"America the Beautiful"

Our immense natural resource endowments — and how it has impacted manufacturing competitiveness through comparative (dis)advantages

In elementary school, we learned to sing “America the Beautiful”, which highlighted the enormous natural resource endowments bestowed upon this country:

O beautiful for spacious skies,

For amber waves of grain,

For purple mountain majesties

Above the fruited plain!

America! America!

God shed His grace on thee

And crown thy good with brotherhood

From sea to shining sea!

Having spent my entire life on the East coast, in my early 20s I finally had a chance to truly understand what those words meant.

Following the footsteps of my father when he first arrived in North America in the 1960s, in June 2001 two buddies and I set off on a classic post-college graduation roadtrip. We started in San Francisco and drove south to Nevada, Arizona and New Mexico and then all the way to Houston, Texas. We then drove north through Texas, Oklahoma and Colorado until we reached the Rockies. After driving up through Wyoming, we veered west through Idaho and Nevada and back to San Francisco.

Similar to song composer Katharine Lee Bates more than a century earlier, I was awestruck by the natural beauty and splendor of the American West.

Interestingly, in the song composer Katharine Lee Bates may have unwittingly embedded lessons about certain structural conditions of this country by identifying key areas of natural economic advantage:

“Amber waves of grain” and the “fruited plain” — bountiful land that has fed the nation for centuries and turned the country into an agricultural powerhouse

“Purpled mountains majesty” — enormous reserves of shale oil and gas (not to mention minerals) sitting beneath the Rocky Mountains

Buried deep in the poem’s fourth stanza, Bates also references gleaming “alabaster cities”. This was a reference to the growth of cities like Chicago1 and represented the rise of man-made industry and manufacturing in the late 19th century. In the 20th century, these natural and man-made advantages combined to create immense absolute advantage, resulting in the most powerful nation the world has ever seen, peaking at one-third of global GDP at the end of World War II.

Following the war, the rest of the world has been in catch-up mode. First, with the reconstruction of war-torn Europe and Japan. Then with the rise of former colonies in Asia, Latin America and Africa in the post-colonial era. Finally, over the past three to four decades, the rapid rise of continent-sized economies in China and India.

To better understand these long-term trends, it has become increasingly important to understand comparative advantage, how it has changed over time and how it contributes to changes in absolute advantage over the long run.

While references to “amber waves of grain” and “purple mountains majesty” are meant to imbue in us a sense of enormous gratitude for the natural resource endowments of this country, in the long run what will matter more is that less well-known reference to “alabaster cities”. In school, we never quite got to the fourth verse of “America the Beautiful” so this is something I had to look this up:

O beautiful for patriot dream

That sees beyond the years

Thine alabaster cities gleam

Undimmed by human tears!

America! America!

God shed His grace on thee

And crown thy good with brotherhood

From sea to shining sea!

The potential downside of such bountiful natural resource endowments is how it can create comparative disadvantages in manufacturing. In this essay, I will discuss two examples of how bountiful land and resources have contributed to the relative decline in global competitiveness of our manufacturing industries.

Corn-based ethanol and the “Paradox of Plenty”

I have been a huge baseball fan ever since I got my first Nolan Ryan baseball card2 sometime in the third grade. Perhaps inspired by Field of Dreams, one of my childhood wishes was to one day take a summer roadtrip across the country, stopping at small towns and cities in the Midwest like Peoria and Cedar Rapids to watch recently drafted high school and college baseball players start their professional careers3. Like in the movie, I imagined baseball fields surrounded by endless rows of corn extending deep into the horizon.

While “amber waves of grain” tends to be associated with wheat, corn4 is actually America’s largest agricultural product, accounting for about one-third of agricultural output. Corn is an incredibly versatile vegetable/grain and can be used in natural form as corn-on-the-cob5 to a multitude of uses including cornstarch, syrup, cooking oil and many others. It can also be converted into ethanol and used as a fuel to supplement gasoline.

