Threads Archive: 2025

Ongoing compilation of various threads from 2025

This page will be regularly updated throughout the year.

Previous Archives:

Active/Ongoing Threads

December 2024: Hidden taxes in U.S. society that add friction costs with dubious value-add.

May 2024: Ongoing thread of outbound foreign direct investment (FDI) by Chinese companies in EVs, battery, clean energy and other advanced industries

October 2025

October 1: Errors & omissions (E&O) in China’s Balance of Payments accounting.

September 2025

September 29: China still has a long way to go to become fully developed according to its own standards.

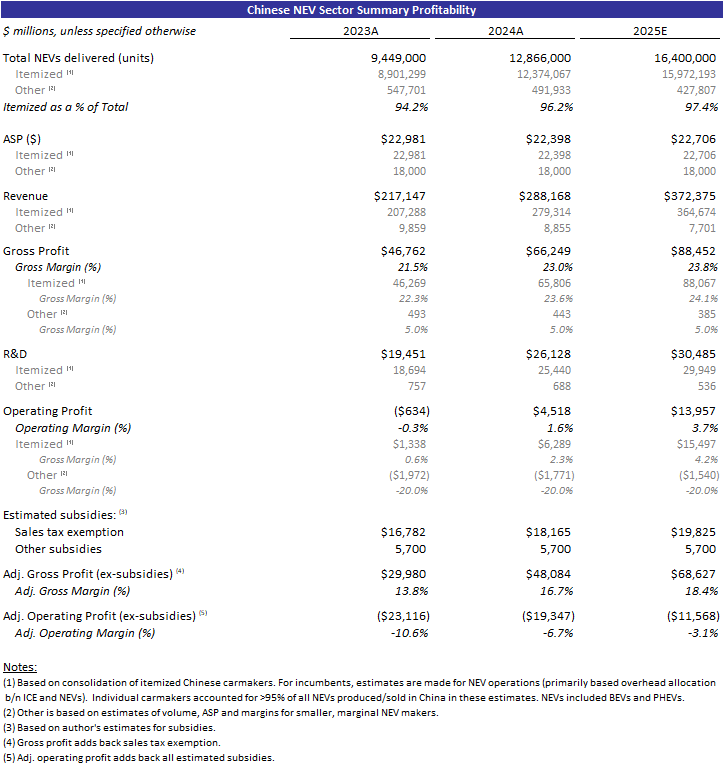

September 27: Confusing EV brands with firms. Related: Latest update on overall China NEV sector profitability.

September 26: Allocating Huawei’s access to elite STEM human capital to chips.

September 24: “Tiger Parent” CCP and “Tiger Child” Alibaba.

September 10: David Fishman checks in on the “ghost city” narrative in Ordos in his piece “Ordos City - The World's Most Famous ‘Ghost City’ (That Isn’t)”.

September 9: “Sitting on the couch with three generations of this one Chinese family, you could catch a glimpse of each phase of the development of China’s modern economy and get some idea of its trajectory in the coming decade.” Reference to old piece from 2018 responding to the question “Why is China's GDP growth rate slowing down?”

September 8: LFP vs. NMC in commercial NEVs.

September 5: Solar PV is an extremely commoditized product and cyclicality is a natural part of the industry.

September 2: Emerging 2025 themes in China’s NEV sector.

September 1: “Hot take: Solar ‘scaling laws’ will ultimately prove more impactful on humanity than the AI version.”

August 2025

August 31: “Cat city”

August 31: China’s version of Forrest Gump / iShowSpeed provides wholesome content for U.S.-China geopolitical relations.

August 26: “There will be a ‘[fully domestic Chinese advanced node foundry] moment’ in 2026.”

August 26: Beijing’s top priority is not “beating the West” but domestic development.

August 25: China’s transition away from the real estate sector has entered the “late innings” stage.

August 24: Productivity is what ultimately drives per-capita economic growth and increases in living standards over the long run. The key issue with the Pettis/Setser accounting identities framework is lack of acknowledgement of productivity effects.

August 24: DeepSeek’s deepening collaboration with chip designers.

August 23: Industrial policy is good/bad depending on the competency of the people and institutions running it.

August 22: In 2025, China will officially become a “high-income” economy, as defined by the World Bank.

August 22: Surging token consumption in China, driven by the rise of generative AI.

August 21: China is now entering the “late innings” of the nearly decade-long transition away from the property sector as the economy’s key principal growth driver.

August 20: The role of infrastructure (large and small) is the long-term intrinsic value it delivers to society.

August 20: The rise of renewables has disrupted the traditional economics-based concept of “baseload” supply.

August 18: China’s retirement age is unusually low.

August 16: Inconsistencies in recent FT article about alleged delays in DeepSeek’s next model: “DeepSeek’s next AI model delayed by attempt to use Chinese chips: Difficulties of training the start-up’s latest system with Huawei’s semiconductors highlight dependence on Nvidia”

August 16: To prove HSR represented large capital misallocation in China, critics need to provide a reasonable alternative solution to transporting the roughly 3.6 billion annual passengers per year with superior unit economics. Follow-up response (August 21).

August 16: The relationship between credit and GDP differs by asset type. Housing and infrastructure are long-lived assets that can be more highly leveraged in China compared to manufacturing.

