How will the race to 5G dominance play out between Qualcomm and Huawei?

The history, technology and geo-politics of wireless in five Acts

Prologue

First, let me start off by saying that I agree with Benedict Evans that 5G as a technology isn’t all that earth-shattering. It’s really just a continuation of a well-established trend: fatter and fatter data pipes. Imagine being able to take your home Wi-Fi everywhere and that pretty much describes 5G.

This is not to say that 5G is not important, or diminish the work done by hundreds of thousands of engineers, scientists and other wireless industry professionals around the world … or that it won’t catalyze the development of a host of cool new applications bearing all of the latest buzzwords and acronyms.

It’s just more that I find the underlying economic and geopolitical story far more interesting and meaningful. Sort of like the 2006 film Babel starring Brad Pitt, it is a multiple-storyline epic featuring two main protagonists that lead completely separate lives for the first four acts while gradually converging … until the climactic moment when their paths smash into each other.

As the curtains open on Act V, we find the two protagonists having finally taken the stage at the same time. And while we can make some guesses as to how things unfold from here, the reality is that the story is still being written.

The implications are enormous and bigger than the wireless industry itself. Indeed, this is perhaps the most important area to pay attention to in today’s increasingly tech-driven geopolitical arena.

But we are getting ahead of ourselves; to fully appreciate the saga we need to start at the very beginning … where we find ourselves on a deserted Hamptons beach at the break of dawn, sometime in the mid-80s …

Act I

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way — in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.”

Opening paragraph to A Tale of Two Cities by Charles Dickens

I remember the iconic scene in 1987 film Wall Street when Gordon Gekko officially brings Bud Fox, an ambitious young broker, “inside” the curtain. It is a critical scene in the movie, made even more dramatic by use of what was then a novel piece of modern technology — the cellular phone. Gekko delivers the coup de grâce to the young broker by expounding — in real-time on that phone — on the beauty and awe of the sunrise from his beachfront palace as a metaphor for a new world of hitherto unimaginable wealth that he was about to enter.

The first cellular phones were analog radio devices that would connect to a local tower that oversaw a fixed area, or “cell”, on a dedicated frequency. The radio-frequency (RF) technology was pretty much the same as that powering walkie-talkies — the trick there was figuring out how to connect the walkie-talkie to the circuit-switched phone network.

Call capacity was limited because there are only so many slices of frequency into which you could divide spectrum before you run into quality issues. As a result, early cellphones and their related service plans were extremely expensive and generally limited to wealthy moguls like the fictional Gordon Gekko.

But while Gekko extolled the “virtues” of unmitigated greed, scientists and engineers were working on the next generation of wireless standards, and trying to solve the fundamental problem of how to cram more channels into the same allotment of limited spectrum. It is essentially the same problem that they continue to try to improve on today.

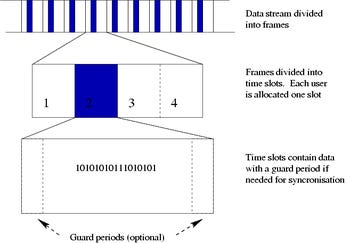

At the time, there were two competing methods on how to do this. The first was something called time-division multiple access (TDMA). With TDMA, you could have multiple users share the same frequency by dividing the signal into fixed time slots that were assigned to each active user.

The second method was code-division multiple access (CDMA).

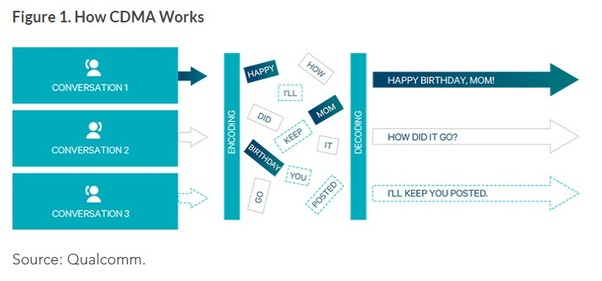

As with TDMA, the goal of CDMA was to permit multiple users from sharing the same slice of frequency but instead of having fixed, assigned time slots to differentiate between users, CDMA used unique codes to identify each user (hence the name). These codes could switch and hop across multiple channels, making it more flexible than TDMA.

