Threads Archive: 2023 and Earlier

Compilation of threads through 2023

Link to 2024 archives.

December 2023

December 28: In-kind benefits are not typically included in wage calculations collected in from surveys.

December 27: BYD is building out a verticalized supply chain in Indonesia.

December 24: In the Solow model, it is important to account for changing mix of capital investment from shorter-lived “factory machine” type assets to much longer-lived housing & infrastructure. Response to pieces by Michael Pettis and Noah Smith on this topic.

December 18: Another reason why China today is not Japan in the 1990s — Chinese companies have been gaining global competitiveness as they have moved up the value chain while Japanese companies have lost competitiveness since peaking in the 1980s.

December 18: China’s focus on legacy nodes to ramp up the learning curve for chipmaking.

December 9: 218-mile Las Vegas-to-Los Angeles semi-HSR project (Brightline West)

December 8: Using PPP-adjusted GDP to compare economies is not ideal but better than using the spot FX rate. This is especially true for two large-sized economies the U.S.and China where the tradeable sector is typically smaller as a percentage of GDP than smaller economies.

December 5: More fundamental reasons why Chinese cities tend to have lots of coordinated, flashing buildings. Hint: most of them were built in the post-LED/IoT era.

December 1: The economics of my coffee machine.

November 2023

November 30: Does China have “too many airports”?

November 18: Ultra-HSR based on low vacuum maglev.

November 15: High-speed rail was really enabled by civil engineering skills and favorable land acquisition policies. Lessons for India

November 11: China has been radically re-thinking the role of coal in its grid from from high-capacity-factor (CF) baseload to low-CF standby generation.

November 8: A speculative thread on the linkages between ethnic Chinese criminal syndicates in Southeast Asia and the rise in “asylum seekers” through the Darien Gap.

November 7: Corroborating data on how real estate activity plateaued in China as a key economic growth driver almost a decade ago.

November 1: Updates on the moderate adjustments local governments are making.

October 2023

October 31: On-the-ground observations on the electric vehicle transition in multiple Chinese cities. EVs have made an enormous impact on taxi drivers.

October 30: Comprehensive government deficit (national and local) sits somewhere between the official fiscal deficit and augmented figures.

October 29: Why FDI is really declining in China. Responding to FT article “China suffers plunging foreign direct investment amid geopolitical tensions”

October 28: How an “uneducated” workforce built China — and educated themselves and their kids in the process.

October 27: How many worker hours are needed to import an Audi Q5 in 2007 vs. a BYD Song Plus today? Lowering the cost of production helps China conquer scarcity.

October 26: Should China’s property sector be cut in half from its peak? Response to Michael Pettis’ thread on why the property sector needs to fall by half to reach sustainable levels.

October 25: The economics of Very Tall Bridges in Guizhou.

October 24: Reponse to Evan Osnos’ essay on “China’s Age of Malaise” (archive). I argue that while this essay might capture the sentiments of the top 5-10% well, it does not represent the sentiments of the entire country.

October 20: Commentary on Q3 numbers released by the NBS.

October 19: Linking debt directly to GDP is a red herring and does not necessarily tell us much about the quality of Chinese growth.

October 17: The property transition has been milder than expected and this tells us something about the aggregate amount of malinvestment that occurred.

October 15: Chinese GDP growth targets appear to be driven by middle-of-the-fairway underlying factor assumptions.

October 12: Investment is really capitalized consumption and can certainly raise living standards (nicer houses, better transport options, etc.).

October 11: Breaking down debt/GDP into its component parts.

October 11: “Social Transfers In-Kind” (STIK), which is Chinese policymakers’ preferred social welfare mechanism, is now getting more coverage. From The Economist article “How economists have underestimated Chinese consumption” (archive).

October 10: Denominating high-speed rail asset investment costs in worker hours to get a sense of labor productivity.

October 10: The short- and long-term effects of different types of capital stock on GDP growth.

October 9: China is well on its way to transitioning the economy from property to other sectors.

October 8: Updated construction cost comparisons for China’s HSR system vs. other systems.

October 8: “Solving scarcity is the common theme behind the last four decades of Chinese economic policy and development.”

October 7: “It is quite naive to think that advancements in process knowledge to get older-generation lithography equipment to work at commercial yields for 7nm chips is a ‘dead end’.”

October 6: Regulatory capture in the United States vs. China.