August 15: Priors about “scaling laws” may need updating. The locus of competition of AI has shifted from training to inference. Historical analogy of AI with Internet search engines and browsers.

August 12: Is the market always better at allocating capital compared to the state? I explain how it varies sector-to-sector and how institutional capacity plays a role. Also related response to Greg Ip thread.

August 12: Some implications of Beijing’s apparent ambivalence towards the nVidia H20.

August 11: Contextualizing Tamil Nadu’s impressive recent per capita GDP growth.

August 9: Re-invigoration of biking culture in China and relentless expansion of dedicated biking lanes can be traced to the invention and proliferation of dockless bike-share systems starting around a decade ago.

August 2: More confusion on Chinese government debt: a critique of Shih/Elkobi paper that does not separate out principal repayments from interest in its credit analysis. This was a follow-up to earlier critique from 2023.

July 2025

July 30: Addressing confusion over the function of debt in the Chinese economy.

July 27: Difference between how the U.S. and China are provisioning greenfield power.

July 27: China unique differentiator is having both (i) high tech and advanced manufacturing and (ii) a vast blue-collar labor force … under a single unified political/economic entity.

July 25: SpaceX has a large lead [around a decade] over China in reusable rockets.

July 23: Affordable solar photovoltaics has the same effect as discovering tech that allows you to upgrade a desert tile into an energy-producing one in the classic computer game Civilization.

July 22: China’s economic model relies on external markets just as much as external markets “rely” on China for supply. Unwinding imposes costs on both sides of the trade.

July 21: “Foreigners — especially Americans — do not fully appreciate China's predilection for large, capital-intensive infrastructure projects because most do not know what it was like to live in a place starved of God-given natural endowments.”

July 21: How rising share of wage income from stock-based compensation skews traditional balance of payments interpretation.

July 16: Taiwan Taxicab Chronicles: Mr. Yu, former CNC operator.

July 14: Using technology and automation to maintain all the “shiny new infrastructure” China has built in recent decades.

July 11: Beijing is now mandating that heavy industry start using renewable energy by including sectors like polysilicon, steel and solar in the RPS (Renewable Portfolio Standard) program.

Responses to a largely non sequitur attack by Seaver Wang in response to this thread.

July 11: How rare earths restrictions in 2010 against Japan may have contributed to its (in retrospect) misguided focus on hydrogen and fuel cells.

July 11: “We’ve been chasing the fusion dream for decades when it was right here in front of us all along.”

July 10: I am not a big fan of “isms” as it oversimplifies complex systems, ignores idiosyncratic endogenous factors including historical exigencies, and does not account for execution.

July 10: Commentary on recent developments in 600 km/hour maglev.

July 3: China’s undercounting of consumption.

June 2025

June 30: Disagree that there is a cultural/genetic explanation for “invention”.

June 21: Commentary on BYD and the extended payables issue in China’s auto sector.

June 19: Challenging certain narratives about Tesla’s role in the development of China’s EV industry.

June 16: After three years, there still isn’t credible evidence (an accumulating asset pile of trillions in capital outflows since 2021) backing claims that China is manipulating / under-reporting its current account balance.

June 14: Ignoring FDI income in the analysis of global trade and investment flows and questions of “fairness” and “balance”.

June 3: “If you pull long enough at every thread, you’ll eventually find your way to some explanation that is related to human capital development.”

May 2025

May 31: Finding workarounds to export restrictions is an order-of-magnitude easier than advanced chip lithography.

May 29: There are more than “2 to 3” profitable Chinese EV companies.

May 25: HSR and air travel are complementary modes of transportation.

May 16: Chinese coal usage has peaked.

May 14: On Patrick McGee’s hyperbolic claim that “Apple is investing $55 billion in China”.

May 13: Beijing does care about its economic relationship with the U.S. and generally believes in the “win-win” benefits of trade and resulting economic specialization.

May 3: Huawei has a monopsony in elite tech/STEM talent in China.

April 2025

April 27: The impact of China losing Apple iPhone export processing business.

April 26: The profits that Apple generates selling products and services to Chinese households is not captured in the trade deficit.

April 24: “Will the U.S. be able to secure rare earths processing capacity before China develops self-sufficiency in advanced node chips?”

April 24: The relationship between the United States and the European Union is splintering.

April 22: We are in a full-blown trade war; gloves are coming off.

April 22: Disproportionate focus on the goods trade is hampering U.S. trade strategy.

April 22: The Chinese car market is mainly driven by a productivity-driven virtuous cycle of rising incomes and declining real costs of NEVs, not “reliance on foreign demand”.

April 21: Steelmanned arguments for the Trump administration’s prosecution of the tariff war are often full of gaping holes.

April 21: Chinese “culture” can explain why Chinese society has a tendency to converge back into a unified state after periods of dysfunction but it does not make the rise of a strong Chinese state “inevitable” either.

April 20: Explaining the recent divergence between GDP growth and tax receipts.

April 20: Jiang’s visit to Hyundai Heavy’s Ulsan shipyard in November 1995 came at a pivotal moment in the debate of the role that SOEs should play in the economy.

April 19: Huawei has deep expertise in optical and leveraged it in the development of its latest AI server.