From a technology perspective, CDMA was better because it was more scalable especially as the world became more digital and less analog over time. But as we saw in the battle between VHS and Betamax, sometimes it is not just about technological superiority.

Act II

The race was on between the two competing standards.

Western European countries latched onto the TDMA method and a generally open, collaborative approach, releasing Global System for Mobile Communications (GSM) in 1991.

The world’s first GSM call was made by Finnish Prime Minister Harri Holkeri on July 1st, 1991 and commercially deployed at the end of the year on a network built by German conglomerate Siemens and a then-relatively unknown conglomerate subsidiary called Telenokia. It would later drop the prefix, adopt the name of its conglomerate parent and become widely known simply as “Nokia”.

The competing CDMA method was not entirely novel — it had been pioneered as early as the 1930s by scientists from the Soviet Union. Interestingly, wireless phones based on the CDMA method were used in Moscow as early as 1963. However, it wasn’t until a former electrical engineering professor from MIT named Irwin Jacobs latched onto the technology that it found mainstream, commercial applications.

In 1985, Jacobs launched Qualcomm — which stood for “Quality Communications” — based in the Southern California paradise of San Diego. The new company was initially focused on mobile satellite communications and because satellite bandwidth was so expensive and precious, there was an intense focus on bandwidth efficiency, which is what had led Jacobs to CDMA.

The company went public in September 1991, raising $68 million to fund its CDMA research and later an additional $486 million to help commercialize a CDMA-based ecosystem. Qualcomm was perhaps the highest flier in the high-flyin’ 90s, ending the decade with its stock price increasing around 180x from its IPO price eight years earlier.

Knowing nothing else but Qualcomm’s stock chart in the 1990s, one could have reasonably concluded that CDMA and its superior technology had won.

But that was not to be, at least here in Act II.

One issue for Qualcomm and its CDMA-based “cdmaOne” standard was that GSM had gotten a big head start.

The “cdmaOne” standard was not adopted as a standard until 1995 at which point GSM networks in Western Europe and the United States had already reached 10 million active subscribers. By the time cdmaOne networks were deployed at scale, GSM networks had already reached over 100 million active subscribers.

The other issue is that for voice, the technical advantages of CDMA were not that significant. TDMA did a fine job of transmitting voice and capacity constraints could be alleviated by adding additional wireless radios or reducing the size of each cell, especially if those radios could be purchased at affordable rates.

Taking a more open, collaborative approach, GSM had also incorporated certain features such as a standard ID schema that allowed cellphones to be used across multiple networks by simply switching out the SIM card — which was much more important in Europe with its multiple country networks vs. the United States where people tended to travel internationally far less frequently.

Ultimately, GSM won decisively by achieving scale and driving down cost. Because GSM networks were first to market, equipment manufacturers were able to deploy networks more quickly and inexpensively. Because GSM operators reached scale, handset manufacturers designed handsets around GSM standards. Because GSM was developed with a more open, collaborative approach, its technology licensing fees were lower. And because costs were lower, active subscribers tended to go with GSM networks vs. cdmaOne when given a choice.

In September 2001, shortly after 9/11, I moved out to Hong Kong, which had deployed a GSM network.

I was amazed at how much cheaper and better my cellphone service was compared to the United States. It was incredibly convenient to be able to simply switch out a small SIM card and start using your phone on another network. I loved my Nokia 8310 handset. And I still distinctly remember how one annoying thing about work trips to South Korea — one of the few markets that had chosen CDMA over GSM — was having to use a clunky loaner Sanyo handset that didn’t have my address book or Snake.

GSM and Nokia had won the 2G war. CDMA-based technology was expensive and clunky and few people wanted it. By the early 2000s, Nokia was a giant, one of the world’s most valuable companies, at one point accounting for 21% of Finland’s exports and 70% of the Helsinki stock exchange market capitalization.

But we were really just getting warmed up.

Act III

Long before Apple unlocked “Smartphones” on the Technology Research Tree in 2007, wireless industry executives had suspected that data and not voice was going to be the long-term future of wireless. Fresh off the release of GSM in 1991, the various industry groups that set wireless standards had already begun trying to figure out how to transmit data at high speeds over the airwaves.