October 5: Hukou restrictions did not substantively restrict labor mobility in China in a way that hampered overall long-term economic development. On the contrary, it gave rise to an extremely mobile and flexible labor force in the blue-collar migrant “floating population” workforce.

October 4: My two pushbacks on some key themes from Rozelle’s “Invisible China”.

On-the-job vs. formal education

How infrastructure and urbanization leads to improvements in healthcare and education

Structural transition and re-balancing

October 2: China’s labor force (particularly its migrant workers with low levels of formal education) accumulated skills through on-the-job training, not formal schooling, including the vocational variety.

October 1: Why the average rail trip shortened in China over the past two decades — changing long-distance travel patterns related to the HSR network buildout.

September 2023

September 30: One of the benefits of high-speed rail over air travel is the ability to economically scale up for surge periods.

September 30: Different ways to transfer value to households.

September 30: China’s high-speed rail buildout was just one phase of a decades-long effort to upgrade the country’s transport infrastructure.

September 30: Recent high-speed rail lines are being built out between pair cities that already have HSR. Is it redundant?

September 28: Challenging some prevailing narratives of what actually drove the “Chinese miracle”. Reponse to thread by Mary Gallagher.

Low wages and wage repression

Institutional inequality

Shallow social welfare

September 28: Reponse to article by Martin Wolf “How China can avoid the Japan trap” (archive)

Chinese household incomes are not low

Rising ICOR ratio is primarily an indication of rising asset-intensity but on its own is not a good indication of asset efficiency

September 26: Counterpoints to article by Yasheng Huang “China’s Economic Slowdown was Inevitable: The Illusory Success of State Capitalism” (archive)

September 24: Trying to make sense of macro equilibrium and supply-demand dynamics.

September 23: China in 2011 was like the U.S. from the Gilded Age. A discussion about corruption, how it manifests differently and its economic impacts.

September 23: Rail investment in China has focused almost entirely on the passenger network but China recently completed a new freight line.

September 22: China’s competitiveness is no longer from “repressed wages”.

September 17: Why there is still much catch-up group for China.

September 16: Labor force transformation is driving structural economic transformation in China.

September 13: “Buy vs. build” mentality is the default approach for many Chinese OEMs and contract manufacturers.

September 10: Major areas of disagreement with the “China is over-investing” narrative.

September 8: “Over-capacity is a feature, not a bug” of industry evolution in China.

September 7: The emphasis on capital investment in the East Asian development model was partially a function of poor natural resource endowments.

September 4: Discussion with Patrick Chovanec on whether China is “over-investing” or “under-consuming”.

September 2: Housing and infrastructure are only “less productive” than business investment in the sense that they initially deliver a lower RoI in percentage terms. But their useful lives are typically much longer so overall return can be the same or higher. Counterpoints on tweets by Noah Smith (archive) and Michael Pettis.

“Total debt is rising faster than GDP”

“TFP is declining”

September 1: The relationship between household income and demand.

August 2023

August 31: Why continued buildout of the HSR network makes rational sense: example of a new direct line between Guiyang and Nanning.

August 31: Chinese administrative nomenclature.

August 30: The adversarial relationship between the central government and local governments and how it played out in the coal industry in the mid-2010s.

August 29: China Macro/EconX has been gaslit into thinking that Chinese household incomes are low.

August 29: Background threads on the Japan and China comparison and why I ultimately think Korea on the eve of the Asian Financial Crisis is a better comparison to China’s LGFVs today.

August 28: China’s “Costco” economics.

August 27: “The idea that technology upgrading, supply chains and operational efficiency improvements play such implicitly minor roles here falls apart upon deeper investigation, particularly when one is able to look beyond just a strictly U.S.-centric viewpoint.” Response to Michael Pettis’ thread.

August 25: China’s HSR network and a modified application of Metcalfe’s Law.

August 25: Thoughts and reactions to The Economist article “China’s economy is in desperate need of a rescue” (archive).

August 23: Chinese debt is asset-backed and needs to be evaluated differently from debt that is backed by fiscal revenues.

August 20: Response to Yasheng Huang’s “How to Kill Chinese Dynamism” (archive).

August 19: China’s real estate sector actually peaked a decade ago.

August 18: Why Korea in the mid-90s may be a better comparison for China today than Japan. Response to FT article “China’s Japanification” (archive).

August 8 (Part 1 | Part 2): “Galapagos effect” in Japan with extremely sophisticated cash-handling machines.