Ethanol was first used in 1826 to power an engine. It fueled Ford’s original Model T in the early 1900s and was used during World War II with the war effort and allies needing all the gasoline that could be produced. However, the modern ethanol industry did not really take off until the 1970s and was driven by two key factors:

The formation of the OPEC cartel leading to rapid increases in the price of oil

Environmental concerns leading to the elimination of leaded gasoline, which was a key additive to increase octane6

High oil prices drove industry to explore alternative fuels like ethanol. Federal and state subsidies encouraged the use of higher-octane ethanol to boost octane levels in gasoline. Indeed, taxation and industrial policy have played a key role in fostering the development of the corn-based ethanol industry over the years. For example, one of the objectives of the “Minnesota Model” for ethanol production was to boost profits and create jobs in the community by adding value to agriculture products.

For a long time, ethanol was an interesting case study of how the country’s natural advantage in arable land translated into economic benefits and advantage. In the early 2000s, when we were still worried about energy independence, ethanol was touted as a mitigant to reliance on imported oil from the Middle East. The Energy Policy Act of 2005 increased targets of blending ethanol use with gasoline and the Energy Independence and Security Act of 2007 raised targets to 36 billion gallons by 2022.

But rapid improvements in solar photovoltaic (PV) and battery technology and costs in recent years — especially since the late 2000s — have not only negated this advantage but possibly turned it into a crutch in our difficulties developing domestic clean energy manufacturing. At the heart of the problem is the enormous amount of land required to generate corn-based ethanol.

To compare solar to ethanol, we must examine corn-based ethanol production at a more fundamental level as the conversion of solar energy into useful chemical energy or other forms like electricity:

With solar, sunlight is absorbed by the PV cells, causing electrons to move, creating electricity7. This electricity must then be used right away by the grid or or put into longer-term storage, typically in the form of chemical energy (batteries or conversion to a fuel like green hydrogen) or gravitational (pumped storage).

