January 27: Is it better to invent or commercialize? The story of Lithium Iron Phosphate (LFP).

January 26: The massive amount of investment China is putting into solar and all of the medium- to long-term impacts.

January 26: On China’s “persistent” trade surpluses. What drives China’s manufacturing surplus (comparative advantage) and overall trade surplus (FX policy)

January 25: Thoughts on Rhodium Groups’s low-end estimate of 1.5% GDP growth in 2023 (archive).

January 24: TFP estimate from Lowy Institute’s 2022 report “Revising down the rise of China” (archive). I argue that declining TFP was partially the result of sectoral shift into “low RoI” housing and infrastructure investment. Sectoral shift back into “high RoI” industrial and high-value services should provide a TFP tailwind.

January 23 (Part 1 | Part 2): The generational shift from blue-collar to white-collar labor force.

January 21: Supply-side subsidies can benefit consumers.

January 19: Observations on The Economist’s take on per capita GDP adjusted for hours worked (archive).

January 19: Air travel vs. high-speed rail adjusted for traveler comfort.

January 18: The seeds of U.S. industrial/manufacturing decline were sewn in the 70s and the decline of the machine tools industry was one of the first troubling signs. What happened to the US machine tools industry?

January 18: China Railway full-year 2023 operating results and commentary.

January 17: China’s youth unemployment rate is back after being suspended for a few months to adjust the survey methodology. Additional follow-up analysis on it in April.

January 14: China’s NEV market dynamics.

January 12: The causal link between debt creation and GDP growth is weak, at best.

January 11: Massive upwards revision in renewables driven by China growth.

January 10: Evolution of China’s manufacturing sector from a comparative advantage based on low-cost but productive labor to one based on technology and embedded know-how.

Product type

Target markets

Labor dynamics

Geopolitical environment

January 8 (Part 1 | Part 2 | Part 3): China vs. Malaysia and Thailand

January 2: Housing is consumption.