How much would an iPhone cost if Apple were forced to make it in America?

You might not like the price

In the $30,000 to $100,000 range … and no this is not a typo.

In fact, if Apple were forced to solely manufacture the iPhone in America, there is a good argument that it would not be able to manufacture any at all. And if they could somehow successfully make the manufacturing transition, capacity would likely be constrained to a just a few million units a year.

The issue here is not really about differences in the cost of labor. It is more about the supply chain and it is mostly about differences in the necessary skills required to manufacture hundreds of millions of iPhones at high-quality to satisfy current market demand.

As Apple CEO Tim Cook points out in a recent interview [1], the U.S. is sorely lacking in certain critical skills required in the manufacturing supply chain. One of these skills is precision tooling and specifically, tooling engineers.

Here is the transcript from the relevant section starting at the 9:26 market:

There’s a confusion about China … the popular conception is that companies come to China because of low labor cost. I’m not sure what part of China they go to but the truth is, China stopped being the low labor cost country many years ago and that is not the reason to come to China from a supply point of view…

… the reason is because of the skill … and the quantity of skill in one location … and the type of skill it is. The products we do require really advanced tooling. And the precision that you have to have in tooling and working with the materials that we do are state-of-the-art. And the tooling skill is very deep here.

In the U.S. you could have a meeting of tooling engineers and I’m not sure we could fill the room. In China you could fill multiple football fields.

Tooling engineering is a highly skilled position that requires years of training and experience. It is an “analog” type skill that combines artisanal craftsmanship with precision engineering skills. And as Mr. Cook alludes to later in the talk, the Chinese have developed and scaled these skills over the last three decades while the U.S. and other countries have gone the other direction and de-emphasized them:

It’s that vocational expertise is very deep here [in China]. And I give the educational system a lot of credit for continuing to push on that even as others were de-emphasizing vocational. Now I think many countries in the world have woke up and said this is a key thing and we’ve got to correct that but China called that right from the beginning.

Relative scarcity of qualified precision tooling engineers is just one of many reasons why it would be hard to scale manufacturing of the iPhone in the U.S. Foxconn employs over one million workers on its payrolls even as the company makes a big push into automation. The consumer electronics supply chain migrated to Asia three to four decades ago and rapid procurement of components is critical to cost, time-to-market and ability to scale. Logistics and infrastructure are also key for a product that is shipped around the world — seven of the world’s ten largest ports are in China.

Tim Cook is the foremost expert on consumer electronics manufacturing [2]. Prior to becoming Apple’s CEO after Steve Jobs, he had spent his entire career in operations, including 25 years working closely with Chinese manufacturers. He was critical to Apple being able to eventually scale up and produce billions of the most highly engineered consumer devices in modern history. The guy knows what he is talking about.

Theory …

Theoretically, if Apple were forced to manufacture only in the U.S. I certainly believe we have the capability to eventually re-build the technical skills required to do this. But it would take many years due to the nature of skills required. Vocational professions like precision tooling engineering require many years of training under a master-apprentice style system working in a live environment. There is a lot of “trial and error” involved in fine-tuning manufacturing equipment and assembly lines. There are few shortcuts around this; being smart or working extremely hard alone won’t get you there. Indeed, Tesla is facing some of these issues as it tries to mass-produce its Model 3s without sacrificing quality: CNBC: Tesla Model 3 production issues.

We are having a hard enough time convincing young people to choose computer science and now we would have to convince even more of them to get involved in a vocational profession — which will not be easy given the often pejorative connotation attached to the word (think “vocational school”). To really get this done right, we would probably need to re-design much of our public educational system to look more like Germany’s where students start moving down the vocational path during high school [3]. This is a pretty massive undertaking to say the least.

Even if we were to start today, it would take an entire generation to really scale this up. In the meantime, using the existing scarce resources (sub-optimally) my guess is that we could initially produce a few million units per year [4] and then slowly ramp that up as we get better with repetition, add more resources etc. over time.

And precision tooling is just one slice of the overall equation — we haven't even yet considered the other aspects of scaling such as building the component supply chain, improving our logistics infrastructure and finding hundreds of thousands of workers willing to work the assembly line (even with robots and automation).

