Do any countries have a trade surplus with China?

Breakdown of iPhone BOM

Three groups of countries/economies tend to run trade surpluses with China [1]:

Resource-rich commodity exporters like Saudi Arabia, Iran and Australia

Luxury goods exporters like Switzerland

Highly industrialized upstream exporters like Germany, Taiwan, South Korea and Japan

The first group of commodity exporters is straightforward and easy to understand. China needs to import a lot of crude oil, iron ore and other commodities to power the domestic economy and its export factories. These include countries like Saudi Arabia (crude oil), Australia (iron ore) and Brazil (iron ore, soybeans).

The second group of luxury exporters is also pretty easy to understand. China is the largest market for a lot of luxury goods these days, even after the recent anti-corruption crackdown. A large portion of these purchases may not even necessarily show up in official trade figures because the goods are often purchased on overseas trips to avoid China's various taxes on luxury goods.

As for the last group, China often acts as a “pass-through” for industrial exporters that ship their highly engineered and high-value components to factories in China to be assembled into the finished product. The interesting thing about this is that — based on the way bi-lateral trade statistics are measured — China often gets “credit” for exporting product even though its actual capture of the economic value add is quite low.

This is something that is not well-understood even though it has significant political implications, especially in recent times as protectionist trade sentiments are on the clear upswing. It’s worth a deeper dive.

The primary role that China plays in today’s export markets is to add value in the more labor-intensive final assembly leg of the export processing value chain. In a typical example, China imports highly engineered components from countries like Germany and Japan, assembles the final product and the re-exports the product to the final destination.

Let me explain this concept by using the Apple iPhone as an illustrative example [2]:

Listed below is a breakdown of the manufacturing costs of an iPhone 4S (yes, this is quite dated, but the categories and costs will not have changed materially in the latest iPhone):

Based on the chart above, here is a breakdown of the main component categories and the likely source/provider:

Manufacturing ($8 cost / 4% of build cost) — China

Memory ($29 / 14%) — South Korea

Display / Touch Screen ($41 / 19%) — Taiwan

Processor ($15 / 8%) — USA (Apple’s in-house chip design), fabricated in Taiwan’s foundries

Camera ($18 / 9%) — Germany/Japan

Baseband ($24 / 12% ) — Germany

Other components ($66 / 34%) — Multiple countries including China

You may notice that the manufacturing portion is a relatively minor 4% of the overall build cost of the iPhone. This is because the highly engineered components that go into the iPhone are for the most part designed and manufactured outside of China and these components make up the vast majority (90%+) of the economic value-add.

However, for the purposes of calculating international trade statistics, every iPhone that China manufactures and ships to the U.S. adds an incremental ~$200 to China’s trade surplus with the U.S. Multiply this out across the 80+ million iPhones sold in the U.S. in 2016 and this one product accounted for something like 4% of last year’s U.S.-China trade deficit by itself. Meanwhile, for every iPhone, China runs a $190+/phone trade deficit with this group of highly industrialized upstream exporters. But the U.S.-China trade figure does not capture this part of the equation.

