newsletter | 2020.12.4

The relationship between debt and GDP in China, high-speed rail, dockless bike-sharing

Hello, World.

This is the first reading, writing & investing newsletter. I have been writing informally on other platforms for about a decade now and recently decided to switch to Substack and publish in the more structured format.

A little about me: I have been investing professionally for most of the last two decades, starting in venture capital & private equity and out on my own since 2014. I look at a fairly wide opportunity set — publicly listed stocks to private investments to real estate — and in recent years have been spending a lot of time and focus on China.

My general approach:

I am on a never-ending quest to seek worldly wisdom and understand how things work — expanding the toolbox of skills and mental models that I can put to good use in investing and life.

I strive to both understand the big picture to frame the opportunity set and then dive deep when the situation calls for it.

I prefer rational thinking over demagoguery.

I believe that one of the best ways to learn and improve is to engage with the community. I want to actively to engage with my readers on the topics I write about.

This site and newsletter will be a reflection of these philosophies.

I am normally based in New York City and traveled back-and-forth regularly to Asia until the pandemic. For the time being, I am in Taiwan with my family. More about me and reading, writing & investing here.

I am still trying to figure out the right format and cadence for a newsletter, but I think it will be some combination of:

recently read — quick analysis and commentary on a curated selection of recent news and articles

musings — summary and links to original content posted since the last newsletter

charts & data — interesting data that I have come across

from the archives — links to writing from the past

I will post individual content pieces directly to the website. You can also get a live feed via RSS @ lukecapital.substack.com

Only the newsletter will be distributed via e-mail — it will highlight and link to all of my recent writing. I will also tweet new content directly on Twitter (@glennluk).

Thank you for subscribing and joining me on this journey.

recently read

SupChina: President-elect Joe Biden’s four-decade history in China

“If we’re swayed … by those who believe that conflict with China is inevitable, as some do, or if we’re lulled into this false sense of security by those who comfortably predict that China’s automatically going to transform itself into this Jeffersonian democracy we assume is all over the world, I think we’re going to miss out on an opportunity to help shape modern China and our own interest.”

— Then Senator Joe Biden (June 18, 1998)

“We need to be having the rest of our friends with us saying to China these are the rules,” he said. “You play by them or you’re going to pay the price for not playing by them, economically.”

— Soon-to-be President Joe Biden (October 22, 2020)

SCMP: US bill to delist Chinese companies from stock exchanges passes in House of Representatives

The bill now passes to President Trump who is expected to sign the bill. Listed Chinese companies will have three years to comply with new regulations. Last year, I discussed how potential de-listing might affect investors in Chinese ADRs.

Bloomberg (Andy Mukherjee): Why I’m losing hope in India

For many of my generation, our long-cherished hope for a better, greater India is all but gone. We wanted to trade some of our democratic chaos for a little bit more growth. We ended up with less of both.

In 2007, my firm acquired an e-mail marketing company with a large back-office in Hyderabad, India and over the next five years, I spent a fair amount of time out there. It was an amazing and enlightening experience. But since 2012, I haven’t been back and my 10-year visa just recently expired.

Andy shares a heartbreaking essay on the dual promise and disappointment of India — set to overtake China as the world’s most populous country by 2027.

The Economist: How Ping An, an insurer, became a fintech super-app

[Ping An] has a 110,000-strong technology development team — larger than the commercial-banking divisions of all but the biggest banks — including 3,000 scientists. It submitted 4,625 technology patents in the first half of the year alone. The tools developed within the group’s technology unit are often used across the company. These include credit-risk models that use vast stores of data to make quick lending decisions at Ping An’s consumer-finance division, Puhui. Similar data crunching can track a customer’s driving habits through movements detected on a mobile-phone sensor and price car insurance accordingly. More accurate pricing on both fronts saves the company money.

Lost in all of the recent fintech regulatory news that seems to be squarely focused on Ant Group, Ping An Insurance has quietly turned itself into quite a fintech powerhouse on its own.

Nikkei: China aims to shake US grip on chip design tools

From the front lines of the US-China technology rift. EDA tools companies are dominated by American firms and China is actively trying to built out its own domestic capabilities. Building multiple segments of the highly specialized semiconductor value chain at the same time will take a long time and not be easy — but China sees this as a strategic imperative.

MacroPolo: Guaranteed government bailouts: Is the end nigh?

As I discuss in my newest piece about the role of credit and GDP, one of the challenges in evaluating China is that there are so many moving pieces. The financial sector is one of these moving pieces, having undergone significant change over the last decade plus.

As China’s economy gets more sophisticated, its financial system is evolving from one built on direct loans from a handful of national banks to a much more complex one involving hundreds of smaller local banks, asset management firms and tech-savvy new entrants. Dismantling implicit government guarantees would just be another in a series of steps — not always forward — towards building a modern financial system that will most likely look very different from what we are familiar with.

musings

Debt and the Chinese economy: A complex relationship

My response to a recent FT article by Michael Pettis, a finance professor at Peking University, who contends that China’s goal to double its GDP by 2035 is an “unlikely bet” on the basis that (i) this level of GDP growth would require credit growth that leads to debt/GDP levels that are unsustainably high, (ii) the structural shifts required to re-balance the economy from investment to household consumption will be difficult to execute politically, and (iii) productivity improvements need to make up for a decline in working-age population.

To analyze these points, I channel my experience as a 22-year investment banking analyst to re-build the forecast model used to come to this conclusion as described in the article. I point out some issues I found with the assumptions in the model as well as the logical framework of the model itself. I offer my own take on the feasibility of re-balancing the economy by leveraging a “virtuous cycle of consumer-led innovation” and why the demographic tailwind is not that significant.