August 5: Highway passenger-km refers to inter-city bus transport, not private vehicle traffic.

July 2023

July 22: New planning districts are not just a China thing. A day trip to Taichung in central Taiwan.

July 20: Framework to evaluate the real scope of China’s real estate issues and empty, unfinished developments.

July 18: Trying to quantify the level of China’s residential overbuilding.

July 18: “Not all capital stock is created equal”

July 17: Urbanization in China.

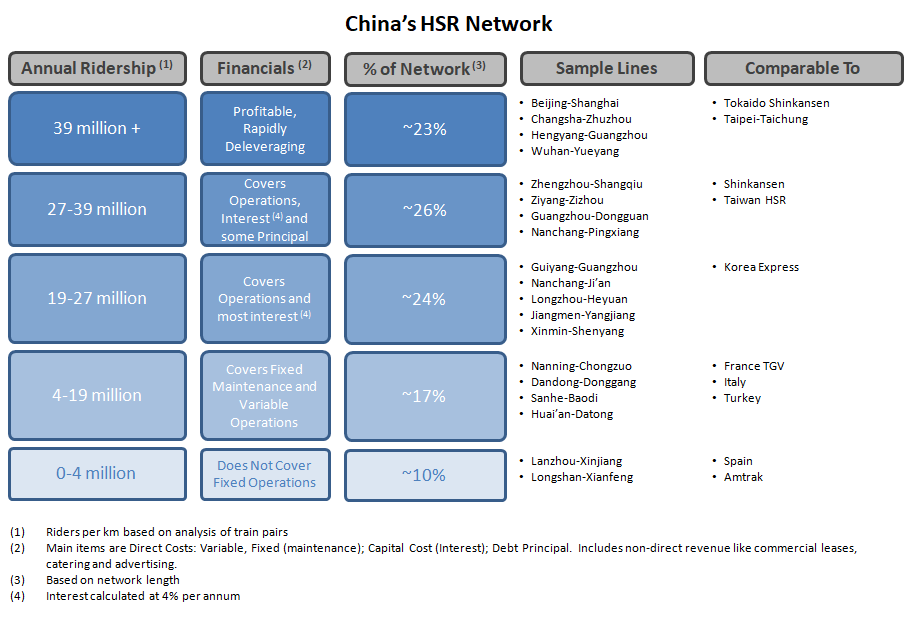

July 16: What China’s HSR network looks like if you compare it to others.

July 14: The buildout of the HSR network freed up conventional track that could be used for freight and lowered emissions.

July 10: We need to consider room & board in-kind income for lower-wage jobs held by migrant workers. This income is not included in basic income surveys.

July 7: “China's productivity growth has slowed significantly over the past decade per TFP. Prevailing opinion seems to be that it is almost a given that trend will continue if not worsen. But there is much more to this story and trend.”

July 5: Reactions to Richard Koo’s talk on the China and Japan comparison.

July 3: The paradox of Chinese coal buildout and clean energy push.

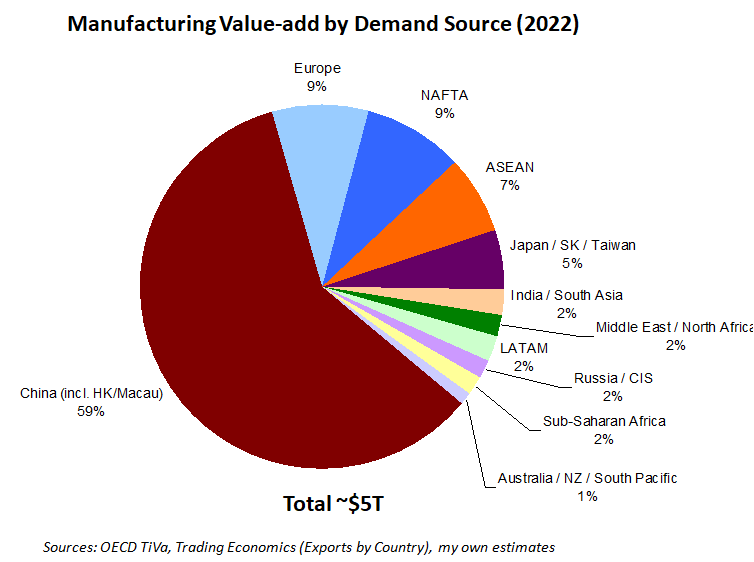

July 3: Increase in manufacturing wages has correlated with increase in China’s manufacturing value-add share.

