Financial repression in China

A tax on household assets

One simple way to think about China’s “financial repression” policy is as a tax on household sector assets that was used to subsidize loans to largely state-owned companies in capital-intensive industries.

This economic policy had resulted in an ever-increasing proportion of economic activity in China being driven by investment-type activity (e.g. infrastructure build-out, construction, real estate). Over time, the marginal benefit of each incremental infrastructure project began to wane. Not only were the benefits decreasing, input costs were increasing as heavy incremental demand from China for natural resources drove commodity prices to all-time highs. In other words, the quality of each incremental dollar of GDP was decreasing rapidly particularly in the last years of the Hu Jintao administration.

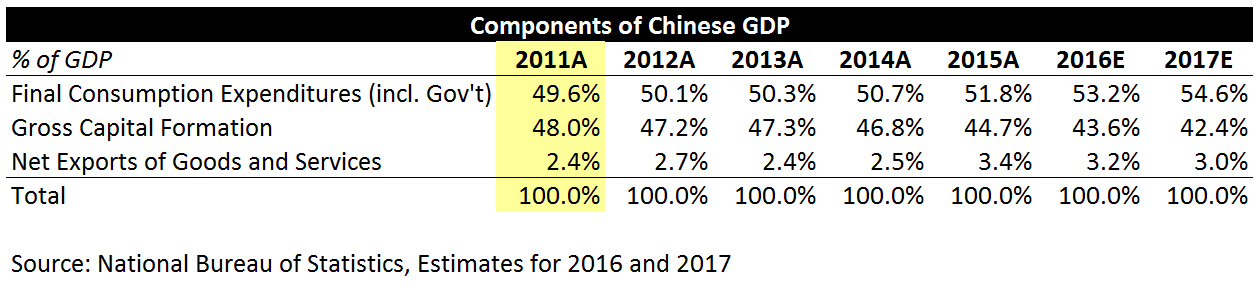

Gross capital formation peaked in 2011 at 48% of GDP which was quite extreme even when compared to economies like South Korea and Japan when they were at similar stages:

Over the past five or six years, this “financial repression tax” has been effectively lifted through a variety of policy changes, including (i) the relaxation of controls on interest rates (ii) greater flexibility on the RMB exchange rate (iii) opening up of the consumer finance sector to new entrants like Ant Financial and Tencent and (iv) an increasing variety of investment options available to individuals.

The crash in commodity prices — particularly crude oil — has also had a similar effect on consumption and the overall economy.

Last but not least, policymakers are experimenting with mixed-ownership reform for State-Owned Enterprises and one of the potential outcomes here is that partial ownership will be transferred from the State to the private sector.

So what has happened since 2011 is that investment is no longer the primary driver of growth in the Chinese economy with the majority of growth since driven by consumption:

Investment has fallen from 48% of GDP to approximately 42% over the last six years and I expect it to continue to fall in the coming years.

While China’s double-digit growth percentages have given way to percentages that are more in the 5 to 8% range, the quality of this growth is superior and more sustainable over a longer period of time.

This was originally published on Quora in December 2017.