Ultimately, I conclude that reality is a lot more nuanced than that represented by the simple assumptions in this model. If I were forced to make a prediction, I’d say the goal to double GDP by 2035 is quite achievable. But 2035 is a long way off.

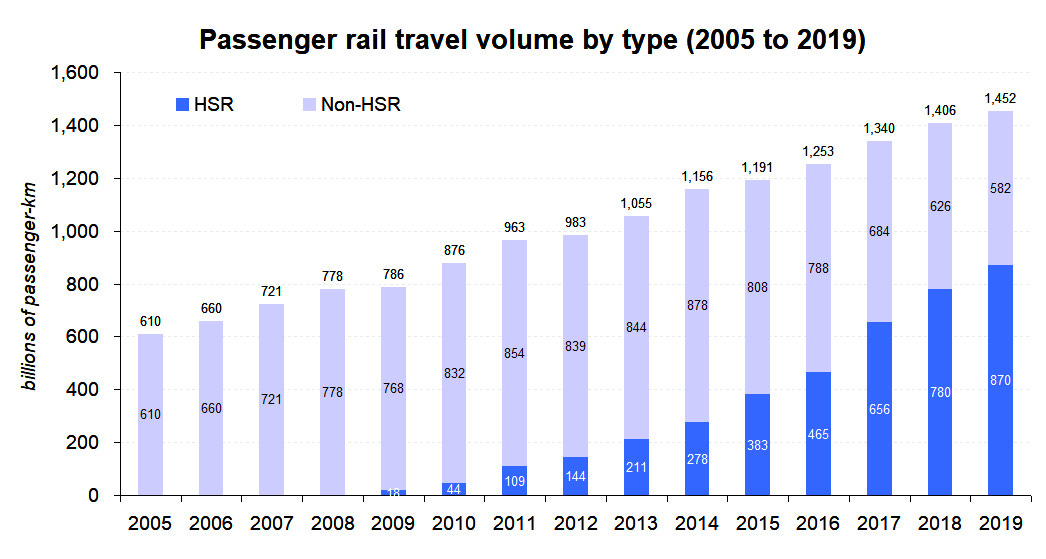

Should China continue to invest in high-speed rail?

I respond to a Bloomberg article by David Fickling who argues that while the first phase of China’s high-speed rail build-out has been successful, China does not need to build more.

Using additional data and analysis from the same World Bank report cited in the article, I come to the opposite conclusion: Phase II is likely to be even more successful than Phase I. For large public infrastructure projects with high up-front costs, we need to take a long-term perspective, look beyond just pure financial returns and consider utilization and other intangible benefits.

Bike-sharing in China: Success or colossal waste?

We have all by now seen the haunting flyover montages of bicycle graveyards. The industry having reached some level of equilibrium, I analyze the costs and benefits of the dockless bike-sharing build-out in China over the last five years. As with high-speed rail, utilization is a key factor in how we should assess the industry. I analyze the industry’s capital efficiency by comparing it with Citibike in New York City.

charts & data

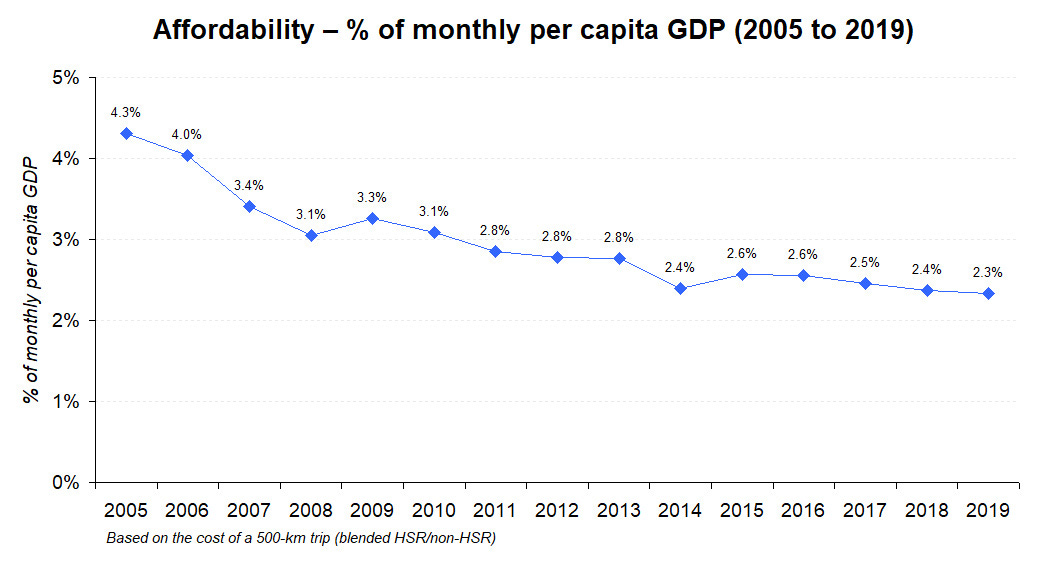

HSR is increasingly affordable in China

In the first “charts & data” column, I take a look at how rail travel in China has changed over time because of high-speed rail — particularly in terms of affordability.

from the archives

February 2016: Why doesn’t the U.S. have high-speed rail like Europe and Asia? It’s about the economics, not the technology

May 2016: Will India be able to avoid the “Middle Income Trap”? Going from a poor to middle income country is not easy; getting rich is even harder

January 2018: Could the Great Pyramids at Giza be re-built with modern technology? Some have speculated that its massive stones could not be lifted with modern equipment

August 2018: Is China’s credit bubble really a problem? It’s a challenge but it can also be blown out — no pun intended — of proportion

diversionary

h/t Damien Ma