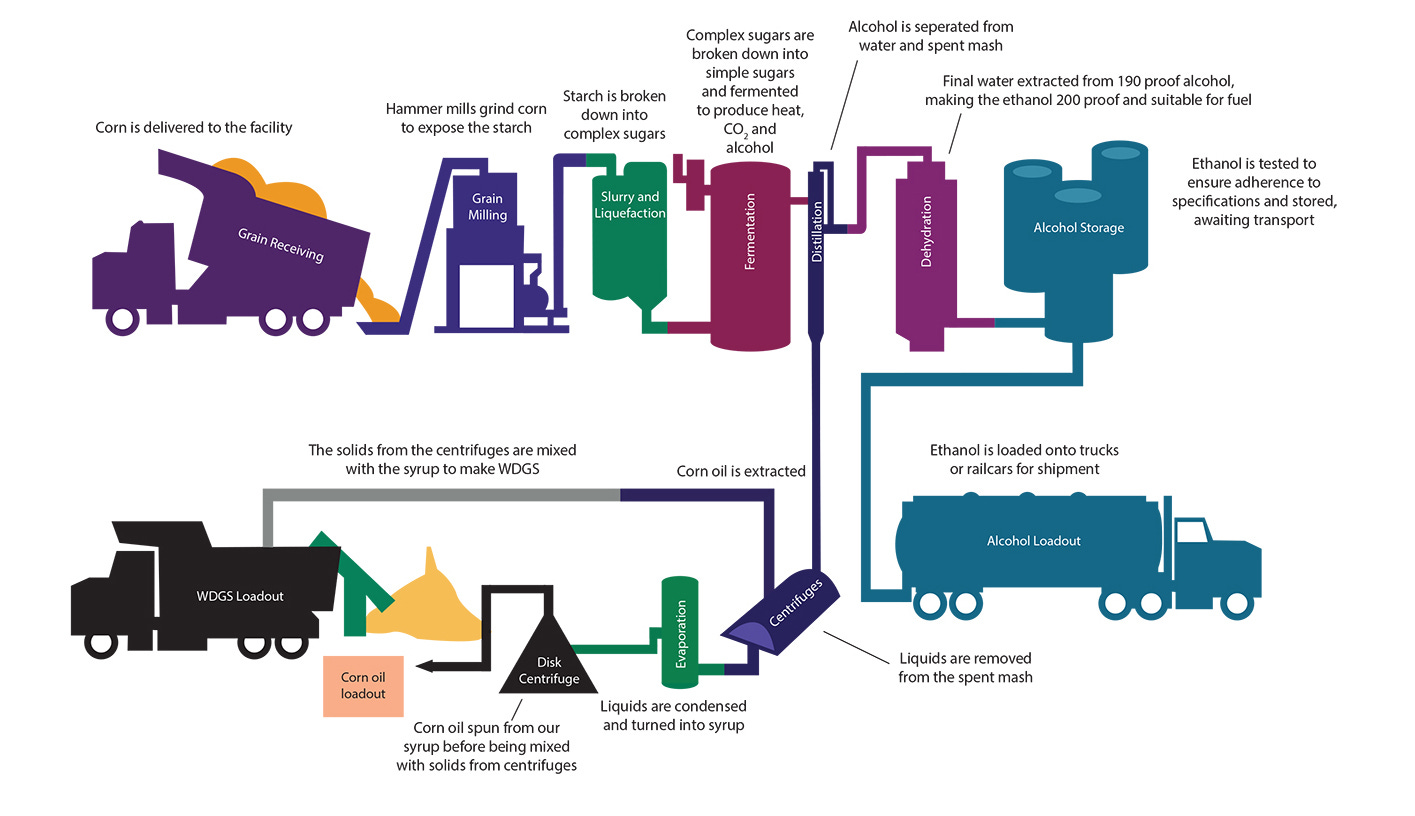

With corn-based ethanol, sunlight is absorbed by corn through photosynthesis and stored in various sugars (chemical energy). The corn is harvested and processed, typically in a dry mill. The processed corn flour is then fermented, which converts sugars into more complex hydrocarbons like ethanol8.

As you can see, the ethanol production process is significantly more complex and also involves energy inputs at each stage to create the final output. Energy Return on Investment (ERoI) measures the ratio of energy inputs vs. energy outputs. Corn-based ethanol is at 1.2, meaning for every unit of energy you put in9, you get 1.2 units of energy back. Solar PV is 8.10 The other downside to “clean” corn-based ethanol is that the energy inputs are typically petroleum-based fossil fuels.