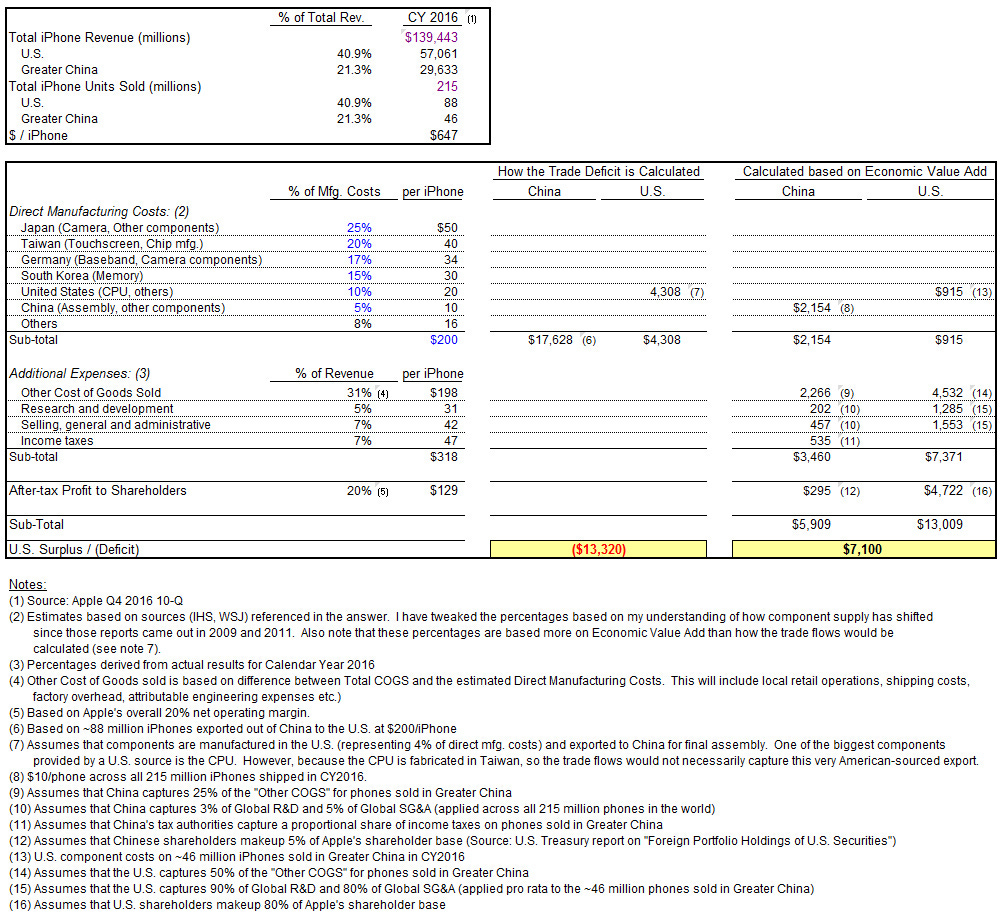

Once you factor in the tens of millions of iPhones purchased by Chinese consumers at retail prices (i.e. $700+ per unit), China is actually running quite a massive deficit with the United States, which goes a long way to pay for six-figure salaries for engineers and designers in Cupertino. Here is a detailed analysis I did comparing how the U.S.-China bilateral trade deficit is calculated vs. how true economic value add would be calculated.

Based on the above analysis, we can see how a $13–16 billion trade deficit with China on the iPhone is actually a $7+ billion surplus for the U.S. economy. Putting that figure in practical terms, the $7 billion surplus supports a lot of American jobs — you can do the math yourself: around 47,000 well-paid jobs in Cupertino at $150,000/person or 178,000 middle-class jobs at $40,000/person. And this is just hardware sales of the iPhone; it doesn’t include iPads, Macs, App Store purchases etc.

If we run this same analysis for countries like Germany, Japan and South Korea, we will see that those countries are actually capturing significantly more value in the manufacturing value chain of an iPhone than China [3]. But China is the one that takes most of the blame for running large direct trade surpluses with the United States.

This has major political implications as it has made China (along with Mexico) the main economic bogeyman in our collective mind. Germany and South Korea are rarely mentioned in any discussion on trade issues even though they effectively run massive trade surpluses with the U.S., especially after accounting for the surplus they pass through China. Even Japan, which had been the economic bogeyman of the 1980s, gets relatively little attention on trade issues these days.

While China is certainly by no means blameless — and there is definitely strategic value in holding onto existing and/or building out new industrial clusters — I also think it is sub-optimal for us to focus so much of our attention on China and ignore other countries that might have an equal or even greater impact on our economy. As much as people would like to believe, we will not solve our trade issues by solely focusing on China and Mexico.

Trade deficits are ultimately about the jobs that we lose to overseas competitors. So another way to think about this issue is by imagining the types of jobs that we want to “bring back” to the country. Should we be fighting to win back the low-value add labor intensive jobs that China’s export industry tends to specialize in, or should we be trying to create jobs that look more like the well-paid high-value jobs that you find in your typical German or Japanese multi-national?

The bottom line is that assessing trade relationships based on based on Economic Value Add is much more accurate than merely basing it on where final assembly took place, and ultimately help us make better decisions on trade policy.

Notes

[1] A good public source for country-by-country trade data can be found here: The Observatory of Economic Complexity: China Exports, Imports, and Trade Partners.

[2] The WSJ also wrote a good article about this back in 2010. And for another illustrative example (using Dell laptops), see Glenn Luk's answer to Given the complexity of supply chains, how is the trade deficit between the US and China calculated?

[3] Although this could be changing in the coming years — Bloomberg: Apple Weighs Chinese Supplier for Next-Gen iPhone Screens

This was originally published on Quora in January 2017.

really good article. Its a pity politicians don't read this sort of thing