April 18: “Net exports” does a particularly poor job of measuring “reliance on foreign demand” for China because of statistical discrepancies related to “factoryless manufacturing” and because it ignores FDI income.

April 17: China and the U.S. are at roughly equal levels of comprehensive income inequality (factoring in redistribution and wealth effects), but trajectories are very different.

April 15: Beijing’s bifurcated view on capital (strategic state capital vs. private sector market-oriented capital).

April 14: On counterfeiting and China.

April 13: “Disproportionate tariff focus is counter-productive because it sucks the oxygen away from fixing core domestic problems.”

April 11: What does economic adjustment look like for China if bilateral trade with the United States completely disappears?

April 9: China State Council releases white paper laying out its vision for the new global economic order.

April 8: Being ignorant about the difference between Balance of Trade and Balance of Payments puts U.S. strategy at a disadvantage.

April 8: Tariff evasion and smuggling is going to increase.

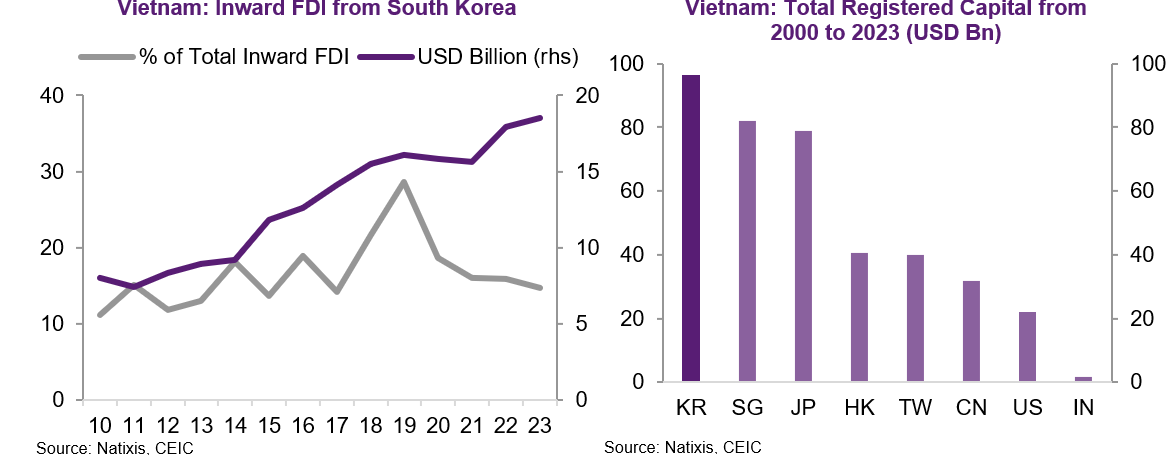

April 7: Game theorying the Trade War from Vietnam’s perspective.

April 6: A “thread within a thread” laying out context for how the underlying driver of the export industry has changed over the last two decades (from foreign-funded export processors to domestic firms that have expanded overseas).

April 6: Layman’s interpretation of the People Daily’s response to the U.S. “reciprocal” tariffs.

April 6: Menswear Guy on apparel manufacturing. China is SOTA for both low- and high-end clothing production.

April 5: Potential tariff impact on footwear and apparel manufacturers (Vietnam and China).

April 4: Vietnam’s future is still bright.

April 4: U.S. trade deficit does not include offsetting profits by U.S. MNCs.

April 3: China is Vietnam’s largest final export destination for electronics (HS85).

April 3: Measuring U.S. demand by global revenue market share overstates how much underlying manufacturing it drives.

April 3 (Part 1 | Part 2): How much does Beijing care about U.S. tariffs?

April 2: Random calculation behind the “reciprocal” tariffs.

April 1: Relative competitiveness of Vietnam and India in the “electrical machinery and electronics” (HS85)

April 1: Aspirational ceiling of Chinese youth has risen to look beyond the U.S. as a frontier model.

March 2025

March 25: China is focused on China, not you.

March 23: Parallels between Beijing’s embrace of containerized shipping and open source technology.

March 23: Vietnam is now exporting electronics at a higher per capita rate than China.

March 21: Key difference between China and India in attracting manufacturing FDI is that China created a much more attractive environment to generate returns on manufacturing FDI.

March 21: IMF released BPM7, which highlights “factoryless manufacturing”.

March 21: “Abundance” or “excess capacity”?

March 20: Kai Fu Lee estimates that DeepSeek’s annual operating costs are around $140 million per year and also discusses why open source at the foundation model level is going to win.

March 19: Piezoelectric walkways generate electricity very inefficiently compared to solar.

March 17: Thoughts on various predictions of China’s EUV development timeline.

March 16: Does the Chinese state stymie or spur innovation? It can’t be both.

March 15: All investment is eventually consumed in GDP accounting.

March 13: 5G was about industrial automation more than it was about consumer wireless broadband.

March 11: China is flipping traditional macroeconomics on its head with its focus on elasticity of supply vs. elasticity of demand.

March 9: Tesla cars manufactured in Shanghai are higher-quality than ones manufactured in Fremont.

March 8: Mao’s legacy will ultimately be tied to the Communist Party of China, not what people like Chen Yun thought shortly after his death, or even what people think about him today.