Most had already known that GSM’s TDMA approach — perfectly adequate for voice communications — was just not going to cut it for data. While data could be transmitted over GSM networks, the transmission rate was capped at speeds reminiscent of the early days of dial-up modems. As nostalgic as I was for the halcyon days of the mid–90s, it was just not practical for anything outside of short-form messaging (i.e. SMS/texting).

As wireless industry executives tried to find solutions for this technical issue, every path seemed to lead back to San Diego.

It’s not enough to just have a good idea — you need to execute.

While wireless operators worked 24/7 to deploy mostly GSM mobile networks around the world in response to the surge in active subscriber growth, Qualcomm was busy executing … and betting its future on CDMA. It too worked round-the-clock — frankly, an amazing accomplishment considering San Diego’s gorgeous year-round weather — to solve fundamental issues related to implementing wireless networks using the CDMA approach.

Its main approach was to patent specific methods on how to perform various functions that were important in enabling wireless communication. For example, US Patent No. 5,280,472, issued on January 18, 1994, called for a “CDMA communication system in which cellular techniques are utilized in a distributed antenna system environment”. This particular one would cover instances where wireless signals need to be split up and re-routed and amplified within large buildings that remote tower-generated wireless signals would have difficulty penetrating.

This was just one of an estimated 16,000 patents filed by Qualcomm over the years, of which at least 6,000 are related to wireless. In addition to building its IP portfolio, Qualcomm took a lead role in fostering eco-system development, including at various points producing handsets, network equipment and designing RF chips and chipsets.

As various 3G standards — represented by confusing acronyms like UMTS, W-CDMA, TD-SCDMA, CDMA2000 — emerged and were implemented, it became abundantly clear that CDMA was the common technology tying all of them together. With such a large patent portfolio around this method, it also became clear that Qualcomm was going to be collecting a recurring, steadily increasing stream of royalty payments for the foreseeable future.

As 4G standards (LTE) rolled around in the mid- to late-2000s, cementing data as the key focus of the wireless industry, Qualcomm emerged as the dominant toll collector in one of the largest and most strategic industries on the planet.

Act IV — Part I:

For most of the first three acts, China is a mere after-thought, a minor character that is largely relegated to watching the main action from backstage:

While Gordon Gekko was recruiting Bud Fox into his insider trading cabal, China was figuring out how to motivate its farmers to really put their backs into it so the nation could avoid teetering so close to the edge of starvation.

While Nokia was busy deploying early GSM networks in Western Europe, China was figuring out how to dismantle its centrally planned industry without uprooting the lives of urban workers to the point where they would pour out into the streets by the millions like they did that fateful spring of 1989.

While Qualcomm’s scientists were patenting thousands of wireless patents, China was figuring out how to open its doors so it could actually start trading the things that it had in abundance — e.g. inexpensive labor — for the things that it lacked, like wireless technology.

In 1987, Ren Zhengfei — a former mid-level officer in the People's Liberation Army engineering division — founded Huawei in Shenzhen, the city bordering Hong Kong which was at the front lines of China’s economic reform program. At this point, China was 100%-reliant on foreign telecom equipment for its landline industry and most major international telecom equipment companies had established a presence in the country on the promise of tapping into China’s billion-person market.

At first, Huawei focused on re-selling imported telephone switches and fire alarms from Hong Kong. But for whatever reason, its founders decided very early on that the company should develop its own technology in-house vs. the “easier” path taken by others like Shanghai Bell to form a joint venture with multinationals to access foreign technology via transfers. Ren believed that “foreign companies were unlikely to transfer their cutting-edge technology and that Huawei would be better served by performing its own R&D”.

Starting from a technology base of virtually nil, Huawei nonetheless prioritized R&D from its early stages. As a private company (vs. state-owned enterprise), Huawei suffered from lack of access to capital and was forced to borrow at extremely high rates in the early years. Despite these challenges, by 1993 Huawei had released its first significant in-house developed product — an electronic switch that could handle 10,000 lines, unprecedented for a domestic company at the time. It was a mature product and comprised almost entirely of foreign components but it was still quite impressive for the six-year old company.