July 2: The pace of metro buildouts is exceeding the pace of HSR investment.

June 2023

June 29: “When China controls all major components of the means of production, it can scale dizzyingly fast. When it doesn’t, it scales just like the rest of us.”

June 28: Comments on a great thread from Adam Wolfe on Chinese income, savings and consumption.

June 23: The scale of American investment in China is actually quite small in the grand scheme of things, representing only around 4% of total FDI.

June 22 (Part 1 | Part 2 | Part 3 | Part 4 | Part 5) Multi-part deep dive into LGFVs.

June 21: (Substack | Twitter): Project Finance with Kweichow Characteristics

June 20: In many ways, China is farther along achieving Master Plan, Part Deux than Tesla itself.

June 19: Evolution of private equity in China.

June 19: China and the United States have real estate problems that are mirrors of each other.

June 18: The story of Guizhou in 9 parts.

June 17: The Chinese state vs. private sector.

June 15: China cannot be pigeonholed into an “-ism”. A discussion of the early days of power sector reform and how it shows how Chinese policymakers experiment with different policies and approaches.

June 13: The circular argument of the “China is over-investing” narrative.

June 12: Details on the 45X MPTC credit for solar panels.

June 8: The biggest driver of China missing long-term GDP forecasts has been the exchange rate.

June 7: “When people talk about how difficult a transition it will be for China to ‘move on from real estate’, I think about the dismantling of the state sector in the 1990s that saw two-fifths of SOE jobs disappear. Post-Communist transitions were brutal. This is child’s play in comparison.”

June 6: Domestic “Belt and Road”: The Western Land-Sea Corridor 西部陆海新通道.

June 5: The importance of viaducts for high-speed rail.

June 5: Housing over-building took place mainly in inland lower-tier cities.

June 3: China’s clean energy interest is driven by national security, not de-carbonization.

June 2: Going down the rabbit hole OECD TiVa data to try to measure the proportion of demand between domestic and foreign sources.

May 2023

May 30: Analysis of China’s youth unemployment figures.

May 29: Differences between China and the United States in taxation.

May 28: Noah Smith is wrong to characterize Chongqing as “car-centric” sprawl (archive).

May 26: Huge geopolitical implications of China’s renewable energy boom. This is “significantly bigger” than AI.

May 23: China Railway’s April operating results.

May 23 (bluesky): “Of course that’s your contention. You’re a first-year associate on Morgan Stanley’s international desk. You just finished reading Business Insider and are convinced that the CCP has taken out a trillion dollars of debt …”

May 22: Trying to quantify corruption in the Ministry of Transport that built the first phase of China’s high-speed rail network.

May 19: The Laos-China Railway. Laos was really poor before. The railway is part of a larger envisioned rail network connecting Southeast Asia.

May 17: China is automating very quickly.

May 13: Advanced manufacturing is about industrial clustering.

May 12: India’s under-employment issue.

May 12: “Whether or not we are ready to accept a multi-polar world order is going to be the defining economic and foreign policy question of our generation.”

May 11: Absolute growth in household income is what matters, not the relative percentage of consumption which is also a function of savings rates.

May 10: Next phase of China’s industrialization is more geographically dispersed.

May 9: Japan’s auto industry is about to get massively disrupted by electric vehicles.

May 9: India’s real economic competitor is ASEAN.

May 8: Chinese SOEs were never big players in export-centric manufacturing.

April 2023

April 29: Japan’s long stagnation was in part from the rise of East Asian export-oriented economies like Taiwan and South Korea (and China, more recently) that chipped away at the relatively competitiveness of Japan Inc.

April 29: Domestic tourism as a wealth distribution mechanism.

April 28: Technology transfer agreements in HSR (China, Korea, India).

April 27: China’s trade relationship with the world is driven by shifting comparative advantages over time. Responding to a more macro-centric equilibrium based approach by Brad Setser.

April 23: Visualization of ridership density on China’s HSR network in Janaury 2023.

April 20: “It’s difficult to see how India can break out of the ‘middle income trap’ without more emphasis on manufacturing”

April 16: China has progressed faster in developing a fully indigenous chip manufacturing value chain than I expected.

April 13: The pandemic accelerated China’s move up the value chain from labor-intensive final assembly to higher-value intermediate products like textile and electronic components. Chinese companies themselves are pro-actively shifting factories to be closer to end consumers for a wide variety of manufactured products.