March 7: China and economic autarky.

March 6: Li Qiang brings up 内卷 at Two Sessions.

March 5: Balance of trade does not do a good job of capturing the increasing “intangibles” global trade. That trade is captured elsewhere on the Balance of Payments ledger.

March 5: Chinese households are sitting on an enormous pile of cash/deposits and this is a “coiled spring”.

March 5: There is significantly more fiscal impulse in the 2025 plan. China is clearly signaling shift to “kinder, gentler” economic policy.

March 4: Closely watching Tesla’s positioning in China.

March 3: China is treating “compute” as a public good.

March 3: The “Great Leap Forward” in chicken and egg production.

March 3: China does not really care that much about U.S. tariffs this time around.

March 3: Analytical reasons behind China’s enormous concrete consumption (vs. U.S.)

February 2025

February 27: Does Beijing actually set persistently high GDP targets?

February 27: Breakthrough invention vs. incremental innovation.

February 26: Chinese distant-water fishing and Argentine short-fin squid.

February 26: AI tools will increase both the ability to find signal as well as the noise.

February 26: “Velvet glove” needs to be backed up by an “iron fist” for the geopolitical strategy to work.

February 25: The challenge with re-industrialization is reality that the U.S. will need to re-learn how to walk before it can run again.

February 24: Taiwan is stuck between a rock and a hard place.

February 24: Rapid decline in LIDAR component price makes me question whether Tesla pursued the right ADAS strategy based on vision-only.

February 23 (Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Bonus Day 6): It’s open source week at DeepSeek.

February 23 (Part 1 | Part 2): Some updates and rebuttals on the Apple iPhone and BoP debate.

February 19: China’s shift from a real estate-driven economy to one driven by the “new three”.

February 17: Different drivers that contribute to an economy’s overall capital efficiency: production efficiency vs. distribution efficiency.

February 15: Twitter Spaces with TP Huang on AI in China.

February 14: On tech transfer, TSMC and Intel.

February 13: The software developer role will change in the coming years due to AI, just like how human calculators were replaced by electronic ones.

February 13: Focus vs. diversification was a key difference between prominent Chinese companies and Japanese and Korean ones.

February 10: Framing exports as one-sided reliance can be misleading.

February 7: The rising U.S. trade deficit (based on physical flow of goods) is a mirror to the profitability of U.S. MNCs that generate large offshore profits.

February 6: The Twitter financial turnaround and “doing more with less”, the “scarcity mindset”.

February 4: If there is one overarching theme in China’s private sector, it is cost and operational efficiency, not extravagant waste.

February 4: China retaliates to U.S. tariff announcement with an expanded bag.

February 1: OpenAI is like Windows (closed, proprietary). DeepSeek and other open-source contributors are like Linux (open, shared). Perhaps this is less a “Sputnik” moment (1957) and more a “Netscape” moment (1994).

January 2025

January 30: Seven years ago, export controls were a strategic mistake (with tactical blunders). Today, it would be a tactical mistake to roll them back. But strategically, we need to re-focus elsewhere (i.e. solving domestic problems).

January 27: Economist Tyler Cowen on “the mistakes of Michael Pettis”.

January 26: DeepSeek’s deep and multi-disciplinary technical depth.

January 25: Electric “intelligent” vehicles and what really makes NEVs disruptive.

January 25: Pettis is wrong about Germany too.

January 24: (Part 1 | Part 2 | Part 3 | Part 4): Ongoing series of posts on DeepSeek

The rise of Deepseek says more about China’s broader tech/AI ecosystem than the company itself. Open vs. closed. Training vs. inference (Deepseek’s likely adoption of Huawei Ascend 910C chips for inference).

DeepSeek demonstrated serious technical chops, using PTX (similar to Assembly) to improve the efficiency of its nVidia H800 chips (which have limitations compared to the H100 due to export controls).

Observations on response from Dario Amodei (Anthropic) on DeepSeek and export controls.

January 24: Destroying trust is no way to build a strong manufacturing base.