One of its strategies was to focus on market segments that were ignored by foreign technology suppliers. For example, international telecom companies preferred to focus on the rapidly growing urban centers while ignoring the poor, rural areas. Seeing this, Huawei adapted foreign technology to deal with “frontier market” issues — problems such as unreliable power grids and rats that like to gnaw on cables. Its business practices were “controversial” and by international standards probably textbook “corrupt” but in China at this time, function prevailed over form.

Huawei began to separate itself from its domestic peers. By 1996, less than a decade after founding, it had secured its first international customer, selling circuit switches to Li Ka-shing’s telephone company in Hong Kong. By 2002, Huawei had overtaken Shanghai Bell, the largest Chinese-international JV at the time. Around this time it began expanding into adjacent markets like Internet and data communications, which was dominated by companies like Cisco.

February 5th, 2003 marked the day that the name “Huawei” was formally introduced to the American lexicon (outside of a small group of telecom industry insiders). This was the day that Cisco sued Huawei’s American subsidiaries for copying code from its routers. It marked the first major instance where a Chinese technology company had brushed up against an American one — not to mention the beginning of what I can only describe as a “lengthy and systematic effort by Americans to devise ever-increasingly creative and sophisticated ways to butcher the pronunciation of its name”.

The suit was settled in 2004 but the damage had already been done. By this time, Huawei had captured one-third of China’s enterprise market and has never looked back.

By the mid-2000s, Huawei was pushing hard into developing markets with an increasingly sophisticated array of products and services for both landline and wireless communications. Like its foray into China’s rural markets in the early 1990s, Huawei adapted mature products for developing countries facing problems that China had dealt with the prior decade such as non-existent or unreliable power grids and inexperienced technical staff.

An example from one of my early Quora answers was a low-power base station that could run on solar power, targeted at African countries that lacked reliable power infrastructure. In another early answer, I also discuss the important role the China Development Bank played in helping Huawei expand into overseas markets.

By 2011, Huawei had overtaken Ericsson as the largest telecom equipment supplier in the world with approximately $33 billion in revenue and industry-leading profit margins.

It was around this time that Huawei had started aggressively pushing into consumer electronics as well, piggybacking on the smartphone revolution and its now massive R&D operation to vault into the Top 10 of smartphone OEMs. By 2017, Huawei was pushing $100 billion in revenue, largely driven by growth in its consumer devices division which was now challenging Samsung for the top spot in smartphone market share (by unit volume). Today, the company has around 180,000 employees worldwide with 80,000 of them involved in R&D.

Act IV — Part II:

While Huawei was pushing forward at breakneck speed (even compared to the rapidly evolving Chinese economy), China’s state-owned telecom operators were plodding along slowly, trying their best just to keep up with the rapid and accelerating march of communications technology.

Prior to 1994, the state held a monopoly on the provision of telecommunications services through the Ministry of Posts and Telecommunications and its operational arm, China Telecom. In 1994, to kick off reforms, the first competitor was established (China Unicom) and in the following years, there would be a series of reforms as Chinese policymakers tried to mold these former government ministries into modern corporations.

It was around this time that Qualcomm had first reached out to China. Although the Chinese government had already selected GSM for commercial use in 1994 — attracted by lower cost and ease-of-deployment — Qualcomm set up a partnership with the People’s Liberation Army (kind of crazy when you look back and think about it) to use its CDMA technology for military communications. However, in 1998, Chinese President Jiang Zemin “shocked the world” when he announced that the PLA would no longer be allowed to engage in civilian activities, swiftly killing off the joint venture plans.

The Chinese government was initially hesitant to partner with Qualcomm until they would address three priority issues:

It wanted to be able to deploy phones that could work on both GSM and CDMA networks

It did not want to pay the royalty fees or structure that Qualcomm was demanding for its CDMA technology

It wanted access to the design of Qualcomm’s CDMA chipset

However, as detailed excellently by MacroPolo, in the backdrop of late-90s negotiations to enter the World Trade Organization (WTO), Chinese policymakers decided to drop most of these demands and, under pressure from the US government, agreed to allow Qualcomm and its CDMA technology into the Chinese market. This decision would prove very costly in later years but for now, China was more focused on WTO accession.