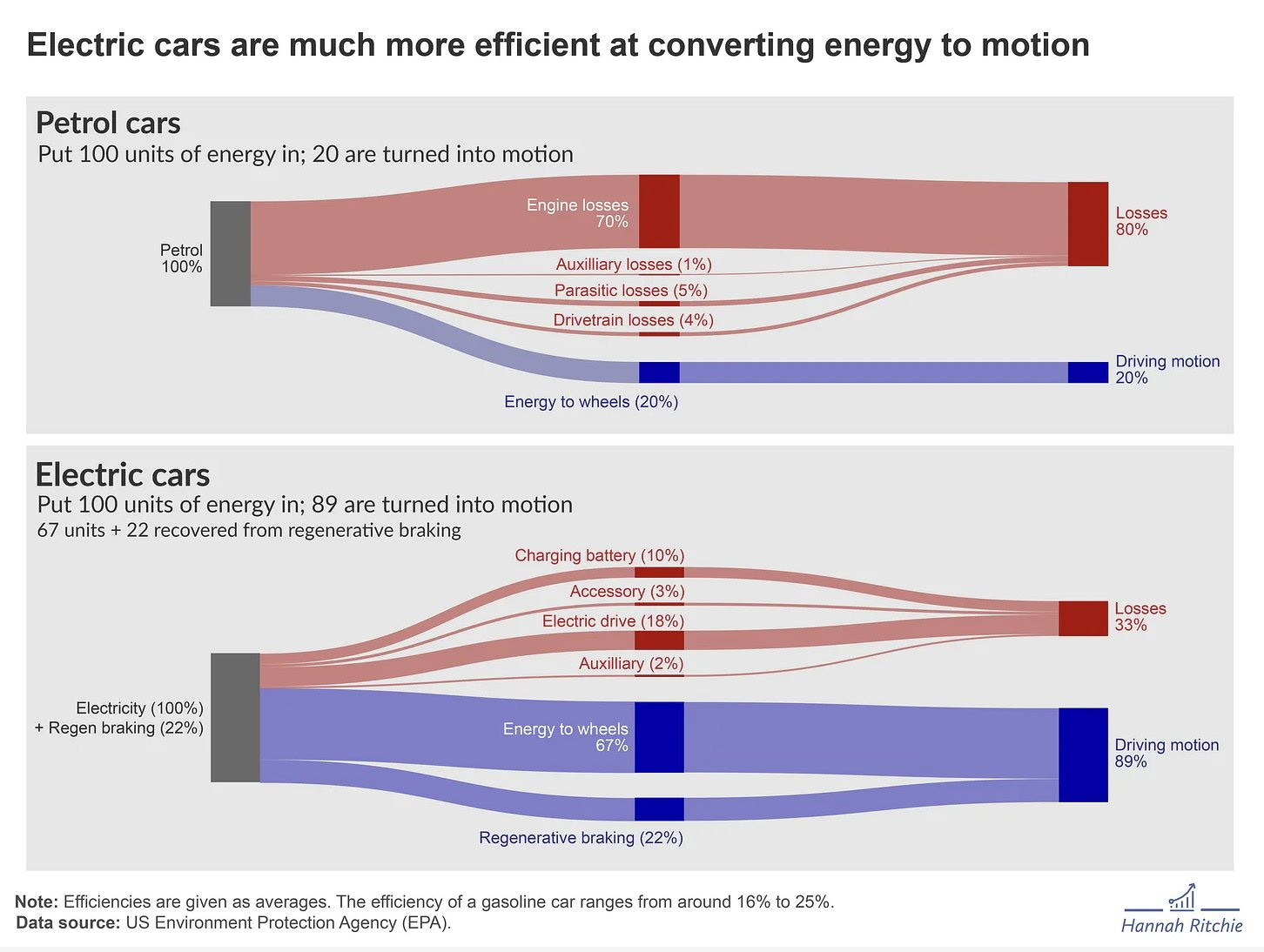

Further, the transition to electric vehicles only further exacerbates these already extraordinary differences in efficiency. Because there is so much energy lost to heat during the combustion process, traditional ICE vehicles are far less efficient at converting stored energy into useful work (movement) than electric vehicles:

This means the differences in land use are yet another order-of-magnitude greater than ERoI. According to this report from Clean Wisconsin, “net energy production per acre is 100-125x greater for solar PV than for corn-based ethanol”11.

Countries like China suffering from relative land scarcity could not pursue corn-based ethanol — they needed all the arable land to produce food. Instead, it was forced by these natural endowment disadvantages to come up with more creative solutions to solve the problem of solar energy capture.

The “Paradox of Plenty” is a term typically used with poor or developing countries that are blessed with natural resources but puzzlingly have lower development outcomes. Obviously, with the highest per capita GDP among large countries, the U.S. does not exactly fit this profile. But there are some indications that over-abundance of land may have contributed to the United States — once the pioneering leader — falling behind in solar PV and other clean energy industries.

For example, given massive differences in ERoI and land efficiency, one might think the obvious thing to do is completely shift federal and state support away from corn-based ethanol to solar, battery and other related clean energy manufacturing. However, there are strong corn-based farming constituencies in a number of important swing states like Iowa, Minnesota and Wisconsin that are highly motivated to maintain ongoing federal and state-level support for corn-based ethanol12. This slows down the transition to clean energy.

In other words, our natural advantages in land led to the establishment of the corn-based ethanol processing industry, which is well-positioned politically to reinforce this advantage. Because comparative advantage is relative, this necessarily widens our comparative disadvantages in manufacturing needed to produce solar PV and other clean energy technologies competitively.

The fracking boom and “Dutch Disease”

The Economist coined the term “Dutch Disease” to describe how the Dutch economy changed after the discovery of natural gas fields in the northeastern part of the country in 1959. It describes how significant natural resource windfalls can shift the comparative advantages of an economy, making other parts of the economy less competitive. Much of this impact was brought about by a rising currency, the Dutch Guilder, which increased the cost of Dutch labor relative to the the rest of the world, which (all things being equal) decreases its competitiveness. This had a negative impact on the country’s manufacturing sector.