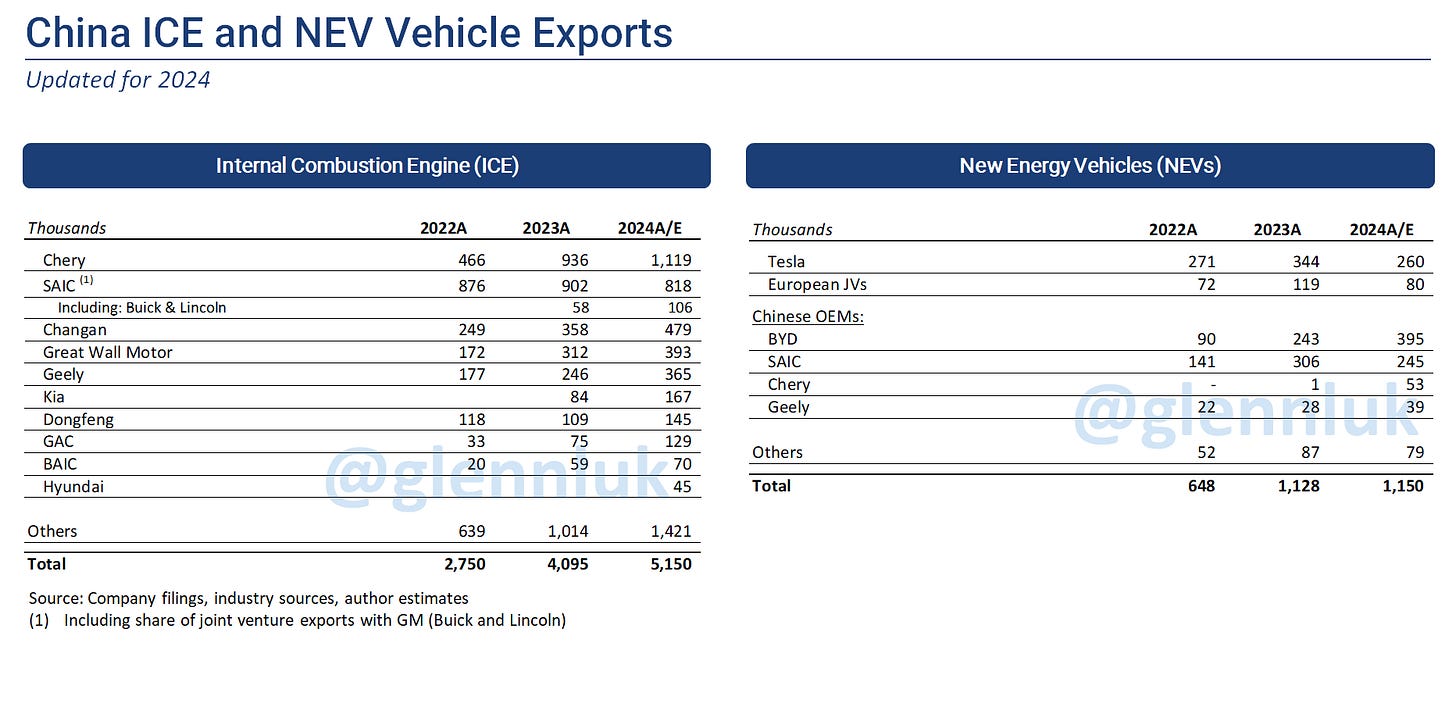

January 23: Update on Chinese auto exports.

January 22 (Part 1 | Part 2 | Part 3): OpenAI / Stargate consortium announces goal of investing $500 billion in AI datacenter. Two key points:

Financing “compute” is different from financing long-lived infrastructure assets.

With this scale of resource allocation and potential direct/indirect taxpayer-funded involvement, we need to think carefully about alignment of interests and incentives.

January 20: The way the U.S. has handled TikTok is just so all-around dumb and reflects poorly on “state capacity”.

January 20: “The success of industrial policy is largely dependent on state capacity”

January 17: Reprise on the idea of how “large countries operate on a different set of economic laws than small ones” in the context of China’s dominance of global manufacturing.

January 17: The rising global competition for Chinese FDI.