Following this decision, over the next decade Qualcomm’s revenue in the Chinese market grew from zero to nearly $2.5 billion and came to represent almost one-fifth of the company’s revenue. And this was just the beginning — as China began to commercially deploy 3G networks in 2008, this number was set to explode even higher.

In the most recent fiscal year (12 months ending September 30, 2018), Qualcomm’s revenue from China had increased to over $14 billion and represented over two-thirds of its revenue stream.

A large part of this revenue stream, especially in the earlier years, was paid by foreign smartphone OEMs like Apple but as Chinese smartphone OEMs (incl. Huawei) took market share in China and around the world, they began to realize how much Qualcomm was making off its intellectual property — because they were now the ones paying these royalty fees in increasing amounts.

But just as Americans are about to break out the champagne and “USA! USA!!” chants, the latest missive from the Debbie Downer-in-Chief himself flashes across our feed …

Somewhere between China’s reputation as the world’s most rapacious “intellectual property thief” and the tens of billions of dollars per year it pays to international technology companies like Qualcomm … lies reality.

Act V is where we are going to find out what that reality is.

Act V

On November 8th, 2016, Donald Trump pulled off a surprise win over Hillary Clinton in the United States presidential election. Eight days later, a far less publicized political battle was taking place, this time over a topic that only a handful of people in the world really understand at a deep, technical level.

Remember the industry groups that we met in Acts I to III that played such a critical role in choosing and setting wireless standards?

Well, they are still around and playing just as critical a role. Depending on which technologies are incorporated, the respective IP holders may be richly rewarded, just as Qualcomm had for the better part of the last three decades.

On November 16th, 2016, members of this standards body, 3GPP, met in Nevada to decide whether something called “polar coding” would be incorporated into official 5G canon. It was up against an alternative approach called “low-density parity check”. Intense debate ensued over which one was better.

To a casual observer, the debate of “polar coding” vs. “low-density parity check” may have appeared to be a Nerd Fight of Epic Proportions but behind all of the computer science and technical jargon was something much deeper — what it was really about was control over the next-generation of communications technologies.

As you may have guessed, this is where the paths of Huawei and Qualcomm finally began to converge.

You see, China was getting weary from paying tens of billions of dollars every year in licensing and royalty fees for technology invented 15–20 years ago at a time when they did not have the capability or resources to even have a seat at the standards-setting table. While they had been late to the standards-setting game for even 4G/LTE standards, the country’s leaders had committed to making sure that this would not be the case with 5G. And Huawei was the main horse that they were betting on.

As Huawei had grown through the years, it had continuously re-invested this growth back into R&D. By 2017, close to RMB90 billion ($13.8 billion) per year, out-spending Qualcomm by two and a half times in absolute terms (i.e. before adjusting for the approximately 3x difference in wages between Shenzhen and San Diego).