The U.S. has also recently had its own resources boom. As I describe here in this 2018 essay, the advent of new “hydraulic fracturing” techniques (“fracking”13) in the Barnett Shale by American wildcatters unlocked immense shale oil and gas reserves, pushing what had once been the world’s largest buyout (TXU) into bankruptcy and contributing to a rare black eye for Warren Buffett and Berkshire Hathaway.

More significantly, it turned the United States from a major oil importer14 to the largest oil producer on the planet. We became a net oil exporter in late 2019 and have not looked back:

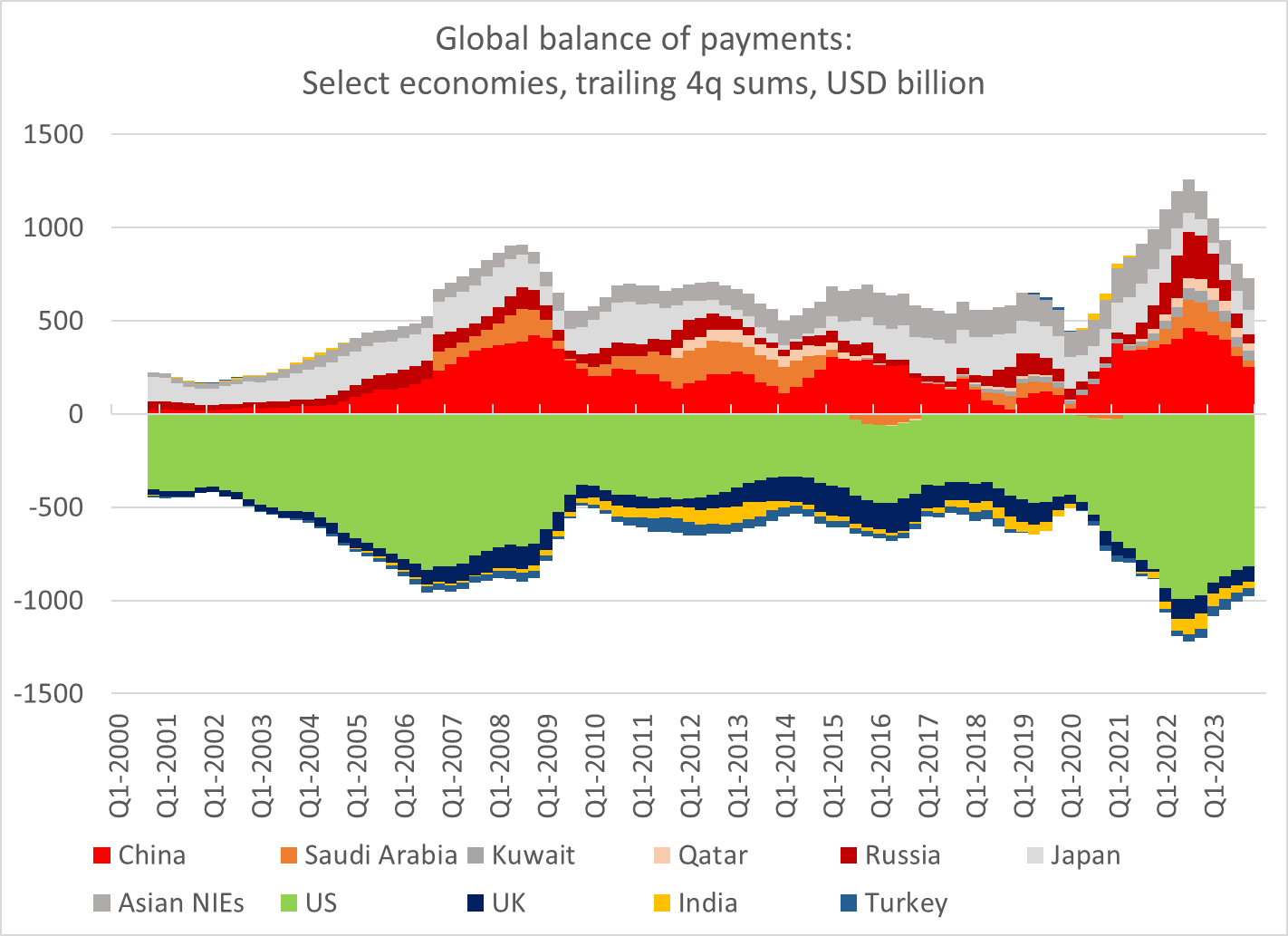

This has been one of the most under-appreciated economic stories of the last two decades. Following the Global Financial Crisis (GFC), the huge trade deficit shrank as Americans underwent a deep and painful recession to cut back on consumption. However, as we progressed through the 2010s, this necessary change in consumption habits was in part alleviated by rising onshore oil production fueled by fracking.

This cushioned the full impact of the GFC and helped America recover faster than Europe, allowing Americans to resume its old consumption habits without significantly increasing the trade deficit, as illustrated by the green area charts below from 2010 to 2020.

As you can also see, the trade deficit ballooned following the global pandemic as households shifted spending on domestic-focused services to foreign-produced (predominantly China) consumer goods. Normally when a country’s trade deficit rises for an extended period of time, its currency will shrink. However, the opposite happened with the U.S. dollar. It strengthened:

These are classic signs of “Dutch Disease”.

The fracking boom attracted rising investment into the oil and gas sector, and dominated growth in non-residential fixed investment after the GFC until recently. Petroleum engineers and wildcatters commanded high salaries, allowing the energy sector to attract a disproportionate share of “hard/deep tech” science, engineering and vocational talent, pulling human capital away from traditional manufacturing sectors. Meanwhile, a rising dollar made those traditional manufacturing sectors even less competitive in global markets.

In other words, like corn-based ethanol, fracking has also shifted our comparative advantages away from general manufacturing. We can see this when we “peel the onion” on the trade deficit and focus on manufactured goods, which after a sharp recovery following the GFC, have been in a consistent downward spiral (blue line below). Fracking masked the decline in the topline numbers for a period of time until it became noticeable with the pandemic-induced demand spike in manufactured goods15 .