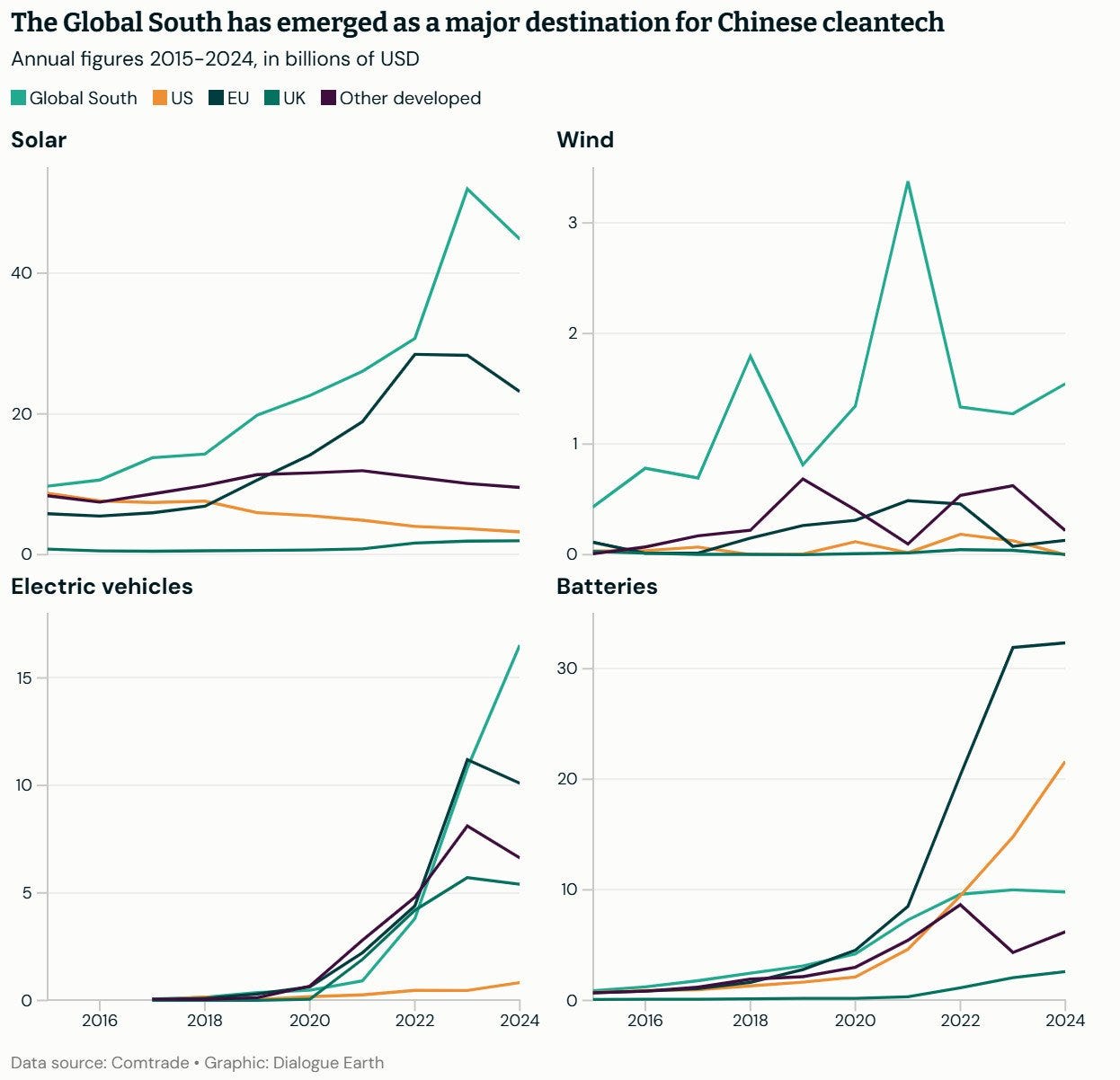

January 17: Updated 2024 Chinese export figures in four renewables categories and related commentary.

January 14: The interplay between labor, capital and consumer surplus.

January 13 (Part 1 | Part 2 | Part 3 | Part 4 | Part 5): TikTok refugees flood into 小红书 (“RED”, “Rednote”, “Little Red Book”)

January 13: China’s goods trade surplus in 2024 will exceed $1 trillion. What are we to make of this number?

January 13: Green hydrogen takes renewables beyond the grid.

January 12: The lack of Taiwanese voices in discussions that are about Taiwan.

January 12: Update on Chinese ICE and NEV vehicle exports.

January 11: The size and scope of foreign multinational operations in China.

January 10: Apple/Foxconn, “producer power” in the context of the U.S.-China and India-ASEAN rivalries.

January 10: How finance is ultimately tied to real world institutional capacity and sector expertise: why “American finance and money” cannot play a significant role in international metro, rail and renewables projects.

January 9: Continuously underestimating China’s technology and economic development.

January 9: The long-term strategic effects of export controls.

January 9: Vietnam is attracting the same amount of manufacturing FDI as India despite a population 14x smaller.

January 8: China’s household share of GDP has re-balanced to normal levels by global standards, but this remains unacknowledged.

