Lost in translation

How seemingly minor misinterpretations of technical terms can lead to very different meanings

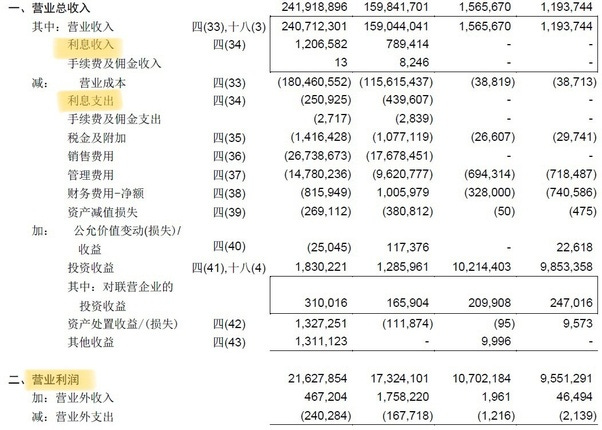

In China Railway Corporation’s financial report, “operating profit” is the literal translation of the Chinese “营业利润”:

This has caused some confusion here because “operating profit” is typically used interchangeably with “earnings before interest and taxes (EBIT)” in U.S. financial reporting vernacular. Normally, it would be pretty obvious but the problem with China Railway Corporation’s financials is that it does not explicitly break out interest expense in its income statement.

The Chinese term “营业利润” is more accurately translated as “profits before taxes (PBT)” or “earnings before taxes (EBT)” in U.S. financial reporting vernacular.

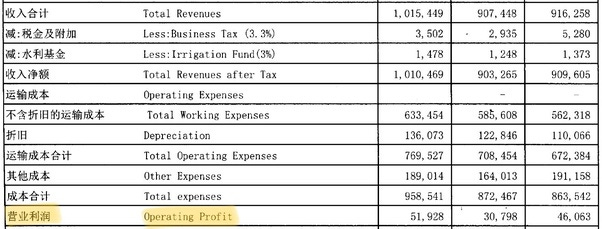

I cross-checked this with the annual report from another mainland Chinese company that I follow. Here, as you can see, “营业利润” is calculated after accounting for interest expense paid (“利息支出”) and interest income (“利息收入”) generated:

I have noticed that many news reports commenting on China Railway’s financial outlook have not recognized this distinction, and as a result formed potentially inaccurate or misleading conclusions.

Indeed, the specific article that triggered me to write this was an FT article: China’s high-speed rail and fears of fast track to debt [1]. Here is one example of the misleading conclusions that resulted from this confusion:

In the first quarter of this year, China Railways reported a net loss of RMB 376 billion. During the same period, bank loans accounted for RMB 156 billion, or more than 60 percent, of its total funding. The company’s interest payments on its debt have exceeded its operating profit since at least 2015.

The implication above is that China Railway does not have enough operating profit to cover its interest payments when this is simply not true. This supports the article’s broader conclusion that China’s high-speed rail operation is in financial trouble when in reality it appears to be quite healthy: How profitable is China’s high-speed rail?

But the “operating profit” in this case it is referring to is actually “profit before taxes” (after deducting interest expenses) which means that China Railway indeed can cover its interest payments with its operating profits (i.e. “operating earnings before interest and taxes”).

Note

[1] The FT article may be behind a paywall, but it has been essentially re-posted here: Ozy: How China’s Railways are Leading to High-Speed Debt.

This was originally published on Quora in August 2018.