April 2: China’s demographic transition from non-college to college-educated. Chart from Adam Tooze via FT.

March 2023

March 30: Response to Zhao Jian’s old essay on why he thinks HSR is a potential “Gray Rhino”. Followed up with a long-form post.

March 28: HSR is not in “sparsely populated areas”

March 10: Moving up the value chain is the story of China’s manufacturing evolution over the last decade.

February 2023

February 25: To say industrial subsidies were the “only factor” in helping establish globally competitive manufacturers is quite silly. A response to Michael Pettis’ thread on TSMC Arizona.

February 21: “The key takeaway with this chart is that labour costs China had already surpassed peers by the early 2010s and has continued to be a headwind since. Its manufacturing competitiveness is driven by other factors incl. scale and supply chain and where the focus should be.”

February 1: Quirks in China’s reporting and how it can led to miscalculated solar capacity factors.

January 2023

January 31: In Trade Wars are Class Wars, the household class is conflated with “household consumption” and government/business class (“elites”) is often conflated with “investment / gross capital formation”. This is an inaccurate description of reality.

January 31: Taiwan is probably the “most mercantilist” economy on the planet.

Pre-2023

January 17, 2022: Comparing the “efficiency” of healthcare GDP to investment GDP.

November 6, 2021: Comparison of Tesla’s facility in Fremont to Gigafactory Shanghai on capital expenditures.

October 30, 2021: “China has been ‘late 80s Japan’ for 12 years in a row.”

October 10, 2021: “HSR is far more about general urban development than the development of outlying Western provinces. Framing it incorrectly inevitably leads to drawing questionable conclusions.” Response to SCMP article “Is there a dark side to China’s high-speed rail network?” (archive).

October 5, 2021: The difference between maintenance and expansion capex in the Chinese economy.

September 25, 2021: “If China is now a high-income country, isn't it by definition no longer stuck in the ‘middle income trap’?”

September 6, 2021: The travails of Asian Americans before the Immigration Act of 1965.

August 3, 2021: Excess mortality study on Wuhan/China covering Q1 2020

July 31, 2021: Biking around Taipei during the lockdown.

January 28, 2021: Laying out to case for why MacroPolo’s analysis of China’s high-speed rail network as a net-positive project is correct.

December 20, 2020: “HSR cannot replace bulk, heavy freight but it can be used to facilitate same-day or next-day delivery for e-commerce as currently being demonstrated in China.”

October 21, 2020: The reliability of China’s GDP metric.

August 26, 2020: China’s economic growth story has been the story of reducing friction costs.

August 22, 2020: Michael Pettis’ analysis of the economic value of HSR (comparing China to Spain) neglects the most important variable, utilization.

August 19, 2020: Response to David Fickling’s article “China doesn’t need 125,000 miles of track” (archive) about the case for why more HSR makes economic sense.

March 18, 2020: Analysis of initial CDC cases.

March 12, 2020: Analysis of Korea’s COVID-19 cases.

March 11, 2020: Analysis of Italy, China and Korea’s COVID-19 strategies by separating out confirmed pools by age cohort.

November 15, 2019: Apple iPhone BOM analysis in lengthy discussion with Brad Setser, one of the first I really followed closely on Twitter. Read up from the bottom of the thread. Plus another debate about central vs. local government stimulus.

November 12, 2019: “Killing the TPP was a major unforced error. Being left out of the world's largest trade deal just magnifies it. This will have significant long-term impact on our ability to project economic power. Still puzzled by the decision-making here.”

October 28, 2019: “One under-appreciated point is that as China’s economy shifted away from resource-intensive manufacturing economy powered mainly by coal, there was less need (relatively speaking) for bulk freight. At one point coal made up half of the bulk freight by volume.”

October 13, 2019: Me and “Andy the R.A. at CTY, Lancaster ‘94”

May 17, 2019 (Part 1 | Part 2 | Previous discussions): Seasonality at Alibaba in a discussion with Jim Chanos. He got irrirated and blocked me.

April 14, 2019: “I don't think there is any difference in terms of the driving impulse: both are driven by capitalism, the desire to grow, profit-driven market expansion. Differences in business strategy and execution are driven more by differences in local conditions and comparative advantages.”

March 20, 2019: The capital-intensity of Huawei’s business model.

February 3, 2019: Alibaba’s business model and financials.

February 26, 2018: First time at a Hema 盒马 store in Shanghai.