Meanwhile, major exports like travel and education were cut off overnight and the cratering of oil prices, which would have helped in the past, were now a slight negative with the country having flipped into a modest oil exporter. As a result, the overall trade deficit spiked to all-time high levels before moderating with the re-opening of the country in 2022.

Comparative disadvantage and the long decline of American manufacturing competitiveness

Fracking-induced “Dutch Disease” is only the latest in what has been a long decline in American manufacturing dating back to the 1970s, as we can see when we go farther back in Brad’s chart above. The post-war rise of Japan, particularly its automobile sector, pushed what had been a surplus in manufactured goods to a deficit.

The machine tools industry was the “canary in the coalmine”, collapsing in the 1980s. The 1985 Plaza Accord forced rapid appreciation of the Japanese Yen and temporarily reversed the decline. But the rise of the “East Asian Tigers” and later, China (which joined the WTO in December 2001), continued to exert pressure on the trade deficit. As a result, we lost critical mass in our supply chains and manufacturing human capital.

In the past, our immense absolute advantages were enough to keep our comparatively disadvantaged manufacturing sector globally competitive. In the post-war period, American multinationals had the most advanced technology and intact manufacturing capital base by a wide margin, which allowed the nation to sustain a quality life that was significantly above the rest of the world, not to mention supporting European allies with the Marshall Plan.

Over the decades, as others developed and our absolute advantages shrank, the effects of comparative disadvantage in our manufacturing sector became increasingly exposed to global competition. Margin of safety provided by overwhelming technological and capital advantage eroded until it was no longer enough to overcome structural disadvantages like high labor wages, an inefficient healthcare system, and higher regulatory burdens. That offshoring manufacturing to East Asia and IT/BPO services to India and the Philippines proved to be so attractive in the 90s and 2000s reflected these trade realities.