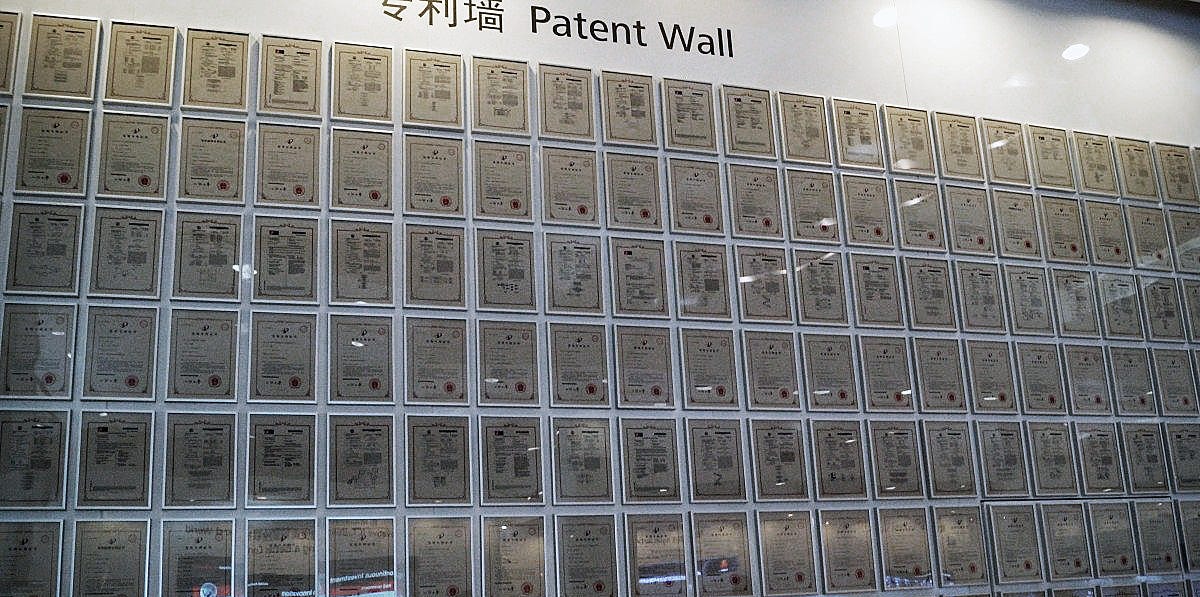

In doing so, it had quietly built up its very own patent wall:

One of these patents was around the aforementioned “polar coding” method while Qualcomm held patents around the competing “low-density parity check” method. During the 3GPP debate, Western companies largely backed Qualcomm’s method while Asian manufacturers favored Huawei’s. In the end, both were accepted into as viable alternatives in the 5G standards book and each side moved on to battle over other (likely even nerdier) topics.

While accumulating the most patents is still an important part of the game (as we saw in Act III with 3G), commercialization is an equally important consideration (as we saw in Act II with 2G).

And on this front, China is racing ahead. Not only is it already the world’s largest wireless market by far, with 10x the number of base stations as the United States (and 40% of global sites), its wireless operators are already well into the roll-out schedule and plan to be fully commercialized (for “standalone” or “full” 5G; see Note i) by the end of 2020:

The 3GPP debate in Nevada presaged the fault lines that we are now beginning to see, not only for 5G but other technologies as well. The elections of President Trump and the rise of other right-wing political parties in Western European countries has only increased the politicization trend.

On April 16th, 2018, ZTE, the second-largest Chinese communications equipment supplier after Huawei, was hit by the U.S. Department of Commerce with an export ban. The ban would prevent it from accessing critical components provided by U.S. suppliers (e.g. optical chips) and force it to re-design its equipment. It was a crippling blow to the company and while later reversed, was one of the first clear signs of this increased politicization.

Then, just a few weeks ago on December 1st, 2018, Sabrina Meng, CFO of Huawei and daughter of its founder, was arrested in Canada at the request of the U.S. government in what was viewed by most as a politically motivated escalation. President Trump essentially confirmed it several days later.

And that pretty much brings us to the present.

The key protagonists, Huawei and Qualcomm stand together on stage, surrounded by a host of supporting cast members. The crowd watches with rapt attention, eagerly awaiting the next twist in the story …

Epilogue

As I sit here and write in the last few days of 2018, it is quite clear that we are still very much in the middle of Act V — and it looks like there will be plenty of more excitement and fireworks to come.

I also must admit that I am not 100% sure how Act V and the “race for dominance” will ultimately play out between Qualcomm and Huawei, not to mention all of the other actors on stage.

As you saw through the first four acts, there were many twists and turns along the way, with new characters entering the space and old ones fading away with each successive generation of wireless standards. Add to that the increasing politicization of technology and the oft-times capricious nature of geopolitics and my crystal ball is quite foggy at the moment.

But I do think understanding how we got to this point is very important if we want to think about the possible future scenarios and where we go from here — and that is why I took you through this fairly expansive review of the history of wireless.

That said, I do want to leave you with some final thoughts on the topic:

The emergence of Huawei as a major IP holder will inevitably cut into Qualcomm’s wireless market dominance and position as the favored toll collector.