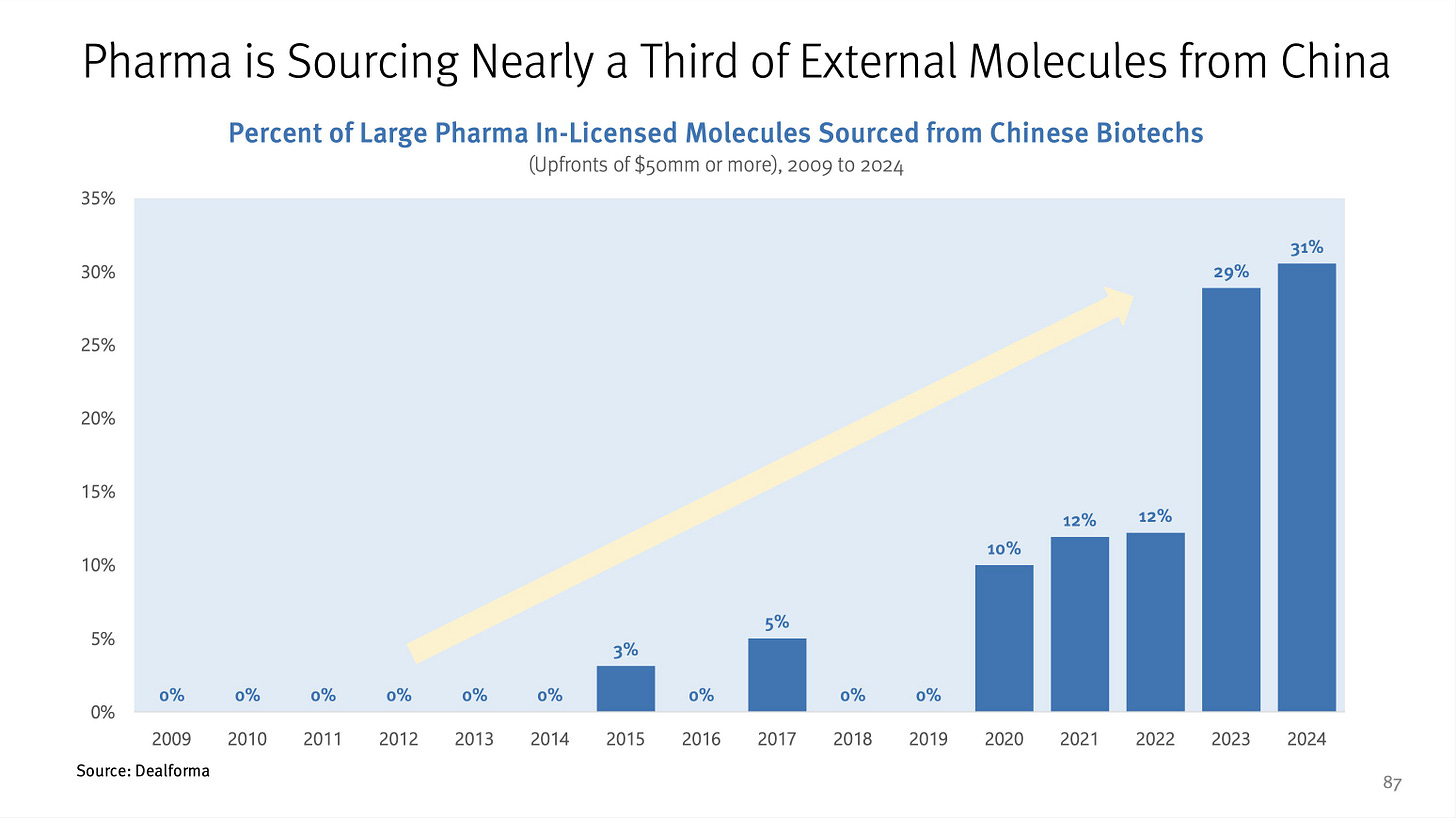

January 8: China continuously exceeds outside expectations on its technology and industrial efforts, this time in biotech:

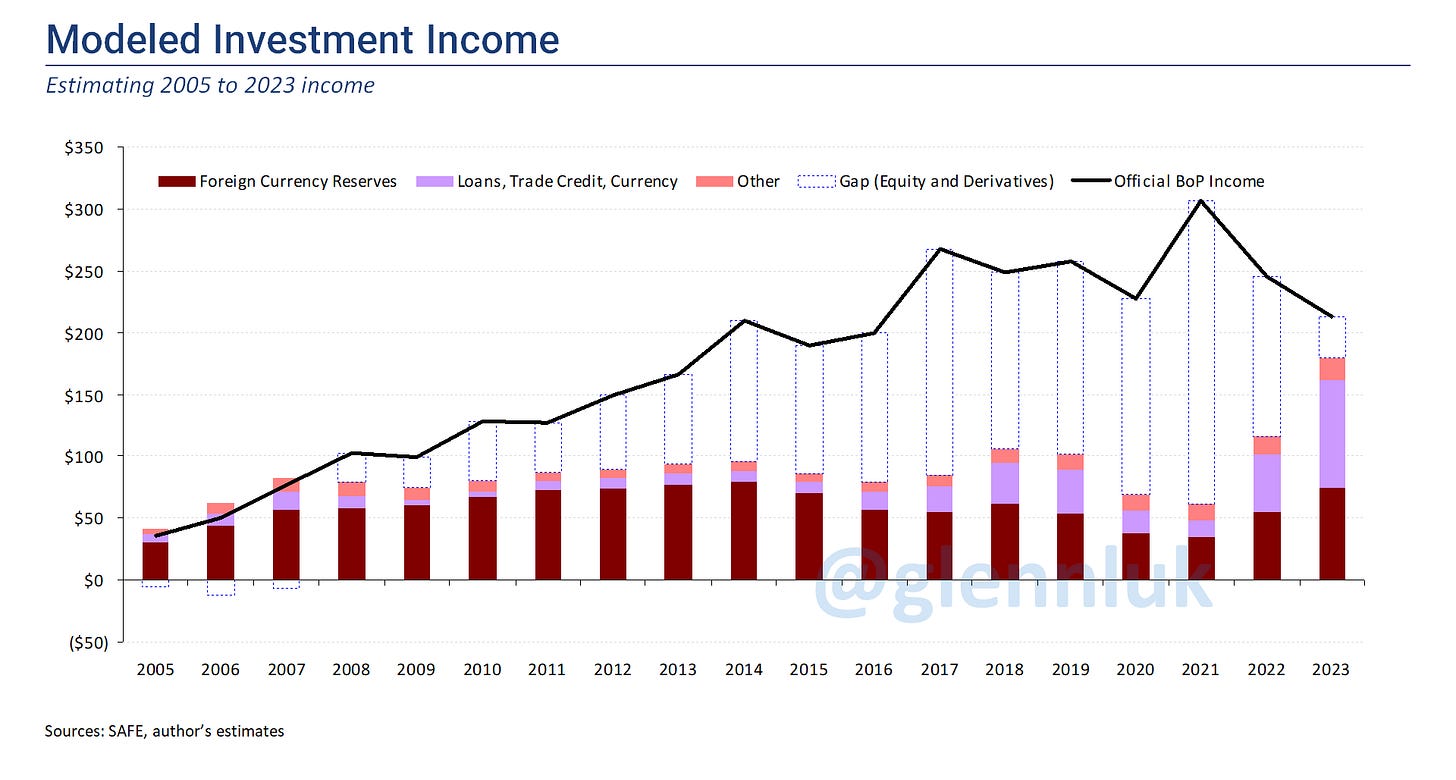

January 7: China’s net international investment position and estimating investment income on the Balance of Payments.