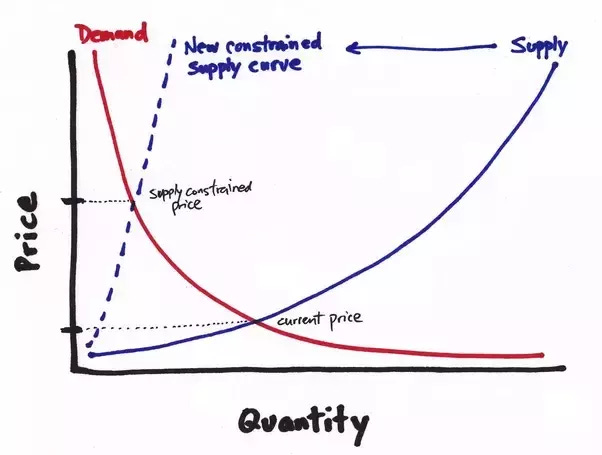

So forcing Apple to manufacture only in the United States means that in a best case scenario you probably go from the ability to produce hundreds of millions of iPhones per year to producing single-digit millions per year at a much higher per-unit cost. This is a two order-of-magnitude difference. While the production costs would undoubtedly be significantly higher, Economics 101 tells me that the biggest driver in the price increase would be the supply curve shifting waaaaaaay to the left resulting in a massive increase in the equilibrium price.

In this theoretical world, where only 1% of the population could have an iPhone (and assume alternatives don't exist for now), the cost would skyrocket. Not only can the 1% afford to pay significantly more, the iPhone would turn into an ultra-luxury item and just look at the order-of-magnitude price difference between say a Birkin bag and a Coach handbag — price differences in the 30–100x range. In iPhone terms that would bring us to prices in the $30,000 to $100,000 range.

In other words, the price increase is driven almost entirely by artificially constrained supply in the face of overwhelming demand as opposed to rising per-unit production costs.

The idea of comparative advantages in Economics teaches us that just because we can do something, doesn't mean we should.

Reality …

Of course in reality, Apple would be rendered completely non-competitive so trying to figure out the exact price in this scenario is a mostly meaningless exercise.

Its business model depends on having billions of active devices and hundreds of millions of active (and relatively affluent) users out there funneling money to the app developer eco-system. Without a large user base, the iOS ecosystem would quickly wither on the vine.

Apple’s scale provides significant negotiating leverage with its component suppliers. Reducing manufacturing production by 50 to 100x would give them less negotiating leverage than many handset manufacturers in China that nobody has ever heard of. Samsung Electronics would cackle with delight when it found out Apple was being forced to move manufacturing to the U.S.

Apple’s scale also allows it to amortize its product development and brand marketing budget across hundreds of million devices per year. Artificially constraining supply by two orders of magnitude would mean that the amortized portion of these fixed costs are going up tremendously.

Its foreign competitors, unconstrained by this artificial and sub-optimal manufacturing requirement, would fill in the void and soon devour the market turning iOS into a non-factor overnight. App developers would stop developing for iOS and just focus on Android. Apple’s future plans extending the iOS eco-system into new product categories would be squashed.

In effect, we would have successfully killed off the most valuable and arguably finest and most successful company in U.S. history — a company that is responsible for directly and indirectly creating hundreds of thousands of well-paying jobs in the United States and helping us lower our real trade deficit [5] by billions of dollars per year.

The irony is that after all of this, even $100,000 might be too low a price. Because after killing off Apple many years from now the only place you would be able to find an iPhone would be in the museum.

Notes

[1] Source: Fortune / Youtube: Tim Cook Discusses Apple's Future in China. The rest of the interview is also quite fascinating with Tim sharing many more of his observations and anecdotes about doing business in China.

[2] Tim Cook rose through the Apple organization in their operations group after spending over a dozen years working in fulfillment and operations in the PC industry. He was at Apple during its transition from the PC era to the mobile era and was instrumental in helping Apple figure out how to do high-quality manufacturing of these smaller devices at scale, eventually rising to COO under Steve Jobs. Critical to this transition was figuring out how to get manufacturing right — Apple had struggled in the 1980s trying to be a vertically integrated manufacturer and this was one reason why IBM-compatible PCs eventually “won”. And key to figuring out manufacturing was working in partnership with Taiwanese/Chinese manufacturers like Foxconn.

[3] Germany is a global leader in the precision tooling industry. Coincidence? I don’t think so.

[4] This estimate is simply based on Tim Cook’s comments on how many qualified tooling engineers we have here (“I’m not sure we could fill this room”) compared to China (“could fill multiple football fields”).

This was originally published on Quora in December 2017. Also published in Forbes and Inc.

Here’s a straightforward answer