Opening quote to Act I notwithstanding, this is actually not just a Tale of Two Companies; it is also about existing players like Ericsson, Nokia and Apple that have long chafed at Qualcomm’s licensing fees and dominant market position.

As I wrote in a recent piece, Qualcomm collects upwards of $30–40 on each iPhone that was sold — on top of any chips it provides — due to its “double-dipping” licensing structure. For 5G, Qualcomm announced that it would charge “up to $16.25” in royalties for every phone — much lower, an indication of lower negotiating leverage.

The battle between commercialization vs. technology will be another area to watch.

I do not know enough of the technical minutiae — stuff like “polar coding” vs. “low-density parity check” — to fully assess but my gut tells me that the differences between Huawei’s approach and the one supported by Qualcomm may not be that material and certainly not like the difference between TDMA and CDMA during the 2G and 3G mobile standards wars.

We cannot rule out the possibility (as unlikely as it may seem at this point) that Qualcomm and Huawei end up collaborating or working together out of pure self-interest (an “if ya can’t beat him, join ‘em” type situation).

The likelihood of global wireless standards bifurcating into different camps seems to be increasing, although it is far from inevitable at this point.

If this happens, there are two clear camps — China and the “Five Eyes” Anglophone group. If you throw the European Union and Japan into the Anglophone group (let’s call it the “U.S. Alliance”), you are talking about a combined population of around 1 billion (that is significantly wealthier on a per capita basis) compared to 1.4 billion in China — all things considered, fairly balanced.

But we cannot forget about the other 5 billion+ people out there — and places like Southeast Asia, India and Africa are where the front lines of the battle for technology dominance will take place.

From the perspective of these 5 billion plus, the entrance of Huawei into the fray is seen as a positive development, insofar as providing them with another option and greater leverage to negotiate on fees.

This bifurcation trend may also play out in other areas of technology, not just wireless standards.

Semiconductors are another strategic (and related) industry. Chips are how you take the IP from the patents and convert into real-world use cases. They are critical components in network equipment, as ZTE was reminded in April 2018.

The U.S. Alliance dominates the semiconductor industry, especially upstream (i.e. semi capital equipment). Certain specialty equipment like extreme UV lithography is dominated by European like ASML and Japanese players like Canon/Nikon and can be easily controlled through measures like export bans over “dual-use” technology.

However downstream production is dominated by Asian manufacturers, notably Taiwanese and South Korean foundries. Moreover, the consumer electronics supply chain is deeply entrenched in China and the East Asia region.

So it is very complicated, and this is what makes predicting how the various points of negotiating leverage play out so hard.

National security concerns are very valid. But I think they can be addressed without forcing others to have to split into camps that are non-interoperable. That would be a shame for everyone.

Finally, the one thing that I do know for sure is that we’ve come a long way since the days of Gordon Gekko and his massive brick of a cellular phone.

Notes

[Note i] There is a bit of confusion out there as to what constitutes “5G”. Part of the reason is that there are essentially two different levels of 5G implementation:

The first is something called “non-standalone” which means augmenting the existing 4G network with 5G hardware that will focus on ultra-high-bandwidth data services.

The second is called “standalone” which means everything can go on the 5G network.

It is somewhat analogous to the difference between a plug-in hybrid vehicle like the Chevy Bolt and an electric-only vehicle like Tesla.

Roll-outs for “non-standalone” 5G implementation are happening in 2019–2020 throughout most of the world — for example, Verizon announced that “5G services” would begin in 2019. However, China is planning a particularly aggressive roll-out schedule for “standalone” 5G compared to every other country with scale deployments in 2020.

Whether or not this is the right strategy remains an open question.

This was originally published on Quora on December 29, 2018.

5G race is OVER, and Huawei WON.

HUAWEI is now driving the lead on 6G.

Glenn, excellent write-up but you omit "national security" in your analysis. Was the Chinese government aware Cisco and Qualcomm equipment have in built "backdoors" for US surveillance. If not, Edward Snowden exposing the USA's secret PRISM program must have forced everyone to take notice. The creation and promotion of Huawei and ZTE is primarily a need for domestic national security. Going forward, shouldn't all analysis take geo-politics into account?