January 6: I agreed with much/most of this excellent interview by The Wire with Barry Naughton on “the State of the Xi Jinping Economy” (archive). This thread goes through some of the pieces where I did not just nod along.

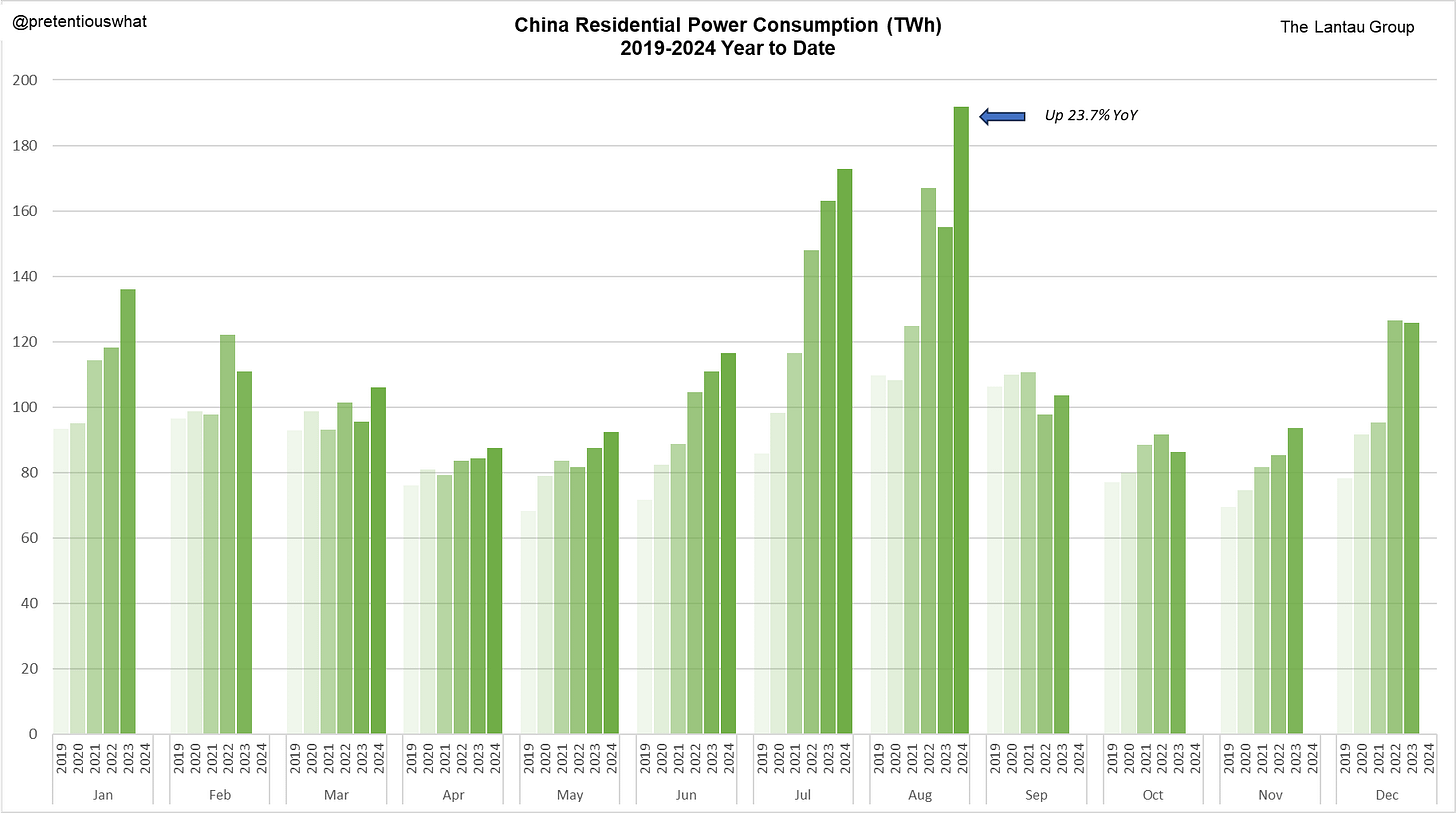

January 5: Some more recent indicators that China’s residential property market is completing its transition into just anothe mundane, boring sector:

5th National Economic Census: Property sector transitioning from greenfield development to management (QQ: archive)

Residential electricity consumption is skyrocketing, driven in part by residents moving into modern new apartments with air conditioning (from David Fishman):

January 5: The Xiaomi SU7 is a direct competitor to Tesla’s Model Y in China.

January 4: Focusing on 26 HSR “ghost stations” instead of the 1,000+ that are being used — the “Costco” trade-off between cost efficiencies and overbuilding.

January 4: Wuhu vs. Hefei and what it says about local government competition.

January 4: China sees failed capital-intensive projects as a challenge.

January 4: China’s manufacturing has a decent chance of weathering the “age of robots” (archive).

January 2: On GM-China and technology transfers.

January 2: An ode to Taiwan alleyways.

January 1: Updated Q3 2024 China balance of payments bridge.

January 1: Key China NEV sector themes for 2025.