newsletter | 2023.7.10

Summer in Taiwan, LGFVs, EV impact on oil demand, TFP, the coal/renewables paradox ...

The past few weeks I have been busy packing up and bringing the family over to Taiwan. This is the first time we are really spending the summer here since 2019. While we lived here two years ago, the entire island was under lockdown during the summer of 2021. It’s good to be back!

As you may have noticed on Twitter and Substack, I have been wrapping my head around Chinese local government assets and finances to better understand the nature of the bulk of the country’s investment in recent years and to envision what a reform path going forward might look like in the coming years. I shared my thoughts in a series of related essays:

There are still some related areas I am thinking through and I will hopefully be able to wrap this series up in the coming weeks.

I’ve officially renamed the sub-domain readwriteinvest.substack.com. Links to the old domain should forward to this new one.

Like everyone else it seems, I setup an account on Meta/Threads under “glenn_luk”. Feel free to follow me there! I am not quite sure what to do with it for now but I may start posting there as well. I will go wherever the best discussions are.

musings

Impact of transport electrification on China’s oil consumption (2023.7.9)

The sharp rise in electric vehicle and HSR adoption is going to have a major impact on China’s oil consumption. Motor vehicles (commercial and passenger) account for approximately 41% of China’s oil demand. Over the next two decades, this could fall by up to 90% depending on how quickly the existing ICE fleet is retired.

How likely is this to happen? The fact that this is based primarily on China’s drive to achieve energy independence vs. de-carbonization increases the chance of it happening, in my view.

China’s declining TFP and implications on LT growth (2023.7.8)

Total Factor Productivity (TFP) has declined in China since the Global Financial Crisis with GDP increasingly dominated by large increases in capital investment. While many point to this and see secular, irreversible productivity decline, I note how the changing composition of gross capital formation has also played a role significant role. The contribution of TFP to GDP growth could very well rebound as China gradually winds down a multi-decade long investment-centric housing and infrastructure boom.

Risk of a balance sheet recession in China? (2023.7.5)

Nomura economist Richard Koo discussed the risk of a balance sheet recession in China based on his extensive experience studying the Japanese economy, particularly as it underwent its stagnation period starting in the 1990s. You can watch the video here.

Overall, I agreed with some but not all points. Some short-term stimulus can help get liquidity flowing again but in the longer-term, real work and reform is required both to (i) manage the large pile of assets created at the local government level and (ii) improve the process going forward for continued asset development.

There are some key differences between China today and 1990s Japan that make the comparison difficult. Perhaps the biggest of all is that China still has significant catch-up growth, with its urbanization rates at 65%1 — compared to a Japan that was fully urbanized (80%+) by the 1990s. This concept of catch-up growth also relates to the demographics question: while China might seem like it is closer to demographic decline than Japan in 1990, it still has some additional rural-to-urban migration tailwind left.

I agree with Koo that the geopolitical environment is more challenging. But I also pointed out how China’s economic scale (12x the population of Japan) means that it can pursue a radically different economic strategy.

Finally, I thought Koo made a great point about how China has the benefit of learning from Japan’s experience. Japan was dealing with some of these economic issues for the first time — like the balance sheet recession — and this likely contributed to the undemanding pace of its reforms.

The paradox of renewables and coal (2023.7.3)

There is a building boom for both renewables and coal in China today. For some, this seems like a paradox. But there are good reasons. Intermittent renewable needs backup power and China is looking to coal as one of its backup solutions. China needs to replace hundreds of gigawatts of coal plants built in the 1990s and 2000s with cleaner, more efficient designs that are more suitable for this backup role. New nameplate capacity does not mean actual coal consumption will increase — capacity factors have been declining and are expected to continue declining as coal takes on more of a backup role over time.

Technology enabling local production of food, fish and freshwater (2023.7.3)

New technology advancements are enabling a scalable, sustainable model that integrates vertical farming, aquaculture, conservation techniques, freshwater production and renewable energy that countries that have historically lacked abundant arable land and water supplies can harness.

Technology shifts the economics of food supply in favor of local. The old model of growing food in one place and transporting it thousands of miles is being supplanted by food that is grown locally using the latest vertical farming techniques. There is significant energy wastage built into such a long food supply chain that is analogous to the energy wastage from internal combustion engine.

charts & data

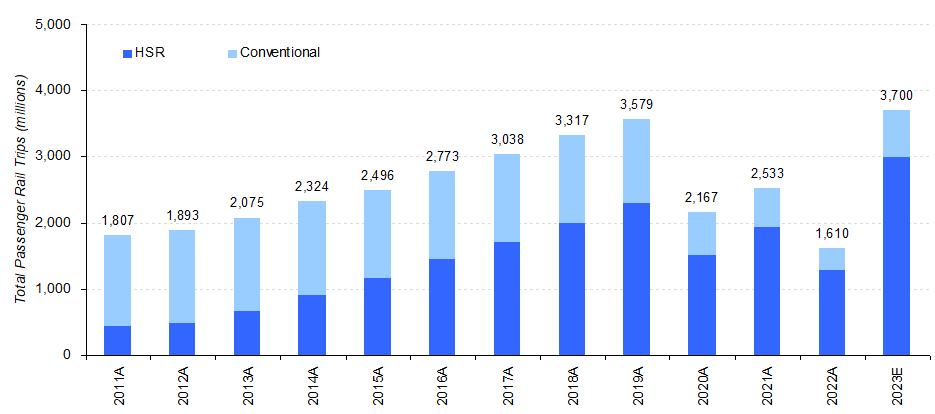

After three years of the pandemic, passenger rail in China is expected to recover to pre-pandemic levels. Recently, China Railways reported 311 million passenger trips in May, which works out to an annualized 3.7 billion riders per year.

from the archives

Will China become an innovator? (2018.12)

Here I discuss China’s ability to innovate in the context of one of my favorite childhood PC games: Civilization. I learned a ton from that game.

Will "shadow banking" in China lead to a financial crisis? (2018.10)

Credit disintermediation “with Chinese characteristics”. Five years later we are talking again about hidden debt and the need for reform.

Could China become another Japan? (2016.1)

China is Japan in the 70s, not the late 80s. Seven years after writing this article, China may now be closer to late 70s or early 80s Japan. Maybe in a decade it will finally be late 80s Japan.

Gold standards of economic development success stories (2015.5)

The fascinating development stories of Taiwan and South Korea.

diversionary

MoatlessCapital makes a good point that even this 65% overstates the true level of urbanization, with approximately 1/3 not getting full benefits.

Welcome back to Taiwan.