To stem further decline of our manufacturing sector, we need to think more in terms of comparative advantages. This means that we need to change fundamental aspects of our economy to shift comparative advantages away from natural-resources intensive sectors like energy back to manufacturing. If we want manufacturing to truly be globally competitive, we need to make real structural changes, the kind that hurt. If they do not hurt, it probably just means they weren’t enough.

The CHIPS Act and IRA are a good start, but much more is required to combat both the natural advantages of resource endowments we sing about in “America the Beautiful” as well as active efforts by other countries that are actively working to shift their own comparative advantages towards manufacturing.

This is not going to be easy and will take decades of persistent effort to put into effect, because part of this requires training a new generation of American manufacturing workers. But if we want to retain our economic lead over the world, we will need to figure out a way to bend the comparative advantage spectrum in factor of manufacturing.

Source: Steady: “America the Beautiful”:

“The ‘alabaster cities’ [found in the fourth verse] are a particular reference to the Chicago Columbian Exposition of 1893 which was meant to herald a future of unending promise (shortly before two world wars). By making ‘cities’ plural, Bates undoubtedly meant to generalize the concept of our shining metropolises well beyond any sole example.”

I was more interested than the statistics on the back, which says something about me.

On our post-college roadtrip, we never made it quite far enough east but this is definitely something that is still high on the bucket list.

Technically, corn can also be considered a grain depending on when it is harvested. But Katharine Lee Bates was likely thinking of wheat when she composed the poem.

A favorite in the Luk household

While gasoline has higher energy density than ethanol, ethanol has higher octane than gasoline.

Department of Energy: Solar Energy 101

Department of Energy: Ethanol Production

This description simplifies what is actually a much more complicated process, as shown in the diagram below from Nebraska Corn Processing LLC:

The energy inputs into producing ethanol from corn are variable and the vast majority (74-95%) are from fossil fuels themselves.

Clean Wisconsin: “Corn Ethanol vs. Solar - Land Use Comparison”

Note: significant rise in organized lobbying and misinformation efforts against clean energy projects.

Technically, the more accurate colloquial term is “fracing” but I use this term because when my mind sees, it rhymes with “racing”.

Remember when everyone was worried about “energy independence” during the early 2000s and our preoccuption with Mideast oil? Those days seem long gone.

This is vaguely reminiscent of how high OPEC-induced oil prices propped up the USSR in the 1970s only to collapse in the 1980s as economies adjusted, e.g. fuel-sipping Japanese sedans.

For ICE vs EV, the key variable is (gravimetric) energy density. On a MJ/kg basis gasoline is 2 orders of magnitude higher, before adjustment by the conversion efficiency as you detailed convincingly. The cross-over point is about 200km, which means great for short commutes in tight cities (where smog is also a problem) but less so for say widely dispersed places like Australia. This is also impacted by the copper wiring infrastructure and long-transmission HV lines.

The technoeconomics change also for planes/ships (existing bunkering facilities).

From a raw energy point of view, ethanol is a loser.

But it makes more sense (for now) because of the different energy-forms of the input and output for the process. And the peculiarities of the North American vs global commodity availability & transport.

The input for the important fertilizer and distillation parts of the corn-ethanol process, is natural gas. Natgas is abundant on the continent, and a key attribute of fracking is the short time-scale. Fracking dumps out most of its value in the first 2 years. Thus it is easier compared to traditional oil/gas investments, to both ramp up and ramp down to follow demand in medium term.

The cost of natgas at the wellhead in North America is also tiny, due to the super-producing dry-gas ends of the shales. Most of the attention is focused on the wet ends of the geology, because dry gas is just not worth much. The reason it isn't worth much is because connection to the global market is limited by lack of intercontinental LNG transport. That lack is structural, the transport infrastructure is slow to construct and energetically inefficient anyway.

The output of the corn-ethanol process, on the other hand, is a liquid motor fuel which due to substitution is price-connected to the global market.

So until such time as NEV's displace ICE in North America, there is a logic to it. The side effect of discouraging US investment in EV's is all the more true because of this.